- Bitcoin’s 30-day correlation with gold is at cycle lows after BTC price action in 2023.

- BTC has outperformed the precious metal even as its correlation with stocks also fell.

- Gold traded near $1,928 per ounce while silver price was at $22.94 per ounce on Tuesday morning.

Gold continues to hover above $1,900 after its recent breakdown from year-to-date highs above $2,052 per ounce threatened a retreat to February lows. But at $1,928 per ounce, gold is negative in the past 30 days and just over 6% higher in the past six months.

Silver prices are also just slightly up at $22.94 per ounce as of writing. However, Silver is down 1.6% in the past 30 days and 3.3% in the red over the past six months.

Bitcoin decoupling from gold, silver

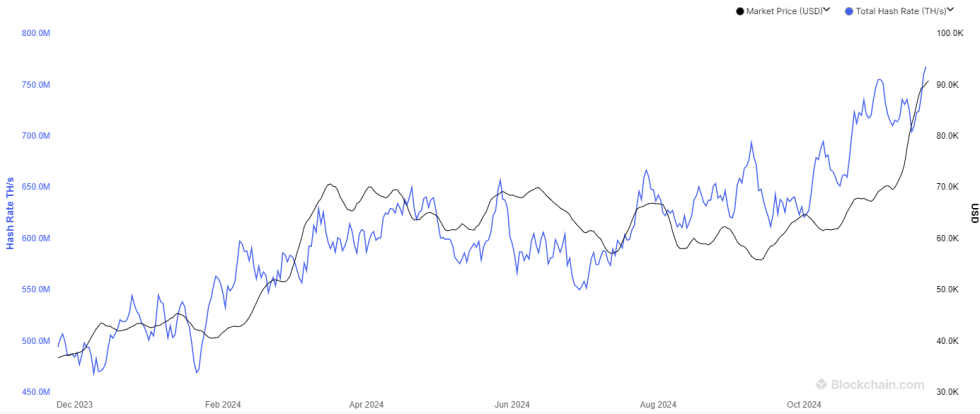

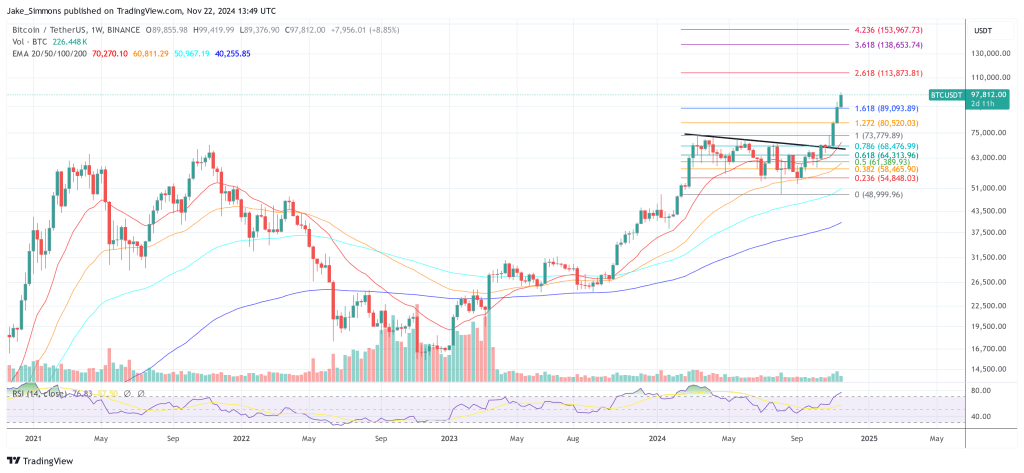

On-chain data platform Glassnode has& shared fresh details showing Bitcoin price action has continued to decouple from the metals. In 2023, BTC has reached highs of $31,500 and is 14% up in the past 30 days and +85% YTD.

The correlation with gold and silver has reached near cycle lows for XAU/USD and new cycle low for XAG/USD.

“Local Bitcoin price action has recorded a decoupling from both Gold and Silver, with the 30 day correlation to gold residing near cycle lows of -0.78, whilst the correlation to Silver has reached a cycle low of -0.9 respectively.”

Local #Bitcoin price action has recorded a decoupling from both #Gold and #Silver, with the 30 day correlation to Gold residing near cycle lows of -0.78, whilst the correlation to Silver has reached a cycle low of -0.9 respectively. pic.twitter.com/066EGsFWNI

— glassnode (@glassnode) June 27, 2023

Although commodities are likely to see a boost with the upcoming US CB Consumer Confidence report on Tuesday, gold and silver remain largely constrained. The main hurdles are at $1,930 and $23.04 for XAU/USD and XAG/USD respectively.

Meanwhile, BTC is showing resilience above $30k and could rip upwards amid the recent spot ETF related news.

The probability that BTC/USD rises further is highlighted in the chart below by Santiment analysts. They say that following crypto markets’s jump to local tops last Friday, expectation among traders has been for a retracement for buy the dip opportunities in the $27k-$29k region.

😨 After #crypto markets topped out last Friday, traders came into the start of the week with expecting that prices would continue to retrace & provide opportunities to buy in the $27k-$29k level. High #bearish sentiment increases further rise probability. https://t.co/bEkYCdNqVH pic.twitter.com/PxJQBTN1Us

— Santiment (@santimentfeed) June 27, 2023

It’s a scenario for increased bearish sentiment, which the analysts suggest could be an ingredient for new upward action.&

As CoinJournal reported on Monday, latest data also shows Bitcoin’s correlation with the Nasdaq 100 is at a three-year low.

The post Bitcoin price action records decoupling from gold and silver appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments