Last month brought sunny weather in terms of market developments. The Bitcoin price surged by more than 40%, while the crypto market cap moved above $1 trillion. Multiple altcoins enjoyed double-digit gains, which, among other factors, were triggered by several announcements that the crypto community has been awaiting:

- Ethereum developers clarified the launch window for the Shanghai update.

- The first Cardano-based stablecoin was introduced.

- The Shina Inu community received details on the Shibarium update.

However, these positive achievements were partially eclipsed by the ongoing drama between Digital Currency Group (DCG), and its subsidiary Genesis. In addition, regulators began in earnest to look more closely at developments in the space, which does not please all market participants.

On our end, we’re continuing work on new ecosystem features that aim to improve your user experience. These efforts include product updates, new educational materials, and partnerships with other platforms.

Dive into our first Trader’s Digest of 2023, and discover the latest developments within CEX.IO as well as the wider crypto industry.

New coin listings

Flare (FLR) airdrop and listing

We listed Flare (FLR) on CEX.IO Exchange, and distributed FLR tokens to users eligible for the airdrop.

FLR is the native token of the Flare project, a layer 1 (L1) blockchain for building dApps capable of cross-chain interoperability. The token can be used for transaction fees, payments, and staking, while improving network security.

&

Company updates

CEX.IO partnered with HaasOnline

In order to enrich the API trading experience for our customers, we partnered with HaasOnline, which offers an ecosystem of automated trading tools. CEX.IO users can now take advantage of HaasOnline TradeServer Cloud to deploy custom and pre-built trading bots.

The platform supports backtesting and paper trading, empowering users to test bots with historical CEX.IO market data, and use simulated CEX.IO accounts, without risking their capital.

Find more details about HaasOnline on our blog, where we also describe some basic algorithmic trading strategies, which could be useful during bear markets.

&

CEX.IO Prime’s Institutional Savings campaign

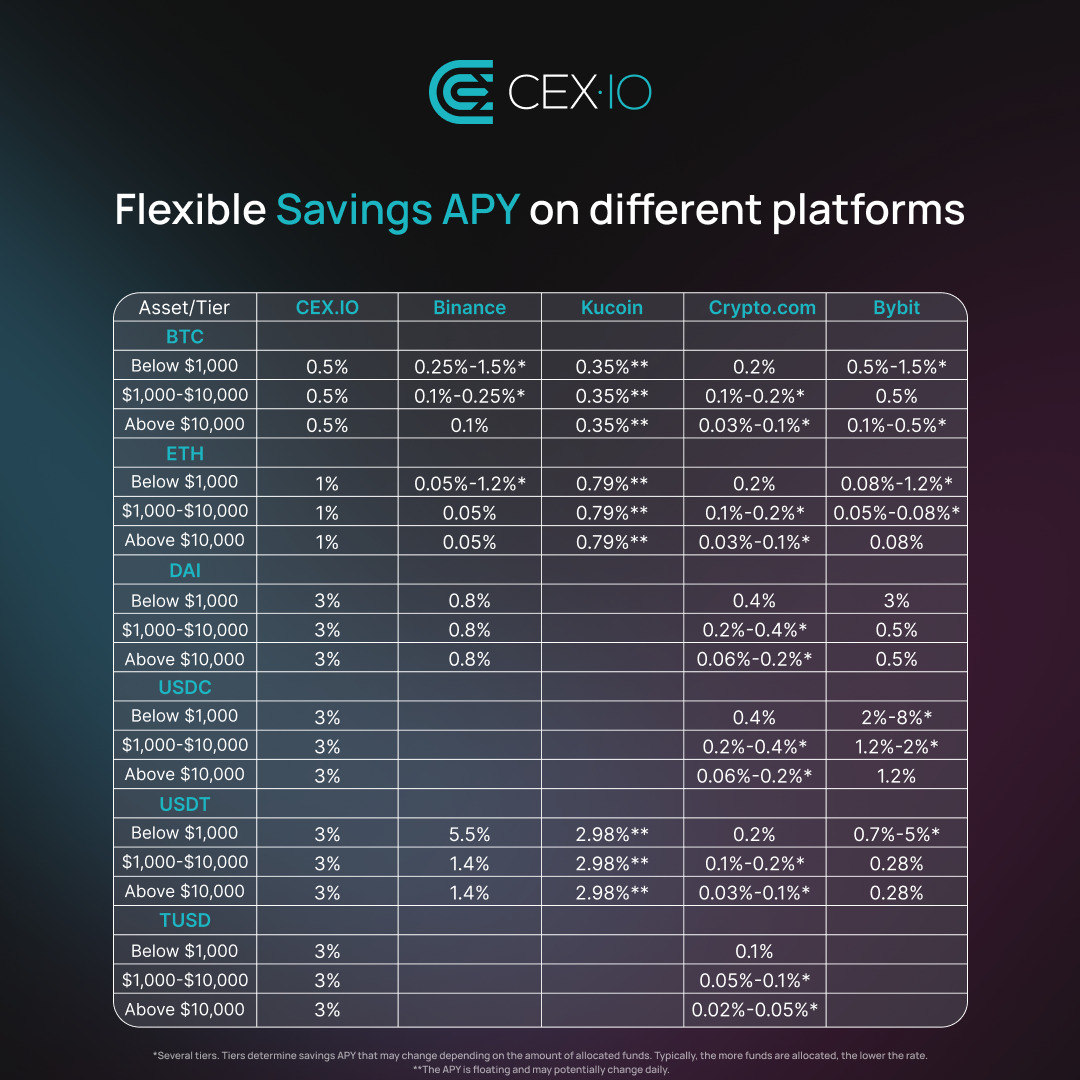

Did you know that many platforms use different savings APY rates, depending on the tier of investment? This is not how it works with CEX.IO. Our eligible users can earn savings rewards regardless of the amount of funds allocated.

We compared our Flexible Savings APY with other, similar platforms, and discovered that our approach empowers users to earn higher savings rewards. Furthermore, the more funds you allocate to savings, the greater the benefit could be. Check more details here.

In addition, if you want to allocate over $50,000 for savings, you can join CEX.IO Prime’s Institutional Savings program to earn increased rewards for stablecoins (4%). Interested in this offer? Fill out the form.

Note: CEX.IO Savings is unavailable for customers from the U.S.

Our Q4 2022 COMPASS report was released

Our Market Research Team has issued the Q4 2022 edition of our COMPASS report series, designed to help you navigate the latest industry developments.

In the newest iteration of COMPASS, we dived into the inspiring resilience of Bitcoin, explored the roots of its dominance, and reviewed the critical DeFi infrastructure that has been built around Bitcoin.

Make informed decisions using our COMPASS to guide you through the ever-changing crypto industry landscape.

Notable industry events

Genesis filed for bankruptcy protection

On January 18, Bloomberg reported the cryptocurrency lending unit of Digital Currency Group (DCG), Genesis, prepared the groundwork for a bankruptcy filing. Two days afterward, Genesis filed for Chapter 11 bankruptcy protection in New York.

According to bankruptcy court documents, Genesis claimed to have $5.1 billion in liabilities, and estimated more than 100,000 creditors. Genesis owes over $3.5 billion to its top 50 creditors, among which include crypto exchange Gemini, Cumberland, Mirana, MoonAlpha Finance, and VanEck’s New Finance Income Fund. In addition, DCG reiterated that it owes Genesis roughly $526 million due in May 2023, and $1.1 billion via a promissory note that matures in June 2032.

Shanghai update was scheduled for March 2023

During their first virtual meeting of the year, Ethereum developers said they are pushing ahead with the Shanghai upgrade that will let users withdraw staked ETH. They agreed to roll out the upgrade in March 2023.

However, core developers decided to remove all EVM Object Format (EOF) changes, and reject any EIPs that might be proposed to replace EOF as a part of the Shanghai agenda. This was done to ensure timely staking withdrawals. As such, this will be the only major instrument added with Shanghai’s activation. To make this process smooth and resource-efficient, the developers launched the Zhejiang testnet.

Shina Inu developers revealed the Layer-2 blockchain Shibarium

The team behind Shiba Inu development announced the launch of the Shibarium Layer-2 solution. It will operate on top of Ethereum, and aims to facilitate faster transactions, while lowering fees.

The move could further bolster SHIB and BONE tokens native to Shiba Inu. Each transaction on Shibarium will burn a certain amount of SHIB tokens, but the specific amount has not yet been decided. BONE will be used to pay for gas transactions and reward stakers within the Shibarium protocol. In addition to BONE, validators and delegators will also be allocated a portion of the forthcoming TREAT token. This token will be launched to incentivize liquidity pools on ShibaSwap.

U.S. authorities are investigating DCG and Gemini

According to Bloomberg, the U.S. Department of Justice’s Eastern District of New York (EDNY) and the U.S. Securities and Exchange Commission (SEC) initiated investigations against DCG. The trigger is alleged to be internal transfers to its subsidiary Genesis Global Capital. However, the report said that neither Genesis nor DCG “has been accused of wrongdoing.”

In addition, in its lawsuit, the SEC alleged Gemini and Genesis sold unregistered securities through the Gemini Earn program. The regulator accused Earn of being unregistered, and claimed that the program’s offerings dictate that it should have been. In its press release, the SEC also stated that Genesis’ closing of lending withdrawals left 340,000 Gemini Earn customers, and about $900 million in crypto, in limbo.

New cryptocurrency subcommittee in the U.S.

The U.S. House of Representatives has formed a subcommittee under the Financial Services Committee, with a focus on digital assets. The body will be dedicated to developing rules for federal regulators toward cryptocurrencies, and creating policies to promote digital financial technologies. The subcommittee’s appointed chairman is Republican Congressman French Hill, who previously led efforts to study the central bank digital currency (CBDC).

Stablecoin regulation will be one of the top priorities for the newly formed U.S. House of Representatives subcommittee.

Avalanche partnered with Amazon Web Services

The team behind Avalanche development, Ava Labs, announced joining forces with Amazon Web Services (AWS) to support the wider adoption of blockchain technology by enterprises, institutions, and governments.

According to the blog post, the partnership will make it easier for developers to launch and manage nodes on the Avalanche blockchain, as AWS will support Avalanche’s infrastructure and decentralized applications (dApps). In addition, Ava Labs plans to add subnet deployment to the AWS Marketplace, enabling both individuals and institutions to launch custom subnets within the network.

Fantom launched a decentralized fund for ecosystem development

Fantom released the Ecosystem Vault to fund projects and applications built on its blockchain. The project is financed by 10% of the transaction fees on Fantom, and is controlled by the community. The initiative was made possible by decreasing the burn rate of FTM tokens, and redirecting the resulting 10% to the vault.

Any proposal must receive at least 55% approval from the community to be funded, with at least 55% of FTM stakers in attendance. For the initial launch of the Vault, there will be only five projects receiving payments at any one time.

Bitzlato shut down, and the platform’s leadership were arrested

On January 18, crypto exchange Bitzlato informed its community that it was hacked, and would shut down its services. The same day, the U.S. Justice Department announced the capture of the platform’s founder, Anatoly Legkodymov. He was arrested in Miami for running illegal operations. The Federal Bureau of Investigation (FBI), Europol, and the U.S. Treasury Department are also involved in the Bitzlato case.

According to Justice Department officials, Bitzlato was one of the largest crypto crime exchanges. It offered peer-to-peer services and hosted wallets of criminals buying and selling illegal goods. Notably, there was no know your customer (KYC) information needed in order to trade on the exchange.

On January 23, Europol announced the arrest of the CEO, CFO, and CMO of Bitzlato in Spain, stating that almost half of all Bitzlato transactions were linked to criminal activities.

Djed, a Cardano-based algorithmic stablecoin, was launched

On January 31, COTI Network developers, in collaboration with Input Output, launched the algorithmic stablecoin Djed on the Cardano network. The Djed ecosystem has joined with over 40 Cardano-based decentralized finance applications (dApps) to bring the adoption of the new stablecoin.

With Djed’s release, developers wanted to re-establish trust in algorithmic stablecoins after the collapse of Terra’s UST stablecoin in 2022. The team has built Djed to be overcollateralized by 400%-800% by Cardano’s native coin ADA, and reserve coin SHEN.

Japan updated guidance for taxing NFT-related transactions

Japan’s National Tax Agency (NTA) issued guidelines for the taxation of transactions related to NFTs and blockchain games. As such, the process would only consider the total income based on a certain token (in-game currency), evaluating it at the end of the year. NFT creators will also face their own taxation. If creators sell their NFTs to Japanese consumers and earn from them, they face consumption tax.

To keep up with critical news and events in the cryptocurrency space, follow our weekly crypto highlights blog series.

To further develop your crypto trading skills on top of receiving the best market insights, stop by CEX.IO University.

Disclaimer: Not investment advice. Seek professional advice. Digital assets involve risk. Do your own research.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments