Summary:

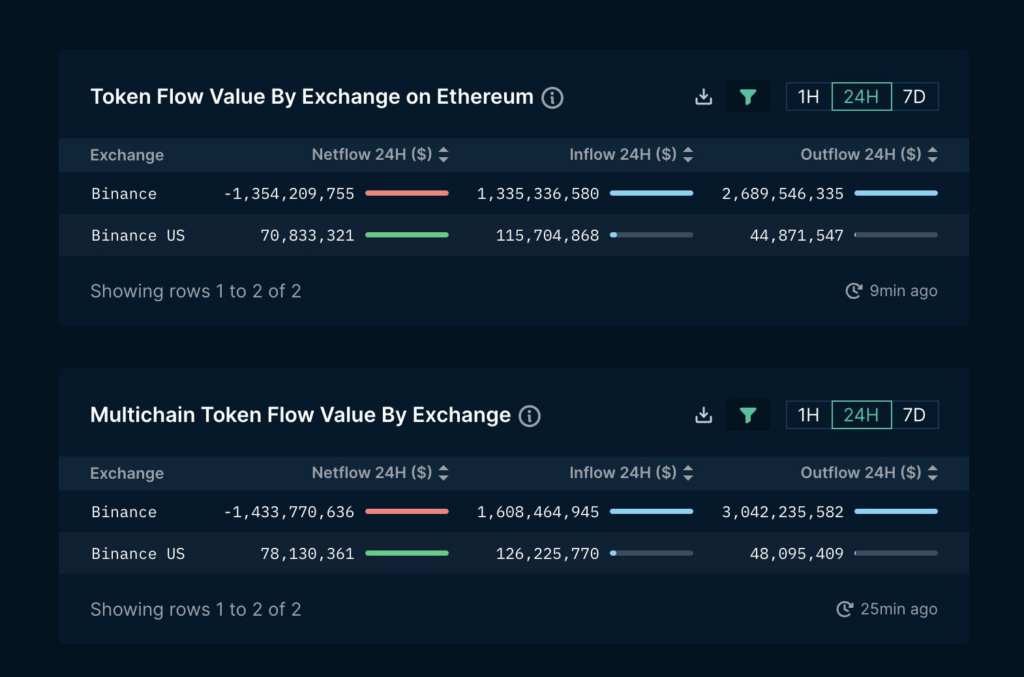

- Data from blockchain intelligence startup Nansen showed negative netflow from Coinbase and Binance after the U.S. SEC sued both crypto exchanges.

- Binance and Binance US recorded a combined negative outflow north of $400 million 24 hours after the SEC’s lawsuit against rival Coinbase.

- Coinbase saw a smaller negative netflow across its crypto exchange and custodial service at just over $80 million, excluding withdrawals on Bitcoin’s network for both platforms.

Data from blockchain intelligence startup Nansen showed negative netflow from crypto exchanges Coinbase and Binance after the U.S. SEC sued both platforms for supporting unregistered securities trading.

Binance was the first of the two exchanges on the receiving end of the SEC’s crackdown this week. Netflow on the company’s American affiliate Binance US was $78 million positive 24 hours after the Securities and Exchange Commission sued BAM Trading and CEO Changpeng Zhao on June 5.

The numbers flipped negative on June 7, 24 hours after rival crypto exchange Coinbase was accused of similar securities violations. Exchanges experience negative netflow when users withdraw more assets than they deposit.

Withdrawals Surpass Deposits On Coinbase And Binance

24 hours after charges were filed against Coinbase, both Coinbase and Binance show negative netflow according to Nansen. For Binance, negative netflow crossed $400 million on its international platform and Binance US, excluding withdrawals on Bitcoin’s network. Binance US’s negative netflow skyrocketed to $120 million after the SEC filed an emergency motion to free the platform’s assets.

Coinbase and Coinbase custody saw over $80 million in negative netflow, a smaller number compared to Binance.

SEC In For A Showdown

Both Coinbase and Binance have expressed intent to fight the SEC in court. The two crypto exchanges denied breaking securities laws and called out the commission for failing its duty to provide clear guidance.

“We’ll get the job done” Coinbase CEO Brian Armstrong said in response to the lawsuit and Binance CEO Changpeng Zhao tweeted “4” suggesting that the news is FUD.

The SEC also classified several cryptos like SOL and MATIC as securities leaving the wider crypto community wondering what other tokens could feature in the commission’s war against digital currencies.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments