Bitcoin has remained above $60,000 for the past two weeks, holding strong as the broader crypto market bulges. This steady performance is fueling optimism among traders and investors alike.

According to key data from CryptoQuant, short-term holders are now selling for profit, leading to a notable decrease in BTC supply. This reduction in available BTC suggests a potential supply squeeze as demand continues to rise, especially following the recent interest rate cuts by the Federal Reserve.

Top analysts and investors view this as a positive signal, with many believing that Bitcoin could be gearing up for another major rally. As demand outpaces supply, traders are increasingly hopeful for a surge in BTC prices over the coming weeks.

However, a key level to watch remains $70,000—breaking through this resistance would provide the confirmation needed for Bitcoin to continue its upward trajectory. Until then, market participants closely watch the charts, waiting for signs of a sustained breakout.

Bitcoin Supply Suggests A Coming Rally

Bitcoin has finally made a decisive move to higher prices, sparking excitement and caution among traders. While some see this as the start of a new rally, others fear it could be a bull trap, setting the stage for a sharp pullback. One prominent on-chain analyst, Axel Adler, has weighed in on the debate, sharing an insightful report on X.

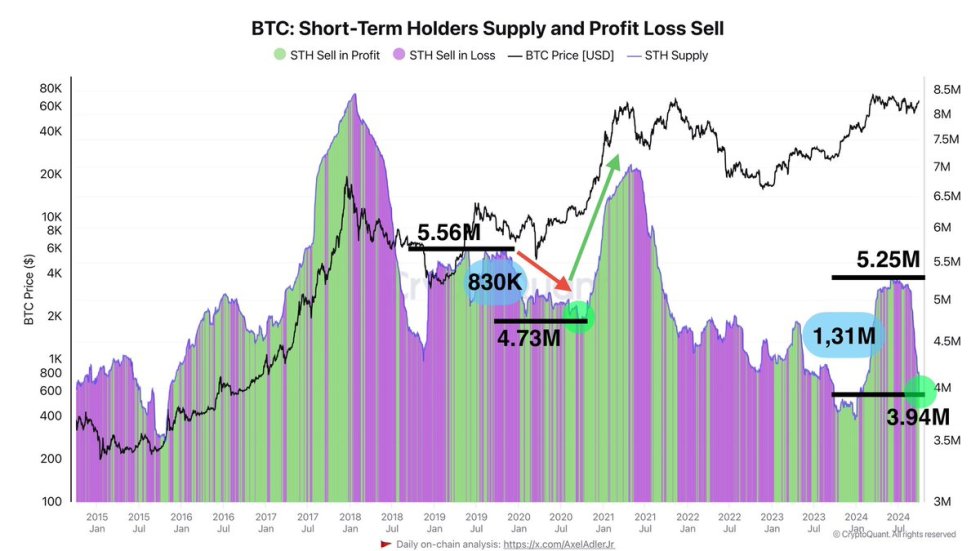

Adler highlights that short-term holders (STHs) have moved into profit and are beginning to sell their coins, as indicated by a green circle on his chart. However, despite this selling activity, the decrease in STH supply by 1.31 million BTC suggests a more positive outlook.

Fewer Bitcoins are circulating among STHs, often associated with frequent trading. This drop in supply, combined with the willingness of more holders to HODL, signals growing confidence in BTC’s long-term potential.

In the chart Adler shared, which shows the BTC STHs Supply and Profit Loss Sell metrics, Bitcoin’s current STH supply stands at 3.94 million—significantly lower than the 5.25 million in April.

This lower supply indicates that fewer short-term traders are flooding the market, strengthening Bitcoin’s price. Investors are increasingly optimistic that this supply decrease will fuel higher prices in the coming weeks, reinforcing the belief that BTC could be on the verge of a new rally.

BTC Technical Analysis: Key Levels To Watch

Bitcoin is trading at $63,617 after a 4% dip, testing the daily 200 moving average (MA) at $63,719 as support. This is a crucial level for BTC, as the price has struggled to maintain a position above this indicator since early August. Holding this level is essential for bulls to keep the upward momentum alive and prevent further downside risks.

If the price halves above the daily 200 MA, it could signal renewed strength, allowing Bitcoin to reclaim the $65,000 area. This would likely set the stage for a stronger push toward higher supply levels and potentially trigger a new bullish phase.

However, if BTC fails to hold above this key support, a deeper correction could follow. A failure to close above the 1D 200 MA would open the door for a pullback to lower demand levels around $60,500, a critical support zone in previous corrections. Traders and investors are closely watching this level, as the next few days will be decisive for Bitcoin’s short-term price action.

Featured image from Dall-E, chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments