What is an exit strategy?

An exit strategy is a plan with the intentions of selling your cryptocurrencies once a predetermined criteria have been met. The main goal is to maximize profits while minimizing losses.

Why you need an exit strategy?

As we all know, crypto prices are utterly volatile. This makes trying to sell at the peak price extremely risky (do yourself a favor: stop trying to get out at the top), since you could miss it and end up selling at a loss. That’s why we make exit strategies, to maximize profits while minimizing losses.

What are your goals?

First think to contemplate is what are your goals. These are personal questions that everyone must consider when investing:

- How much are you willing to hodl for the long term (+5 years)? And how much are you hodling only for the short term?

- How much profit is your main goal? (In % or $)

- How much risk are you willing to take?

- What is your realistic price target?

You will not know what exit strategy works better for you until you have tried a couple, since everyone has different goals. Thus, these are the best and most common crypto exit strategies for beginners that you can try out:

Selling at price targets

This is the most commonly used exit strategy. Here you target a price for your investment and sell your asset when the prices reach that range. This tactic may seem simple, but will eventually lead to better results instead of trying to time the market. For example, if you own 1 ETH instead of selling your whole ETH at $10K, divide it up into 5 different sections and sell them at different prices:

- Sell 0.2 ETH at $8K

- Sell 0.2 ETH at $9K

- Sell 0.2 ETH at $10K

- Sell 0.2 ETH at $11K

- Sell 0.2 ETH at $12K

This way you’re taking profits along the way, and if the Markets dips you would have secured some profits. The example above is a simple one and not financial advice, I recommend you to DYOR and deep studies before setting realistic price targets.

Playing with house money

One common exit strategy is selling what you initially invested when you’re up 2x,3x or even more. With this plan you can take more risk when you sell your initial investment, since if you lose everything, it would be house money. However, for some people securing only 2x/3x/5x is a small amount in the crypto space.

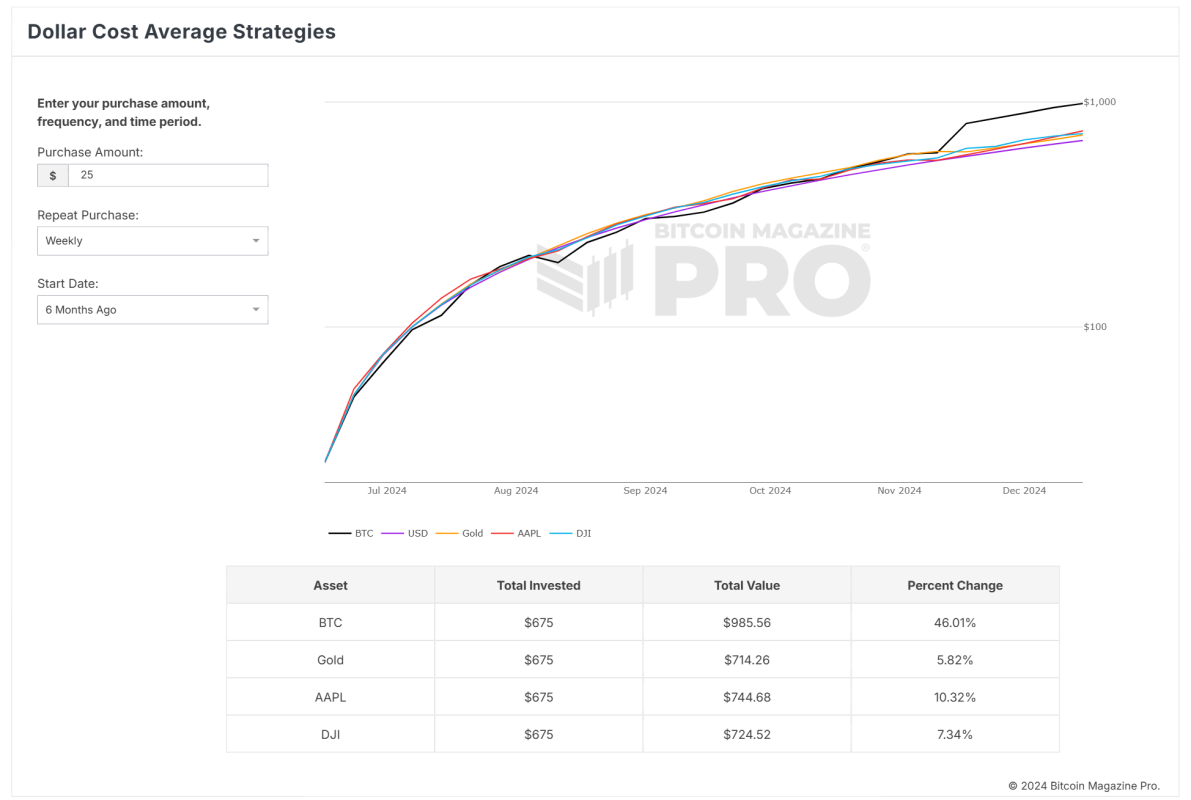

Dollar-Cost-Average out (DCA)

Probably the most mentioned exit strategy in this subreddit. This strategy is particularly designed for safe investment. In the dollar cost averaging method, you divide your portfolio and periodically sell your assets between a regular interval. This strategy can prevent becoming too greedy, or selling too late, while still taking profits from time to time. Many people keep 5-10% of their holdings just in case we are in a super-cycle.

For example, if you think that this bull run will peak in 31 of January, start selling 10% of your portfolio 10 weeks before, selling 10% every week until you sell all your portfolio. Or you can sell 5% every single day, starting 20 days before. Just pick what percentage suits better for you and when to sell it (every day/week/month).

I hope this post was useful to those new in the crypto space. As always, the examples above are not financial advice, DYOR and feel free to share your exit strategies so we can all learn together. This post isn't FUD, I think there's still a long way to go this bullrun but I want people to be ready when the time comes.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments