On-chain data shows the Bitcoin exchange whale ratio has remained at relatively low levels recently, implying that the whales haven’t been active.

Bitcoin Exchange Whale Ratio Hasn’t Observed Any Uplift Recently

As pointed out by an analyst in a CryptoQuant post, whales have not intervened in the latest decline in BTC so far. The indicator of interest here is the “exchange whale ratio,” which measures the ratio between the sum of the ten largest transactions to exchanges, and the total exchange deposits in the market.

Since the top 10 transfers to these platforms are generally coming from the whales, the ratio’s value can tell us about how the deposit activity of these humongous investors currently compares with that of the entire market.

When the value of this metric is high, it means that the whales are making up a high percentage of the total exchange inflows in the sector right now. As one of the main reasons why investors deposit to exchanges is for selling-related purposes, such a trend can imply these large holders are dumping currently.

On the other hand, low values of the indicator imply this cohort is only making up for a healthy portion of the inflows at the moment. Depending on other factors, this trend can be either neutral or bullish for the value of the asset.

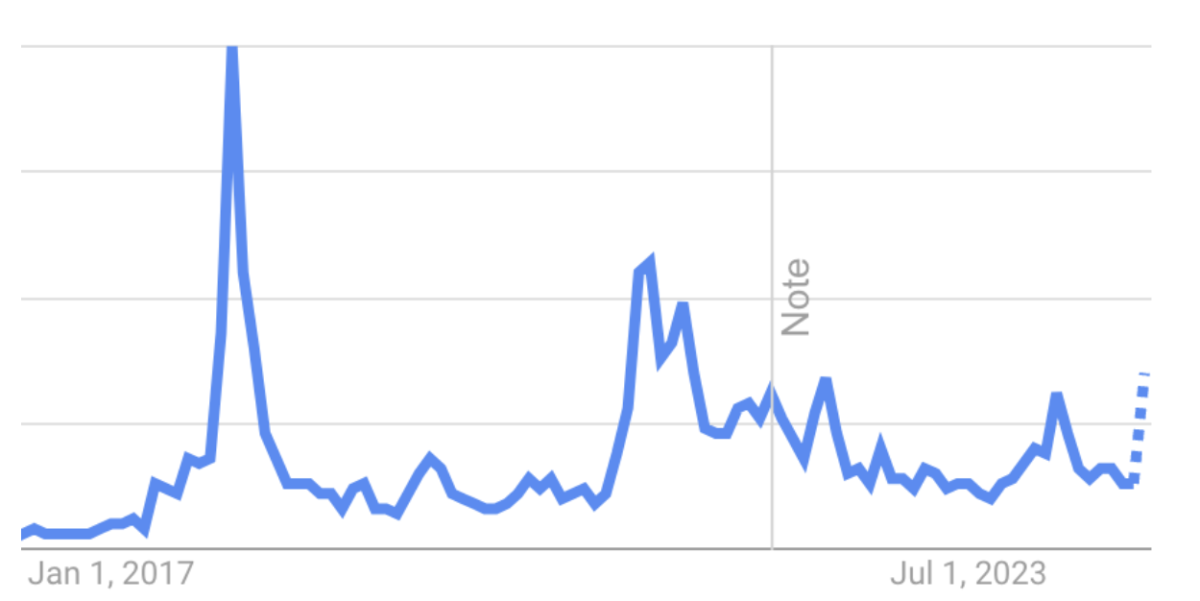

Now, here is a chart that shows the trend in the Bitcoin exchange whale ratio, for spot exchanges, and for derivative exchanges, over the past few months:

As shown in the above graph, the exchange whale ratio for both types of platforms has mostly moved sideways around relatively low values recently. This suggests that these investors haven’t been depositing much to either derivative or spot exchanges.

At the current value of the metric, whales are only making up for 32% of the total inflows to derivative exchanges, while they are contributing to around 41% of the spot deposits. These levels are a decent distance away from what has been the danger zone in the past.

Interestingly, this trend has held through the plunge that the cryptocurrency has registered in the past week, implying that these humongous investors haven’t been playing that big a role in this drop.

And as the exchange whale ratio has continued to stay low even after the plunge, it can be a sign that these humongous investors aren’t particularly bothered about the FUD in the current market.

It now remains to be seen whether this cohort would continue to stay silent in the near future as well, or if it will finally take some action and participate in some exchange activity. Naturally, deposits to spot platforms would be the ones to watch out for, as these exchanges are where selling usually happens.

BTC Price

At the time of writing, Bitcoin is trading around $29,200, down 2% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments