On-chain data shows that Bitcoin miners have been depositing to exchanges recently, a sign that can be troubling for the asset’s price.

Bitcoin Miners Continue To Send Large Amounts To Exchanges

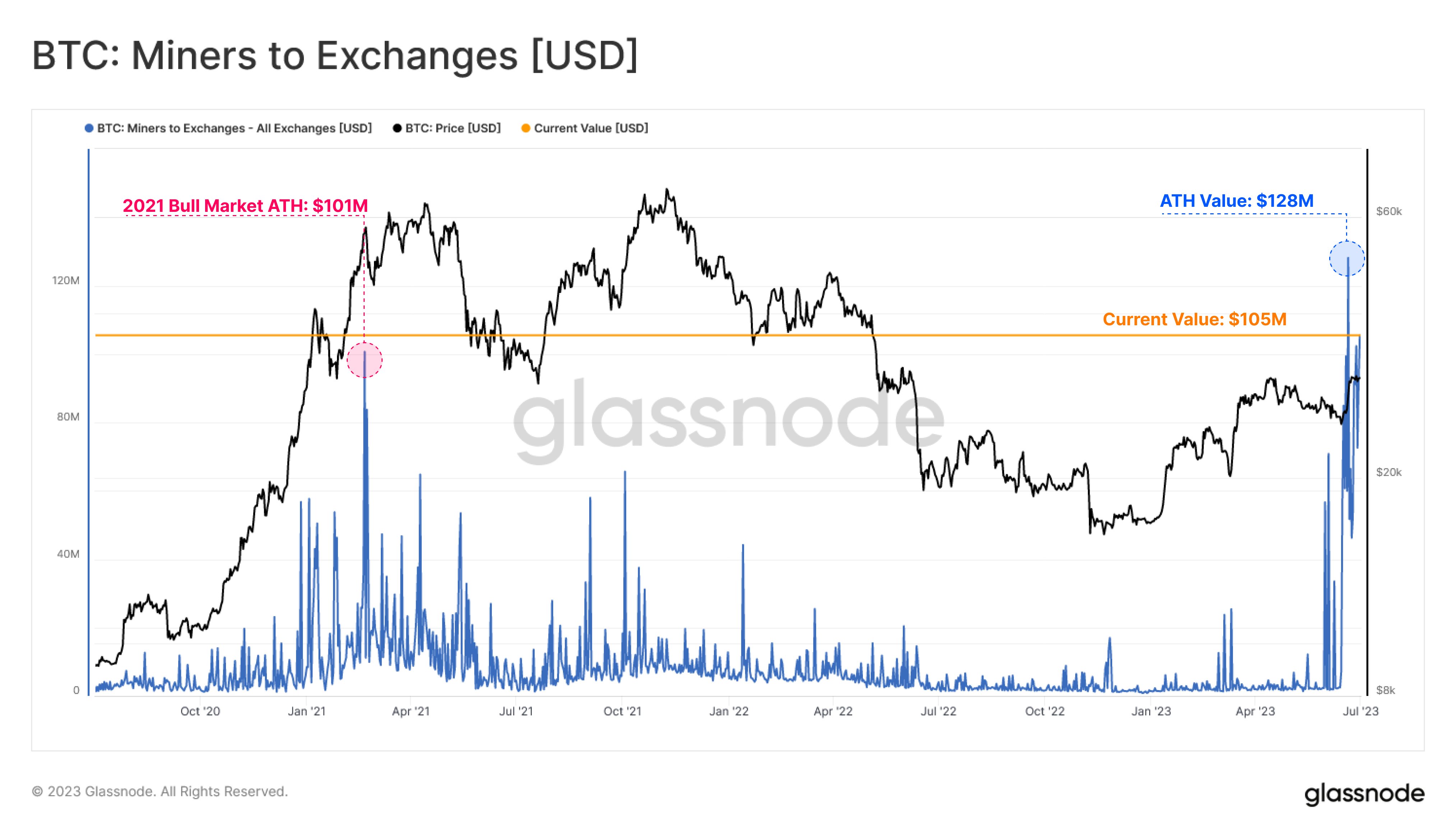

According to data from the on-chain analytics firm Glassnode, the BTC miners have recently deposited $105 million in the asset to centralized exchanges. The indicator of interest here is the “miners to exchanges,” which measures the total amount of Bitcoin (in USD) that the miners are transferring to the wallets of all centralized exchanges currently.

When the value of this metric is high, it means that these chain validators are sending large numbers of coins to exchanges right now. Generally, this cohort deposits to these platforms for selling-related purposes, so this kind of trend can be a sign of elevated selling pressure from these holders.

On the other hand, low values imply the miners aren’t sending any extraordinary amounts to exchanges at the moment. Such a trend can be a hint that there isn’t much selling pressure coming from these investors currently.

Now, here is a chart that shows the trend in the Bitcoin miners to exchanges metric over the past few years:

Since the Bitcoin miners have continued running costs like electricity bills, they make regular deposits to exchanges so that they can withdraw their BTC into fiat and make these payments.

Such deposits are, however, usually relatively small in scale. From the above graph, it’s visible that the Bitcoin miners to exchanges indicator have shot up recently. These latest large deposits certainly don’t look like they have been made simply paying off the miners’ operation costs.

Some of these recent high spikes had come while the market had been under a spell of FUD from the SEC lawsuits against Binance and Coinbase, suggesting that these investors had likely been panic selling.

The larger and more recent spikes, though, have come with the rally in the cryptocurrency’s price beyond the $30,000 mark. Naturally, these high values of the indicator can be a sign of mass profit-taking from these chain validators.

The spike in the indicator that came right after the rally measured around $128 million. This spike is not only the largest one of the latest series of spikes but is in fact the highest the metric has been in the asset’s history.

Bitcoin, however, successfully shrugged off these all-time high deposits from the miners, as the asset’s price continued to maintain above the $30,000 level. Miners don’t seem to have finished their round of selling just yet, though, as the graph shows.

Another huge spike came just a couple of days back as this cohort deposited $105 million worth of the asset to these platforms. While this value is smaller than the ATH spike, it’s still larger than the peak seen during the 2021 bull run.

So far, Bitcoin has still not observed any noticeable negative effect from this potential selling pressure from the miners, as the coin has continued to maintain above $30,000. It remains to be seen, however, if the cryptocurrency can do the same in the coming days if miners do continue to further their selling.

BTC Price

At the time of writing, Bitcoin is trading around $30,600, up 1% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments