The world recently got a sneak peek at what a digital dollar, or at least one component of a hypothetical United States central bank digital currency (CBDC), might look like, courtesy of Project Hamilton, a collaborative effort of the Federal Reserve Bank of Boston and the MIT Digital Currency Initiative. The results of the project’s first phase were originally expected last summer but were released on Feb. 3. The project, announced in 2020, is named in honor of Alexander Hamilton, the first U.S. Treasury secretary, and Margaret Hamilton, an MIT staffer who contributed to NASA’s Apollo program.

Researchers developed two open-source models of transaction processing software, called OpenCBDC, for the “technology-agnostic” project. The researchers note in the project’s white paper that “technical and policy choices are highly interdependent and that these choices are more granular and with more permutations than commonly discussed.” Only one of the models used distributed ledger technology, and it turned out to be the less satisfactory solution, with the technology described as “not needed.”

The distributed ledger model was “not a good match” for the project due to its performance. The project assumed administration by a central actor, and the model was modified accordingly. However, it created performance bottlenecks, and the requirement that the central transaction processor maintain transaction history slowed throughput significantly. The alternative model’s two-phase commit architecture supported “a range of potential privacy options” without central storage of transaction history, although the researchers acknowledged that it presented greater challenges for auditing.

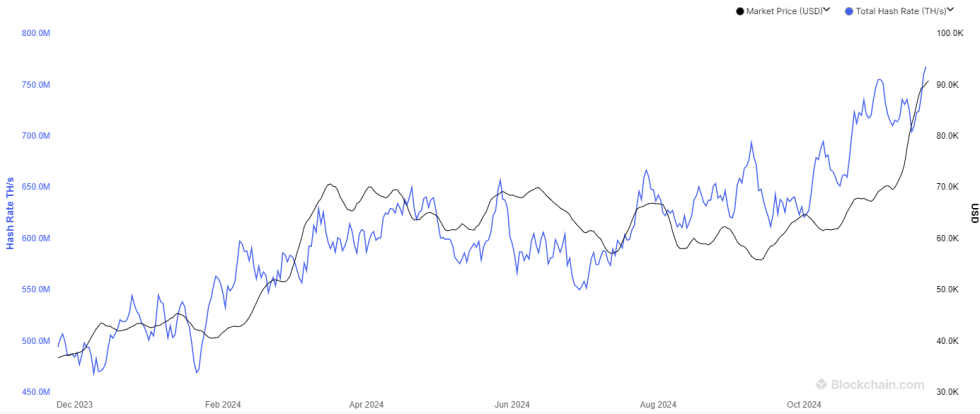

The distributed ledger model had a peak throughput of approximately 170,000 transactions per second, while the competing model, which processed transactions in parallel on multiple computers, had a throughput of 1.7 million transactions per second and showed linear scalability with the addition of more servers.

The second, and apparently last, phase of Project Hamilton will “determine technical and performance tradeoffs associated with various designs.” Researchers have promised to look at “privacy, auditability, programmability, interoperability, and more.” Boston Fed Executive Vice President Jim Cunha said in a press call that “We’ll be defining a number of use cases that focus on different design and possibly policy questions,” adding: “For example, if one policy goal was to maximize privacy, and the other is to stop criminal activity, those create conflicts from a technology perspective in how you design the system.”

The release of the Hamilton Project Phase 1 results comes simultaneously with China’s attempt to scale up its rollout of the digital yuan at the Winter Olympics. The contrast between the United States’ and China’s level of CBDC development could not be starker, and those behind Project Hamilton took pains not to overstate the project’s place in American CBDC development. MIT Digital Currency Initiative director Neha Narula said in a statement, “It is important to note that this project is not a comment on whether or not the U.S. should issue a CBDC — but work like this is vital to help determine the answer to that question.” She added, “The policy conversation around central bank digital currency is still in its infancy.”

The scattershot nature of that conversation is apparent at a glance. The Fed steadfastly refuses to take a stance on a CBDC, reiterating its neutral position in a paper released last month. The same week, Representative Tom Emmer, a Republican from Minnesota, introduced a bill to prohibit the Fed from issuing a retail CBDC, claiming such a law would keep the Fed off an “insidious path” toward authoritarianism. Not long afterward, Bank of America issued a note calling a CBDC “inevitable.” The Fed is welcoming comments on Project Hamilton via an online form with 22 questions. The project is also hiring a new product management director.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments