Well i got pretty fucked when the last bear market came around. I had just sold my apartment to rent an apartment with my girlfriend (now wife yay) and put most of my profit into crypto just to see my portfolio dwindle for all of 2022, only to begin seeing some upside again in 2023 and finally being profitable in the beginning of 2024 (doing preeetty good right now) - I did manage learn a few basic principles, that made my portfolio very happy, without taking on too much unnecessary risk during all this time.

I wanted to prepare myself the next bull-run, the one we are seeing now, so i did all the boring work, and learned how to come out on top.

Obviously I have made bad moves in the span of 2022-2024. But if I had followed these principles from the beginning and more strictly, I don't think i would have made most of those mistakes.

0. Most Important: Find an Actual Strategy and Stick to It

This is the foundation of any successful investment journey. Don’t let emotions like fear or greed drive your decisions—these can lead to impulsive moves that often result in losses. Whether you choose dollar-cost averaging (DCA), technical analysis, or another method, the key is consistency. From my experience, sticking to a well-thought-out strategy helps you stay disciplined and avoid costly mistakes 9 out of 10 times.

1. Bitcoin Dominance Chart

Understanding Bitcoin dominance—the percentage of the total crypto market that Bitcoin represents—is crucial. By analyzing its cycles, you can see how shifts in Bitcoin’s dominance impact the broader market.

For example, when Bitcoin dominance rises, it might indicate that investors are favoring Bitcoin over altcoins (this typically happens during the bear market, and reverses during the bull market), signaling a more conservative market sentiment. Keeping an eye on these trends helps you make informed decisions about where to allocate your investments.

2. ETH/BTC Chart

The ETH/BTC chart is a key tool for understanding the current market dynamics and potential future movements. It shows the relationship between Ethereum and Bitcoin, helping you gauge whether Ethereum is strengthening against Bitcoin or if Bitcoin is maintaining its lead. Additionally, looking at other pairs like ADA/BTC can provide further insights. Understanding these relationships helps you spot opportunities and manage risks more effectively.

3. Risk-Adjusted Dollar-Cost Averaging (DCA)

Risk-Adjusted Dollar-Cost Averaging is a dynamic investment strategy that uses a risk index (e.g., 1-100) to guide buying and selling decisions at specific intervals. When risk is low (e.g., a score of 10), you invest a large amount, gradually decreasing the investment size as the risk increases (e.g., at 20, 30, and 40). Beyond a certain threshold (e.g., 40), you pause buying entirely and start taking profits as the risk level rises. For instance, you might sell 10% of your portfolio at 60, 20% at 70, 30% at 80, and the remaining 40% at 90. This systematic approach maximizes opportunities at low risk while securing profits as risk intensifies, leveraging data-driven insights to eliminate emotional decision-making.

I'm not gonna suggest a specific index, but you can find a few online. (The one i use puts BTC at 63 risk right now)

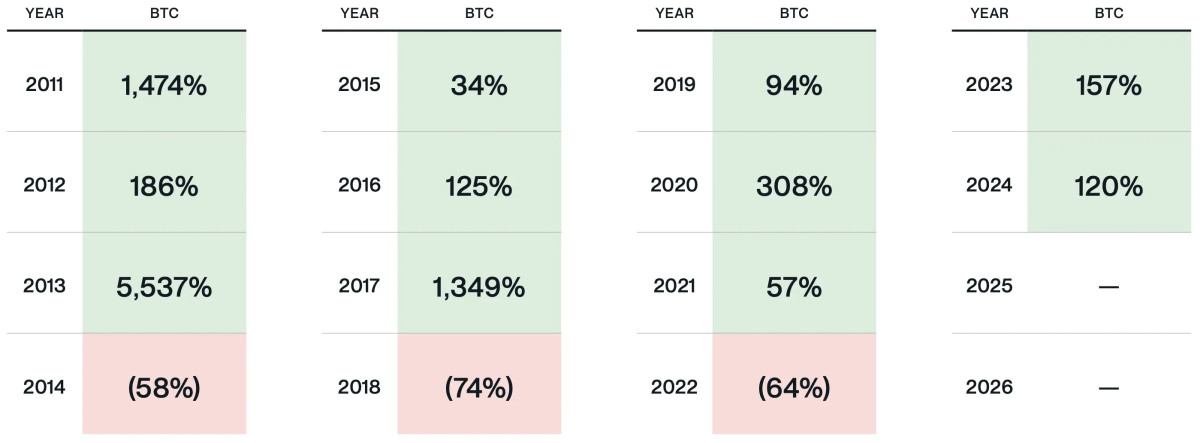

4. Bitcoin is King

Bitcoin remains the most dominant and stable cryptocurrency in the market. Historically, very few altcoins have outperformed Bitcoin on a multi-year basis. When the market’s euphoria settles and volatility decreases, Bitcoin often stands out as the leading asset. Keeping a significant portion of your portfolio in Bitcoin (especially during a bear market) can provide stability and act as a solid foundation for your investment strategy, ensuring you have a reliable asset during turbulent times.

5. Value Your Portfolio in BTC, Not USD

It’s important to assess the value of your portfolio in Bitcoin rather than just in USD. Even if your portfolio’s dollar value increases, it might still be losing ground compared to Bitcoin. This indicates that while you may see nominal gains, you could be taking on higher risk for lower real returns. Valuing your portfolio in BTC gives you a clearer picture of your actual growth and risk exposure, helping you make more informed decisions about your investment strategy. - It's cool that your altcoin made a 70% year-to-date ROI, but BTC made 136% so far on less risk

6. Be Cautious of "This Coin Will 500X" Claims

Avoid blindly trusting promotional claims from YouTube influencers or following trends that have already experienced significant price increases. Investing in a coin that has already surged means you might have missed out on the most substantial gains. Instead, focus on researching the fundamental values and long-term potential of cryptocurrencies. This approach helps you make more rational investment decisions based on merit rather than hype, reducing the likelihood of falling for pump-and-dump schemes or overvalued assets.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments