On-chain data shows the Bitcoin investors have locked in profits amounting to $537 million following the latest rally in the asset’s price.

Bitcoin Entity-Adjusted Realized Profit Has Shot Up Recently

According to data from the on-chain analytics firm Glassnode, BTC investors have just participated in the second-largest profit-taking event of the year. The relevant indicator here is the “entity-adjusted realized profit,” which measures the total amount of profits (in USD) that Bitcoin investors are currently realizing.

This metric works by checking the on-chain history of each coin sold to see the price at which it was last moved/transferred on the network. If this previous selling price for any particular coin was less than the current spot price, then that particular coin is now being sold at a profit.

The realized profit indicator naturally adds up the profits that the sales of such coins are locking in across the entire network. The counterpart metric, the “realized loss,” captures the losses being harvested in the market.

The reason the formal name of the indicator has “entity-adjusted” in it is the fact that it only tracks sales/transactions being done between two different entities rather than two different individual wallets. An “entity” here is a single address, or a collection of addresses that Glassnode has determined belongs to the same investor.

As transfers between the addresses of the same holder (the intra-entity transactions) are irrelevant to the realized profit indicator, it makes sense to cut them out of the data.

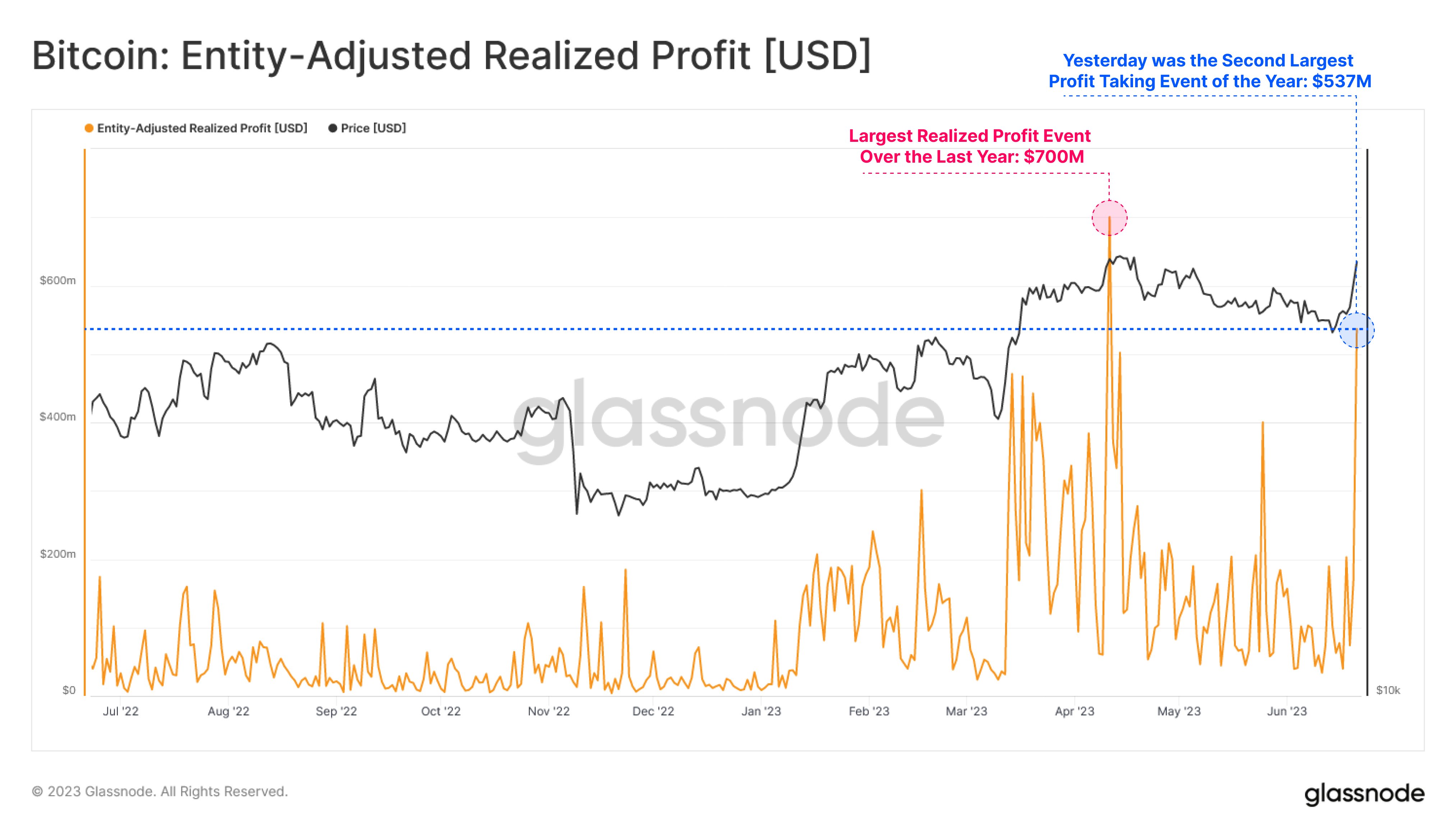

Now, here is a chart that shows the trend in the Bitcoin entity-adjusted realized profit over the past year:

As displayed in the above graph, the Bitcoin entity-adjusted realized profit has observed a large spike following the surge in the asset’s price during the past day.

In this uplift, cryptocurrency holders have harvested $537 million in profits. This is a significant value, and it’s the second-highest level the indicator has touched in not just 2023 but also the entire past year.

The only other profit-taking event in this period where the investors had locked in higher gains was in April when BTC had observed a rally above the $30,000 mark. The investors had realized $700 million in profits back then.

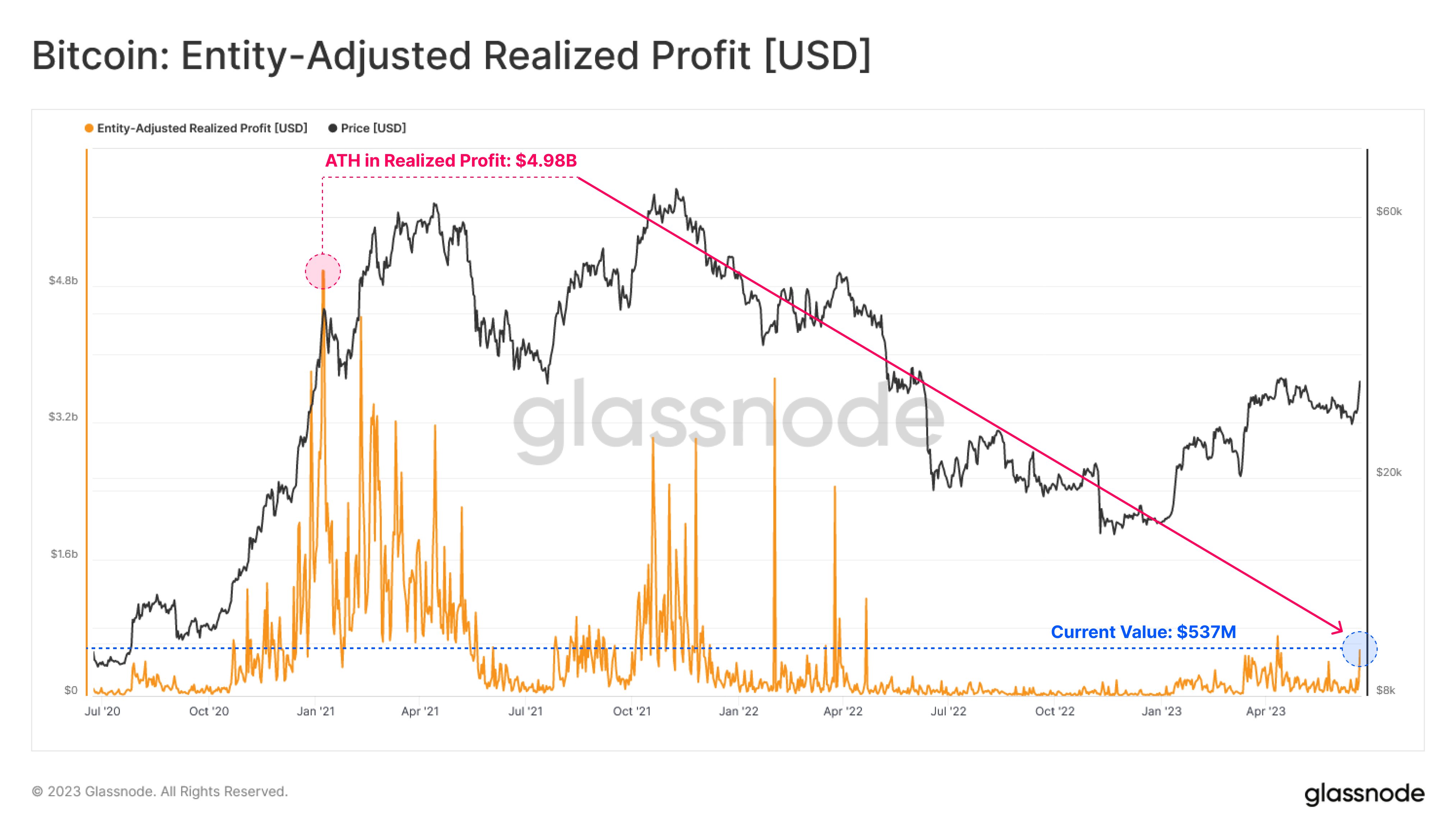

However, the chart below highlights that Both profit-taking sprees pale compared to the spikes seen during the 2021 bull run.

The graph shows that the realized profit all-time high set back during the last Bitcoin bull run measured around $4.98 billion, a whopping $4.44 billion more than the current spike.

BTC Price

At the time of writing, Bitcoin is trading around $30,100, up 21% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments