Summary:

- Su Zhu tweeted for the first time in almost a month.

- The 3AC co-founder claimed that liquidators are baiting.

- Zhu alleged that the company has shown good faith and attempted to cooperate.

- Three Arrows Capital cratered shortly after Terra’s collapse.

- The crypto hedge fund is faced with insolvency and multiple liquidation calls.

- A British Virgin Islands court ordered the company to undergo liquidation in late June.

- 3AC also owes Voyager Digital $650 million in USDC and Bitcoin.

- Voyager served Zhu’s hedge fund with a notice of default and intends to pursue recovery, per reports.

Su Zhu, the co-founder of beleaguered crypto hedge fund Three Arrows Capital, tweeted for the first time since June `15 and called out liquidators for matching the firm’s cooperation with “baiting”.

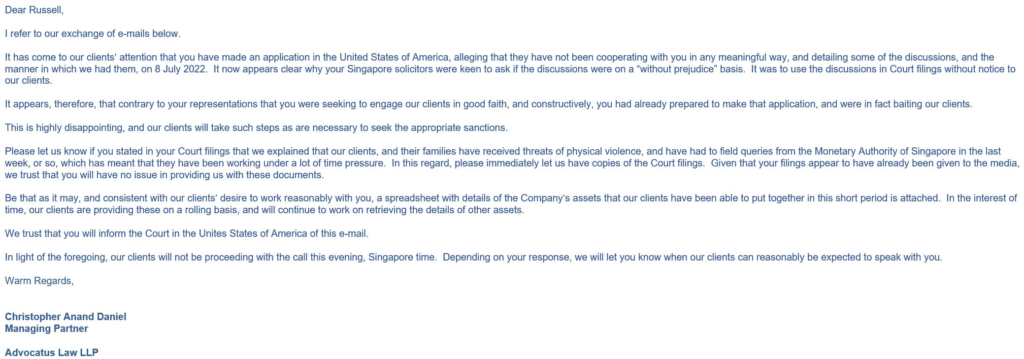

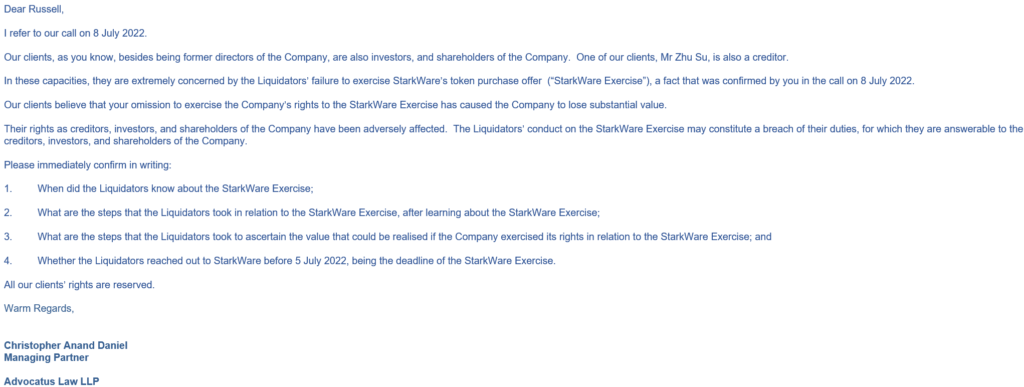

Zhu’s tweet on Tuesday featured screenshots of supposed correspondence between 3AC legal representatives and unnamed entities believed to be liquidators.

Details from the emails shared by Zhu connote dissatisfaction regarding how court filings have proceeded and how liquidators have so far conducted activities.

Three Arrows Capital: Crypto’s Leading Hedge Fund Goes Under

The 3AC boss has not tweeted for almost a month as rumors of insolvency raged on following the unraveling of Terra’s fall. Three Arrows Capital had exposure to Terra’s LUNA Classic (formerly LUNA) token which fell below pennies after UST depegged and wiped out over $40 billion from investors’ pockets.

A number of crypto exchanges also liquidated 3AC positions after the digital asset hedge fund failed to answer margin calls. As EthereumWorldNews reported, BitMEX, Deribit, and FTX closed 3AC’s leveraged positions sometime in June.

Other companies have disclosed their Three Arrows Capital exposure as well. Digital asset trading service Voyager Digital issued a notice of default to 3AC for a $650 million loan. The credit package featured both USDC and Bitcoins.

Voyager served the notice on June 27 and EWN reported that the platform intends to pursue asset recovery via legal means. Genesis and Blockchain.com disclosed exposure to 3AC as well.

Zhu’s company also faces inquiries from Singapore’s Monetary Authority (MAS) and a liquidation order from a British Virgin Islands court. As of press time, the crypto hedge fund has already filed for bankruptcy and the filings claim that the company is unaware of Zhu’s location.

Co-founder Kyle Davies is also unreachable and his whereabouts remain unknown.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments