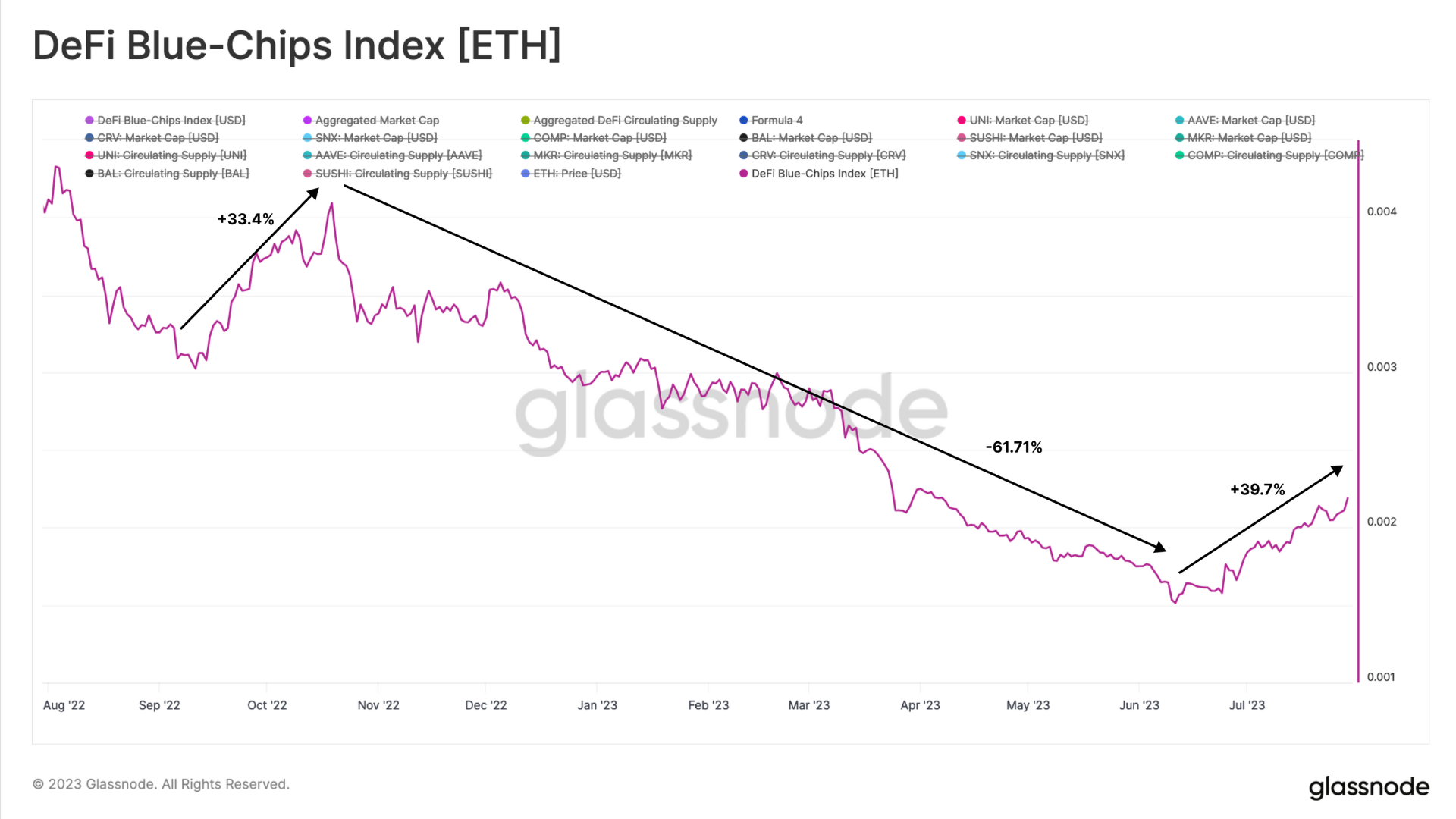

Despite increased regulatory activity, DeFi index price, led by Compound [COMP] and MakerDAO [MKR], has rallied by 56% since 11 June, Glassnode found in a new report.&

Glassnode’s DeFi price index tracks the performance of the top eight DeFi tokens by market capitalization. With other altcoins outperforming leading altcoin Ethereum [ETH], mostly propelled Ripple’s [XRP] partial win over the U.S. SEC, Glassnode noted:

“Our DeFi index…has established an almost two-month-long uptrend relative to ETH. This is the first outperformance since September 2022 and with very similar performance thus far.”

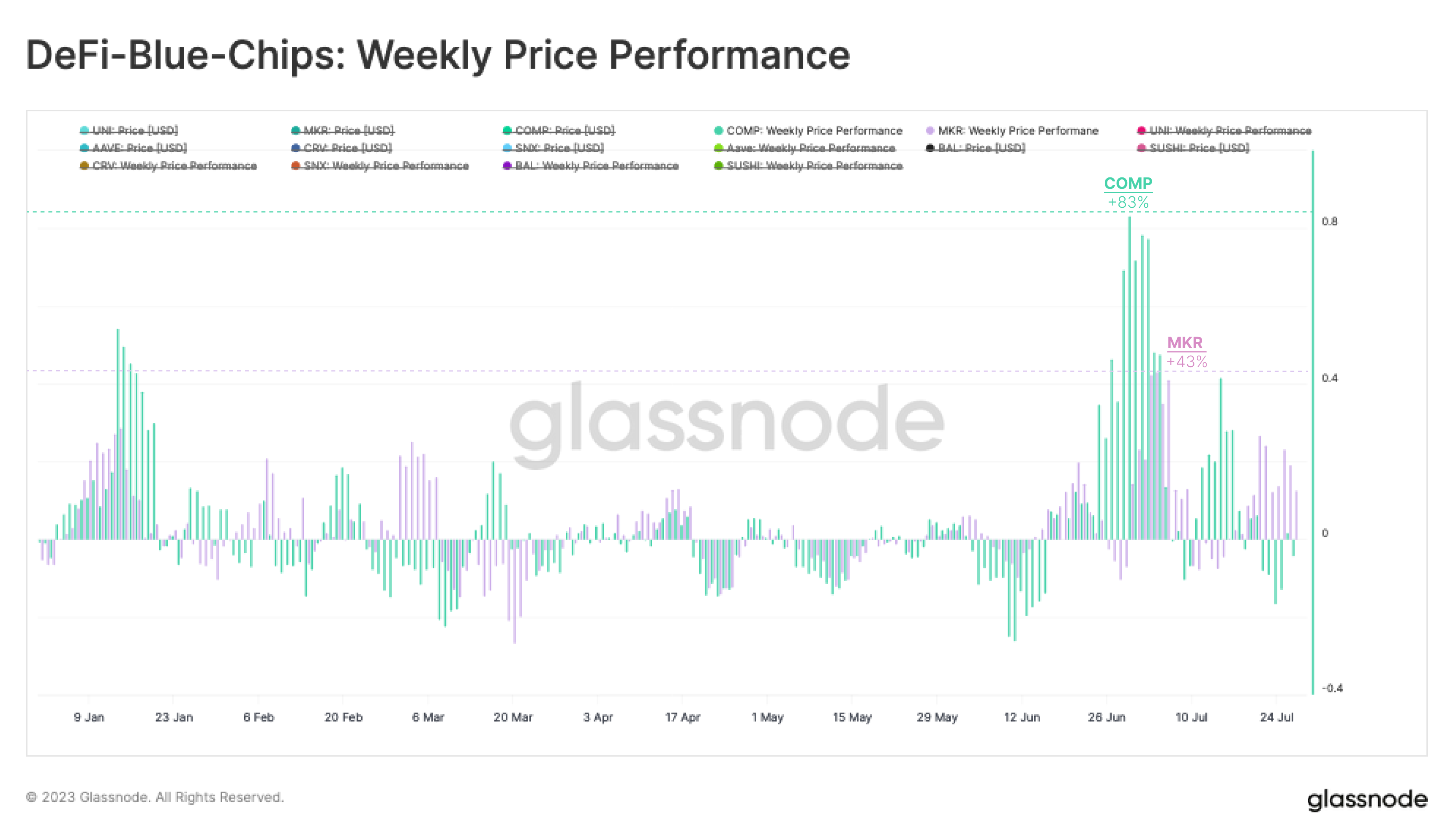

COMP and MKR take the lead

Per the report, COMP and MKR “stand out as primary drivers of this trend.” Regarding Compound, its governance token COMP experienced an 83% uptick a week after the protocol’s founder and CEO Robert Leshner, revealed his exit from the lending protocol and announced the launch of the Superstate project.&

Around the same period, MakerDAO introduced its Smart Burn Engine, which drove up MKR’s value, Glassnode found.& The MakerDAO Smart Burn Engine is a smart contract system that allocates excess DAI to purchase MKR, increasing the on-chain liquidity of MKR over time. This could remove $7 million worth of MKR from circulation in 30 days, increase the token’s demand and drive its price. Following the Smart Burn Engine’s implementation, MKR’s value climbed by 43% a week after.&

DEXes saw increased activity as well

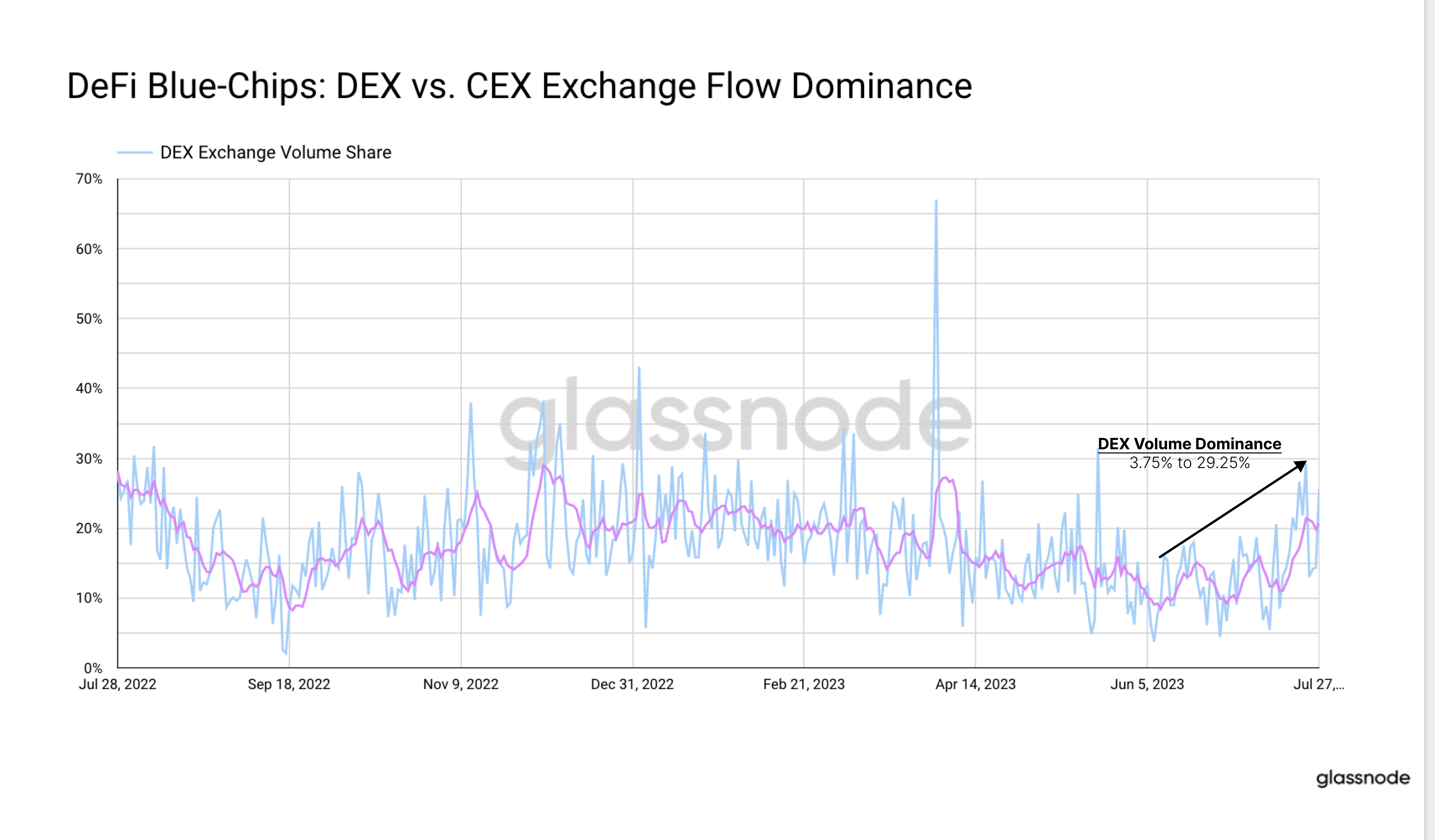

Apart from the jump in the value of DeFi tokens, the past few weeks have also been marked by a jump in network activity across decentralized exchanges. According to Glassnode:

“The relative share of volume traded on DEXs has increased from 3.75% at the beginning of June to 29.2% today, close to the highs seen during the second half of 2022.”

As noted by Glassnode, the rise in DEX volume was partly due to increased trading activity on Uniswap across Layer 2 platforms and the surge in network activity from both human traders and Sandwich bots.

While Uniswap trading volume on Ethereum remained low, Glassnode noted:

“that an appreciable portion of trading has shifted from the Ethereum mainnet across to Arbitrum, attracting up to 32% of volume in March. This trend has remained elevated in June and July, which provides a degree of reasoning for the lower volume on Ethereum we observed above.”

Regarding human and Sandwich bots trading activity on Uniswap, Glassnode noted that while human trading volume has risen by 30% since the beginning of July, Sandwich bots have contributed over 60% of the daily trading volume on the DEX.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments