BNB Coin, like other cryptocurrencies, has been in a consolidation phase recently.

The number of transactions in the ecosystem has dropped from its April high.

There are concerns about the US debt ceiling as divisions increase.

Binance Coin price moved sideways as concerns about the debt ceiling issue continued. After soaring to a high of $346, in April, the token has dropped to $315, giving it a market cap of over $47 billion. The coin remains about 39% above the lowest level this year.

Debt ceiling concerns remain

The main reason why the BNB price has gone nowhere in the past few days is the ongoing risk-off sentiment in the market. This sentiment is evidenced by the rising US dollar index (DXY) and the VIX index, as I wrote& here.

The biggest concern among investors is the ongoing debt ceiling discussion in the United States. With divisions between the democrats and republicans widening, there are concerns that the American government will default.&

The plot thickened when Fitch, a leading credit rating agency, placed the American government in a watch for a rating downgrade. This means that the company will not delay downgrading the government in the coming days.

As I wrote in this& article,& this defauly will likely not happen since the two sides will likely reach an agreement in the 11th hour. In most periods, cryptocurrencies tend to move in sync with each other, which explains why other coins have dropped.

The Binance Coin price has moved sideways as the number of& transactions in the ecosystem wane. Data by BNB Explorer means that the number of transactions in the ecosystem dropped to 5.337 million on May 17th to $4.41 million on May 24th.

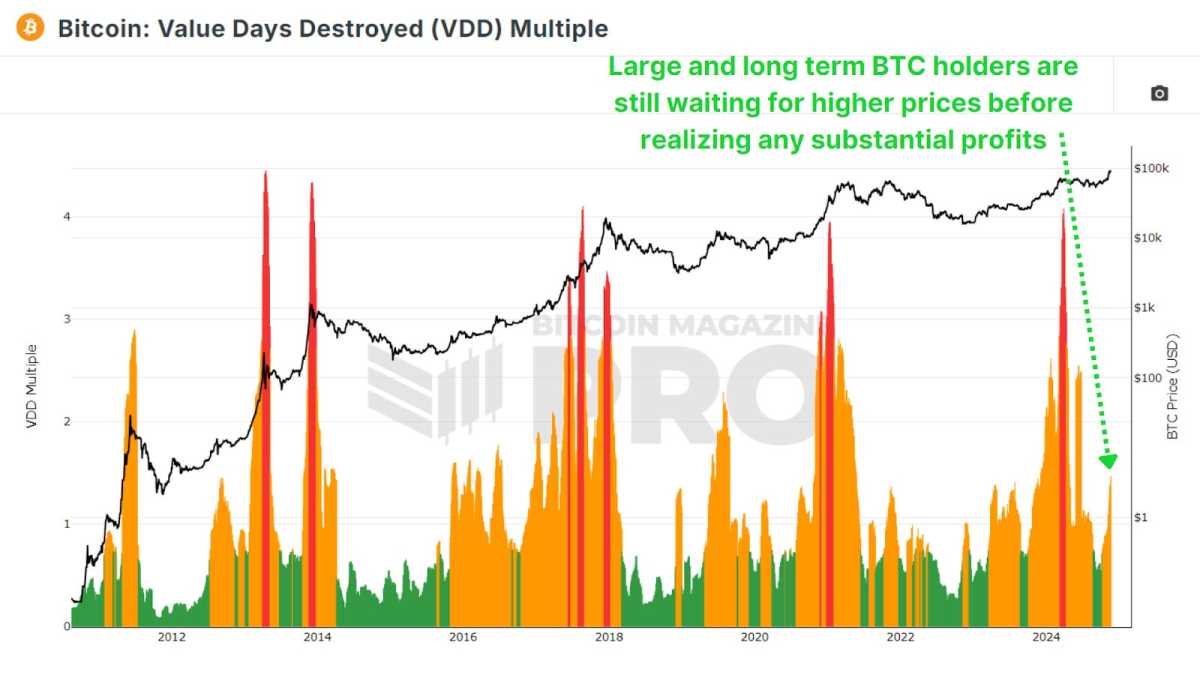

At the same time, the volume of BNB traded per day has been in a strong downward trend, as shown in the chart below. This is also the same as with other cryptocurrencies like Bitcoin, Ethereum, and Solana.

BNB price prediction

The 4H chart shows that the Binance Coin price has moved sideways in the past few days. Looking back, the coin has struggled moving above the important resistance at $337, the highest point on August 9 2022. The coin has also failed to move above this level in February, March, and April this year.

BNB coin price has moved slightly below the 25-period and 50-period moving averages. Volume has dropped after peaking in November 2022. Therefore, the outlook of Binance Coin will likely continue falling below the key support at $300. A move below this level will open the possibility of the coin drop to the key support at $265.7.

How to buy Binance Coin

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600. Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

KuCoin

Kucoin is a cryptocurrency exchange which offers over 200 cryptocurrencies. Kucoin has a wide range of services, such as; a built-in peer-to-peer exchange, spot and margin trading, bank level security and a wide range of accepted payment methods. Users can benefit from a beginner-friendly interface and relatively low fees.

The post Binance Coin price outlook as BNB Chain transactions slip appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments