Bitcoin is currently hovering around $97,000 within the past 24 hours, which is an extension between its range trading between $98,600 and $95,000 throughout last week. Amidst these back and forth motion, data shows a negative trend among Bitcoin traders, which could intensify a price drop.

According to data from on-chain analytics platform IntoTheBlock, Bitcoin saw around $1.4 billion net inflows into crypto exchanges in the just-concluded week.

Bitcoin Exchange Inflows Spike Amid Market Uncertainty

IntoTheBlock’s data, shared on social media platform X, highlighted that $1.04 billion were sent into crypto exchanges last week. Unsurprisingly, this run of inflows erased the outflows in the previous three weeks. As noted by IntoTheBlock, this shift in capital movement suggests growing hesitancy among Bitcoin holders, largely driven by prevailing global political and economic uncertainties.

Adding to concerns, the Bitcoin network saw a notable drop in transaction fees. On-chain data shows that fees declined by 10.74% compared to the prior week. This decline in fees signals lower network activity, which is often a bearish indicator. A rise in transaction fees typically suggests increasing demand and higher market engagement, while a drop implies reduced interest and weaker momentum for Bitcoin’s price.

Image From X: IntoTheBlock

Spot Bitcoin ETFs Could Be Driving Exchange Inflows

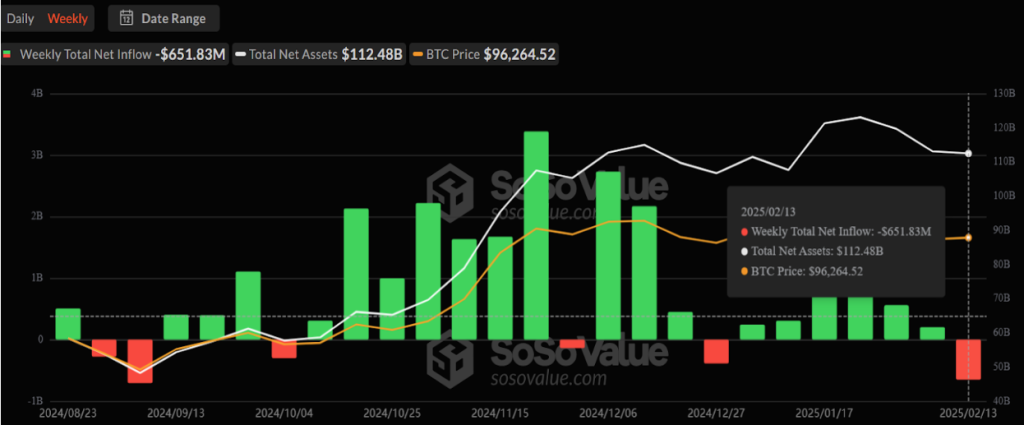

A major factor behind the surge in Bitcoin exchange inflows could be outflows from Spot Bitcoin ETFs. US-based Spot Bitcoin ETFs have been a major cause of Bitcoin’s bull run this year, with consistent inflows fueling upward momentum. However, last week played out very differently for these Spot Bitcoin ETFs.

Particularly, data from SosoValue reveals that US-based Spot Bitcoin ETFs recorded $651.83 million in net outflows over the past week. Interestingly, this is the largest weekly outflow recorded in these Spot Bitcoin ETFs since the first week of September 2024. This suggests that some institutional investors have been offloading Bitcoin, either to secure profits or in response to lingering uncertainty after the drastic price crash at the beginning of February.

Image From SosoValue

The Bitcoin inflows into crypto exchanges open up a bearish case for Bitcoin, especially since it creates a selling pressure on exchanges. Technical analysis shows that Bitcoin is currently trapped between key supply and demand levels. According to crypto analyst Ali Martinez, there is a significant 1.43 million BTC demand wall between $94,660 and $97,540, while a 1.16 million BTC supply wall sits between $97,650 and $99,470. A breakout in either direction will potentially set the trend for the next major move.

If Bitcoin breaks above the $99,470 resistance, it could trigger fresh buying momentum and push the price substantially above the $100,000 mark again. However, a more extended correction could unfold if selling pressure intensifies and BTC falls below the $94,660 support.

Image From X: Ali_Charts

At the time of writing, Bitcoin is trading at $97,504.

Featured image from KITCO, chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments