According to a Reuters report, payment firm Paypal has announced that it will stop purchasing cryptocurrencies on its platform for UK customers starting in October.

PayPal Set To Comply With UK Regulations

In an email sent to its customers on Tuesday, PayPal stated that it would “temporarily pause” the ability to buy cryptocurrencies from October 1.

Per the report, the company aims to ensure compliance with the new regulations, which will come into effect on October 8. PayPal expects to resume crypto services in early 2024.

Furthermore, PayPal emphasized its commitment to working closely with regulators worldwide to adhere to relevant market rules and regulations.

The company assured customers that they can continue to hold and sell their existing crypto holdings anytime.

Introducing stricter regulations reflects a broader global trend as regulators seek to establish frameworks for regulating cryptocurrencies.

According to Reuter’s report, recent incidents like the collapse of various crypto firms, including FTX, have underscored the need for enhanced consumer protection.

FCA Implements Stricter Marketing Rules For Crypto Assets

Paypal’s decision comes as the UK Financial Conduct Authority (FCA) has unveiled stricter marketing rules for crypto assets. Starting in October, British consumers purchasing crypto assets, including popular cryptocurrencies like Bitcoin (BTC), will benefit from a mandatory 24-hour “cooling-off” period.

The FCA’s new rules also eliminate “refer a friend” bonuses for crypto buyers. Furthermore, individuals and entities promoting crypto assets must provide clear risk warnings and ensure their advertisements are transparent, fair, and devoid of misleading information.

According to Reuters, this initiative aligns with the UK government’s plans to regulate cryptocurrencies under a new financial services law later this year. The absence of comprehensive global regulations for crypto has prompted regulators worldwide to scrutinize the sector closely.

Sheldon Mills, Executive Director at the FCA’s Consumers and Competition Division, emphasized the importance of allowing individuals to make informed decisions when investing in cryptocurrencies.

He acknowledged that research demonstrates many individuals “regret making impulsive investment choices.” Mills also reiterated the FCA’s cautionary stance, highlighting that crypto assets remain largely unregulated and “inherently high-risk investments.”

Despite this, the FCA’s research reveals a significant surge in crypto ownership, with estimates indicating that ownership among surveyed individuals doubled from 2021 to 2022. Approximately 10% of the 2,000 respondents reported owning cryptocurrencies.

Moreover, under the new rules, crypto firms must display warnings such as: “Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.”

On the same note, Myron Jobson, Senior Personal Finance Analyst at investment platform interactive investor, welcomed the FCA’s stricter regulations.

He noted that crypto advertising had become a “breeding ground” for “dubious claims” and “misleading information.” Jobson emphasized the need for a robust customer knowledge framework to ensure all stakeholders understand fair practices and consumer protection standards.

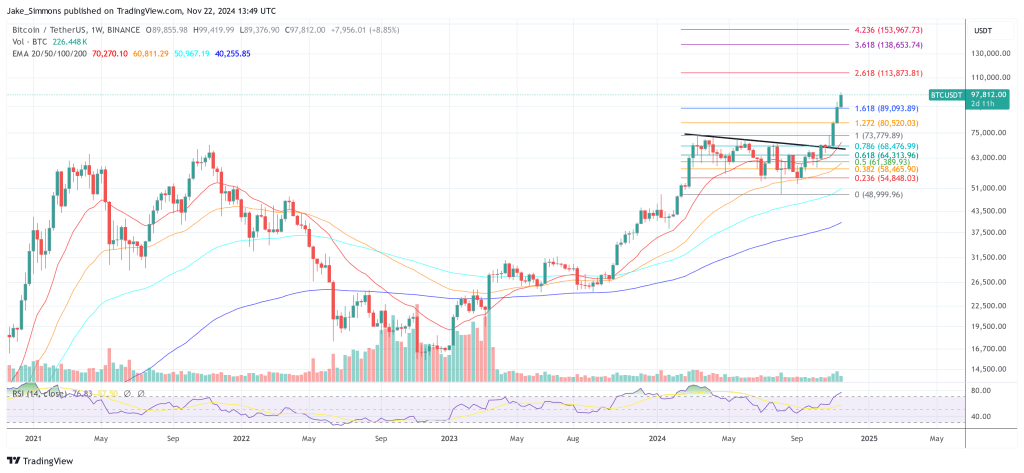

Featured image from iStock, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments