Data shows the Bitcoin Coinbase Premium Index has just seen a sharp rise into the positive region, a sign that could be bullish for BTC’s price.

Bitcoin Coinbase Premium Index Has Spiked Recently

As an analyst in a CryptoQuant Quicktake post explained, the Bitcoin Coinbase Premium Index has observed a surge despite the pullback the asset’s price has witnessed.

The “Coinbase Premium Index” refers to an indicator that keeps track of the percentage difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

When the value of this metric is positive, the cryptocurrency is trading at a higher rate on Coinbase than on Binance. Such a trend suggests that former users participate in a higher amount of buying (or lower amount of selling) than latter users.

On the other hand, the under zero indicates that Binance users are applying a higher buying pressure as BTC is selling for a higher price there than on Coinbase.

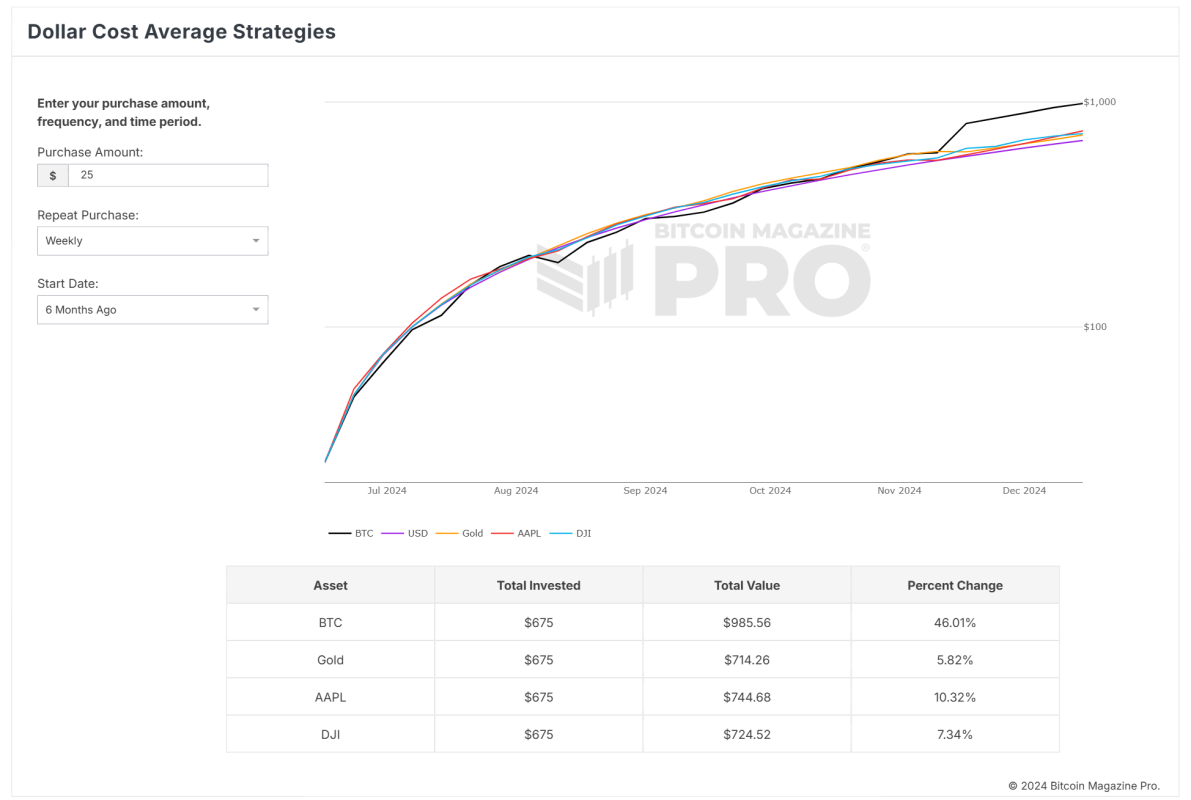

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Index over the last month or so:

As the above graph shows, the Bitcoin Coinbase Premium Index plunged into negative territory as the Bitcoin price drawdown occurred. Still, its value has since rebounded back into the positive region.

The temporary dip into the negative zone implies Coinbase users were selling, which potentially caused the price to plummet, but they have since picked up their accumulation.

In the chart, the quant highlighted what usually followed positive spikes in the Coinbase Premium Index during the past month. It would appear that BTC has tended to see bullish momentum while buying has occurred on Coinbase. This is a pattern that has continuously appeared in 2024.

Coinbase’s main traffic involves American users, especially the large institutional entities, while Binance serves users worldwide. As such, the Coinbase Premium Index essentially represents the difference in behavior between US-based and global whales.

The close relationship that Bitcoin has shown with the Coinbase Premium Index naturally means that American institutional investors have been the drivers of the asset this year.

With buying pressure seemingly returning from these entities after the pause, the cryptocurrency’s price may again be ready to see a continuation of the rally.

BTC Price

The past day has been red for the cryptocurrency sector as a whole, but Bitcoin has come out relatively unscathed so far, observing a decline of 3% that has taken its price to $95,000.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments