Crypto is not part of every banks’ strategy for the future.

HSBC, one of the world’s biggest multinational banks, says they’re not too confident about crypto and thus, will not be offering any service related to it in the future.

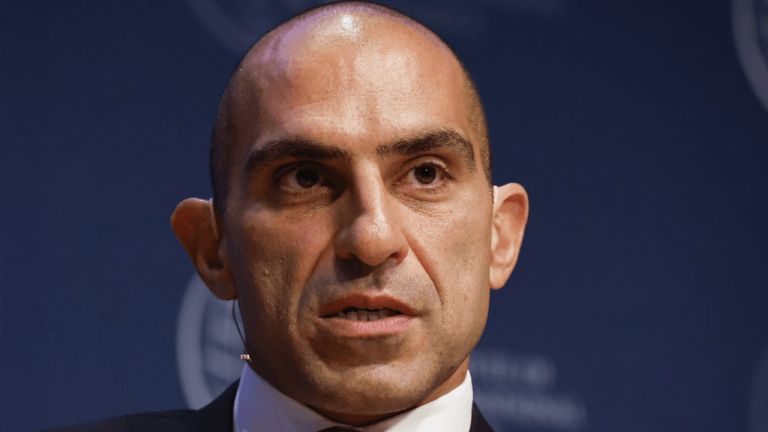

Noel Quinn, HSBC CEO, says:

“I do worry about the sustainability of the valuations of crypto and I have done for a while. I’m not going to predict where it will go in the future.”

In a recent interview with CNBC-TV18, Quinn confirmed that they will not be treading into the crypto space such as exchanges or trading, not now or ever as they believe that it is not too clearly defined and tested in terms of stability and suitability for a lot of consumers today.

Image: PaymentsJournal HSBC Not A Fan Of BitcoinIn May 2021, Quinn has revealed to Reuters his perspective on Bitcoin as unsuitable for payments because it’s difficult to quantify on a balance sheet judging by its high volatility. On the other hand, Quinn sees it as generally an asset class.

He also says that due to the volatile nature of Bitcoin, they refuse to support or promote it as an asset class.

For the same reasons, HSBC is also cautious about jumping into stablecoins. Although stablecoins have some stored value or are backed by the US dollar, it will really still depend on the accessibility, structure, and the organization backing it.

In April 2021, there were some changes implemented in the digital assets policy of HSBC Canada that included the suspension of sales transactions or exchange of products that are related to crypto.

No Security And Stability?Quinn has a rather pessimistic view regarding digital assets and how it will fit today’s market or consumer base.

Apart from the high volatility of cryptocurrencies, the rise of cyber attacks in connection to the crypto space has also prompted many financial institutions to lose faith and confidence in Bitcoin and the like.

In fact, more than 56% of cyber attacks have been targeted towards crypto and were able to hack roughly $1 billion. Lazarus, a notorious hacking group, was able to steal around $540 million worth of digital assets on Ronin Bridge and other DeFi platforms. In that light, HSBC is not considering it as an asset class.

No To Bitcoin, Yes To The MetaverseMeanwhile, as the popularity of the metaverse rises, several businesses, including HSBC and JPMorgan Chase, are establishing virtual presences.

HSBC last March bought a plot of land within The Sandbox’s metaverse, the first global financial institution to do so.

JPMorgan Chase was the first of the big banks to establish an Onyx lounge in Decentraland, where users could purchase property using cryptocurrency, a month earlier.

Crypto total market cap at $926 billion on the daily chart | Source: TradingView.comFeatured image from SuperCryptoNews, Chart: TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments