Data shows the total open interest in the crypto sector has recently been at an all-time high, indicating that volatility may be coming for the coins.

Crypto Open Interest Has Been At Extreme Levels Recently

As CryptoQuant Netherlands community manager Maartunn pointed out in a post on X, the total crypto open interest has recently been sitting around a whopping $51.3 billion.

The “open interest” here refers to the total amount of derivative positions related to all digital assets currently open on the various exchanges in the sector.

When the value of this metric rises, it means that the investors are opening up fresh positions on the market right now. Generally, the total leverage in the sector goes up when such a trend takes form, so the assets could become more likely to show some volatility.

On the other hand, a downtrend in the indicator implies that the investors are closing their positions of their own volition or getting forcibly liquidated by their platform.

A sharp plunge in the metric could accompany some violent price action, but once the indicator’s value has settled down, the markets could become more stable due to a washout of leverage.

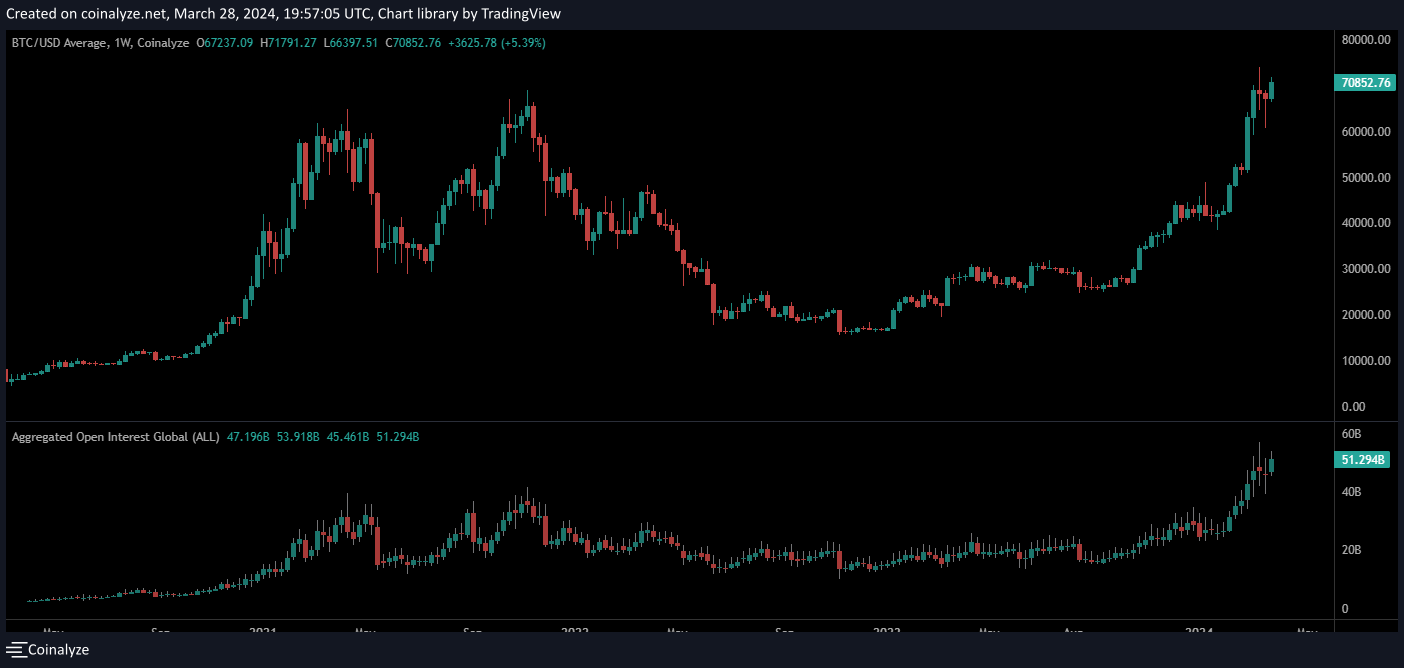

Now, here is a chart that shows the trend in the crypto open interest over the past few years:

As displayed in the above graph, the total open interest in the crypto sector has been riding an uptrend recently. This rise in the metric has come as the prices of Bitcoin and other assets have gone through their rallies.

This isn’t unusual, as the market attracts much attention during such price action. With a large amount of attention naturally comes speculation, so users flood exchanges with positions in these periods.

From the chart, it’s visible that open interest in the crypto market also rose during the 2021 bull run. The latest values of the indicator, however, have already surpassed the peak witnessed back then.

The metric has recently been around $51.3 billion, an all-time high. As mentioned before, high metric values can lead to volatility for the various assets in the sector.

As such, the current extreme levels of open interest could mean that the market may be prone to seeing some sharp price action in the near future. This volatility could take the market in either direction, at least on paper.

As is apparent from the graph, though, the indicator has historically only seen a significant cooldown with crashes in the Bitcoin price, so the current overheated open interest may be a bad sign for the crypto market.

Bitcoin Price

At the time of writing, Bitcoin is floating around the $70,100 mark, up more than 9% over the past week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments