Decentralized finance (DeFi) has been one of the focal points of the crypto industry. This is only getting more true as years go by, with more and more projects, individuals, and funds coming into the space.

It's clear that DeFi has grown exponentially in almost all of its metrics in the past couple of years, from the number of protocols that operate in the space, through the total value locked (TVL), and all the way to the number of users benefiting from various platforms.

This report will cover the performance of DeFi in the bearish year of 2022, as well as decipher what the space has to offer in the coming months and years. Let's get into it!

The Growth of DeFi

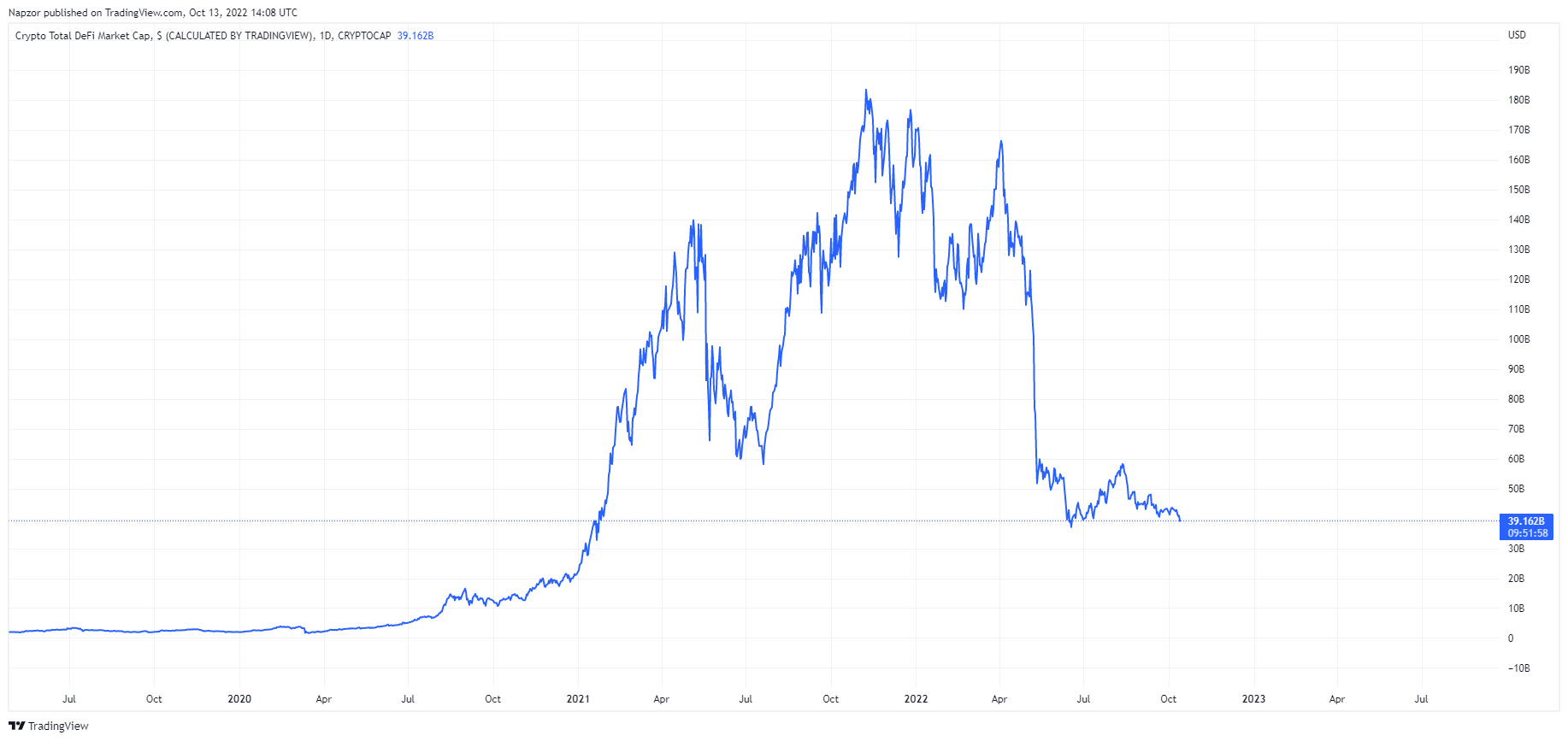

Market Capitalization

Since early 2020, the DeFi ecosystem has exploded in growth, with its market cap reaching over $26 billion by the end of 2020. This growth has continued throughout 2021, with the highest point reaching as high as $199 billion.

However, as 2022 came with lots of economic unrest and a crypto bear market, DeFi has pulled back toward the $40 billion mark.

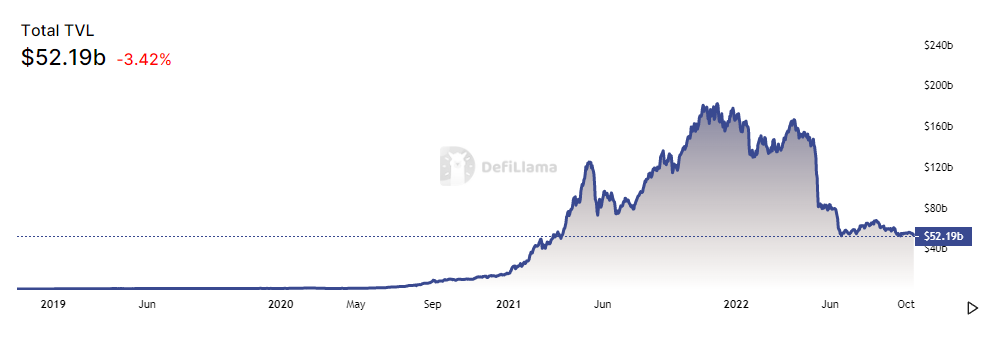

Total Value Locked (TVL)

When we look at the total value locked in various protocols, we may see nearly the same image as before - but the chart may fool you!

As a matter of fact, while the dollar value of tokens locked inside DeFi protocols has been following the DeFi ecosystem market cap, if we factor out the price fluctuations, we may see that the number of actual cryptocurrencies locked remained virtually the same. In fact, the dollar value of DeFi in TVL is now larger on a per-dollar basis than it was almost ever was. This means that, during the bear market, people were still locking their assets in DeFi protocols - they were just doing so with less expensive cryptocurrencies.

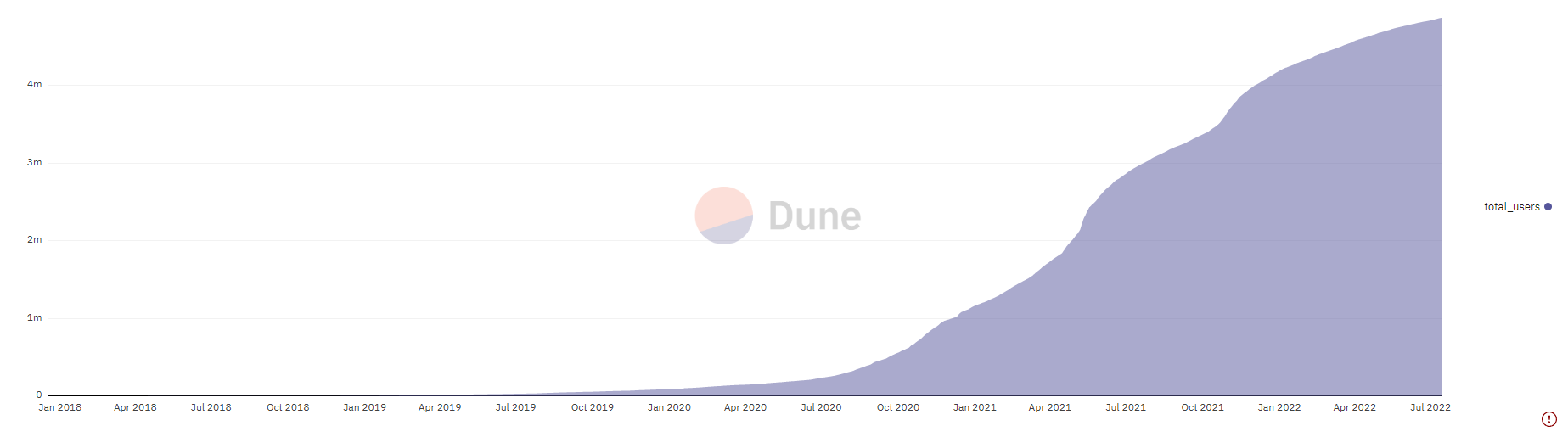

Addresses Participating in DeFi

We may see a different story if we look at the number of addresses participating in various protocols. The data once again shows a steady increase throughout 2020 and early 2021, but also throughout 2022 despite the bear market setting in.

This upward-facing trend seems to continue, likely due to the fact that many of the early adopters and power users of DeFi protocols are still participating, while new users will slowly coming back as the market becomes more stable.

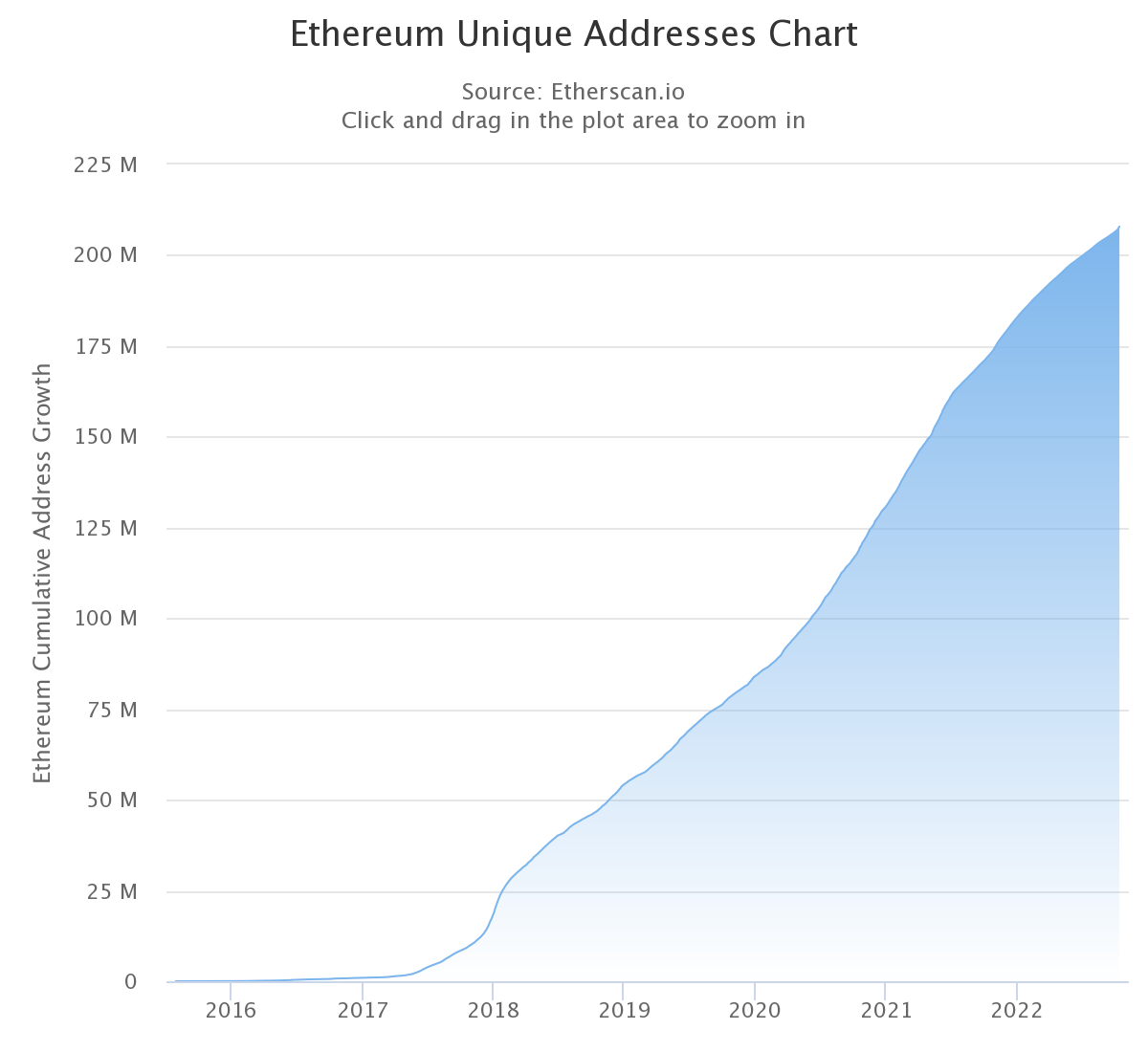

Unique Ethereum Addresses

Since most of the DeFi protocols are currently built on Ethereum, it's also important to look at the number of unique addresses interacting with Ethereum.

The data shows a steady increase throughout the years, which shows that people still transact and operate within the ecosystem despite the current bearish outlook.

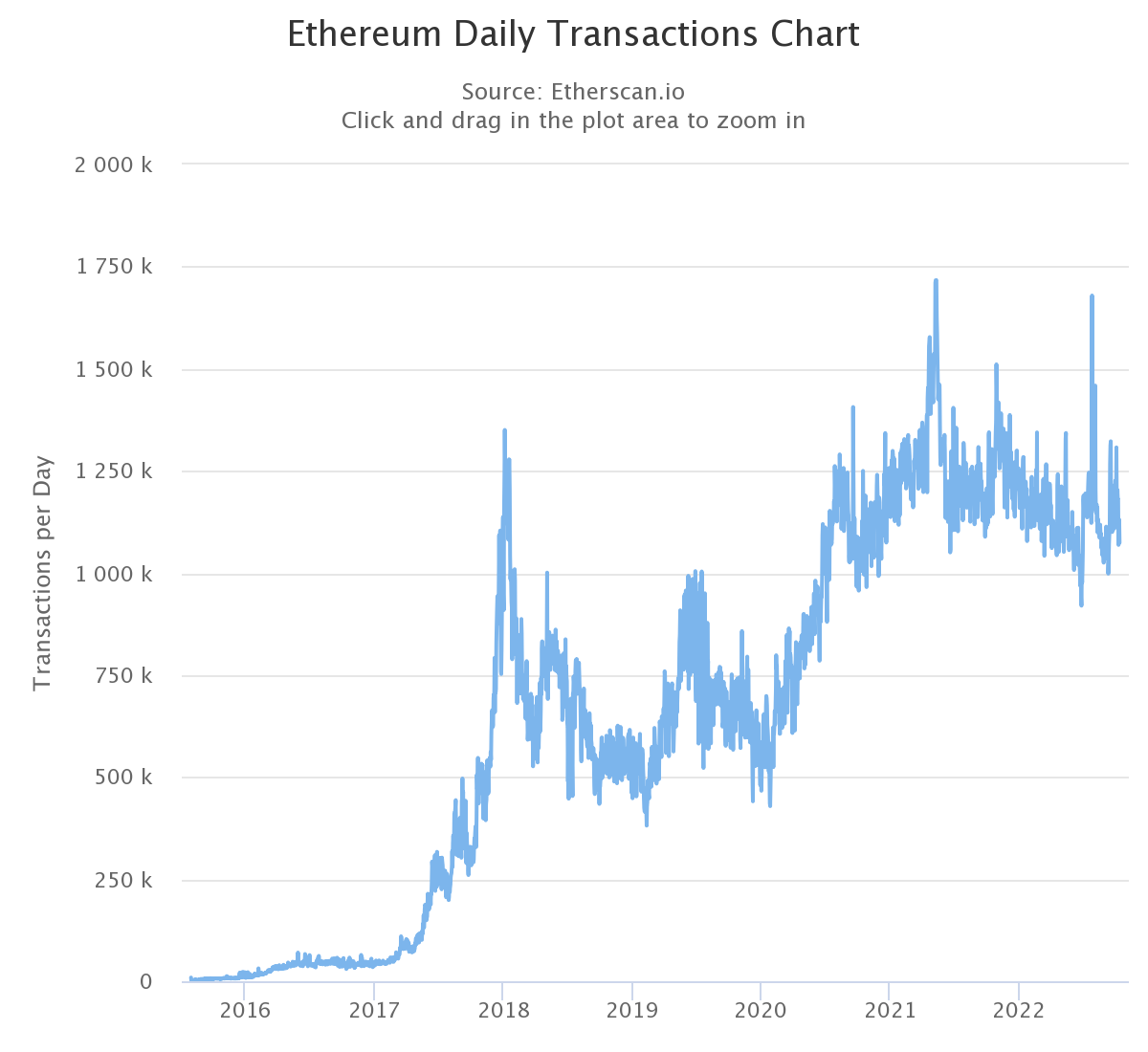

Ethereum Transactions Per Day

If we look at the number of transactions per day on Ethereum, we can see that, despite some fluctuations, the average has been clearly moving toward the upside.&

This is another great indicator that people are actually using the blockchain despite its uptrends and downtrends - and a large percentage of transactions are most likely connected to the DeFi ecosystem.&

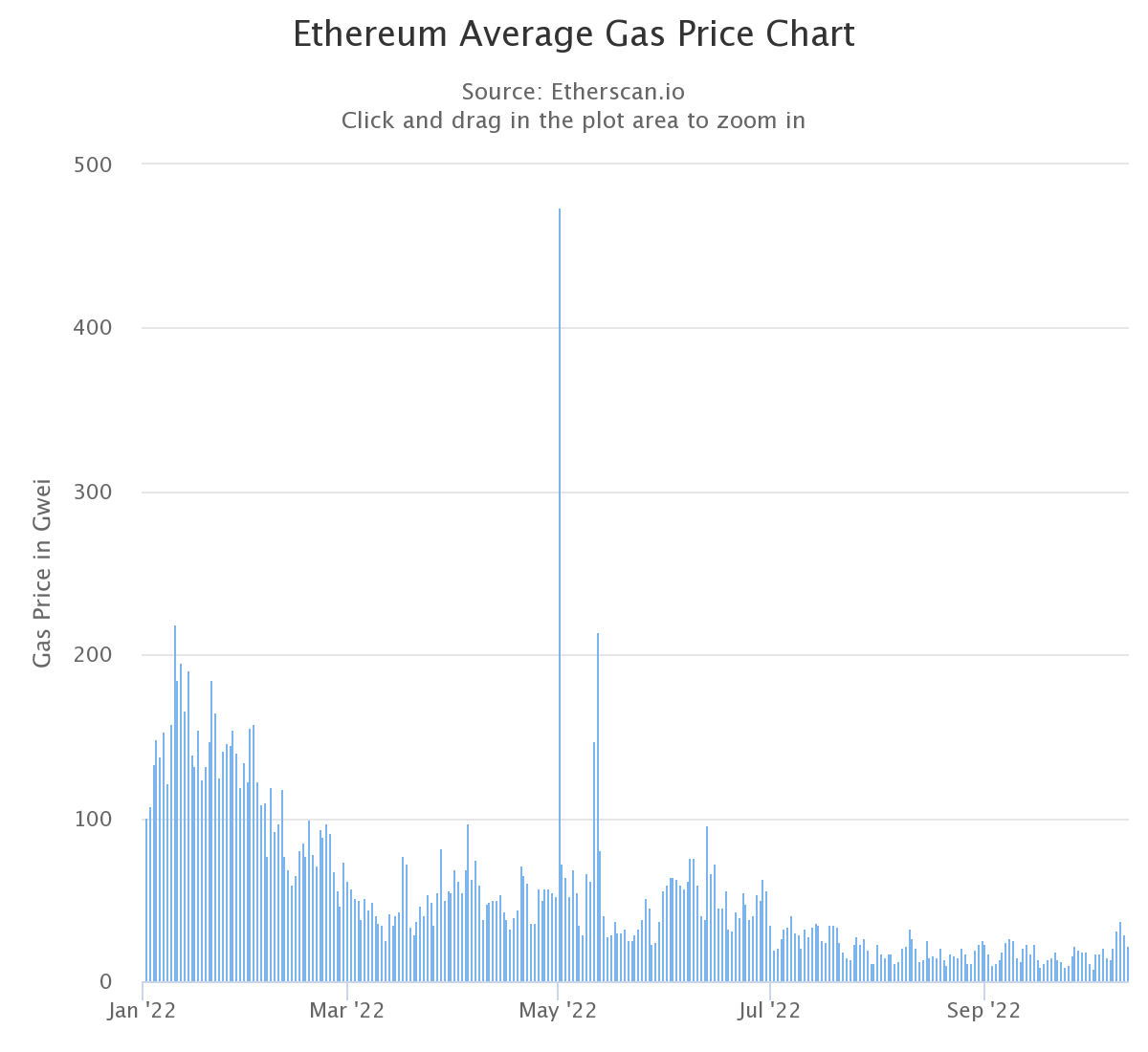

Ethereum Gas Fees

When it comes to Ethereum's gas fees, we can see a steady descent in average gas prices in 2022. There are numerous reasons for this. Some of the main reasons include the ETH price drop that resulted in less ETH moving around, as people shifted more towards other cryptocurrencies for daily transactions.

The bear market also slowed down DeFi slightly, which reduced the overall gas fees on Ethereum as a result.

The current average gas price currently comes up to 22 Gwei, with the peak in 2022 reaching close to 500 Gwei.

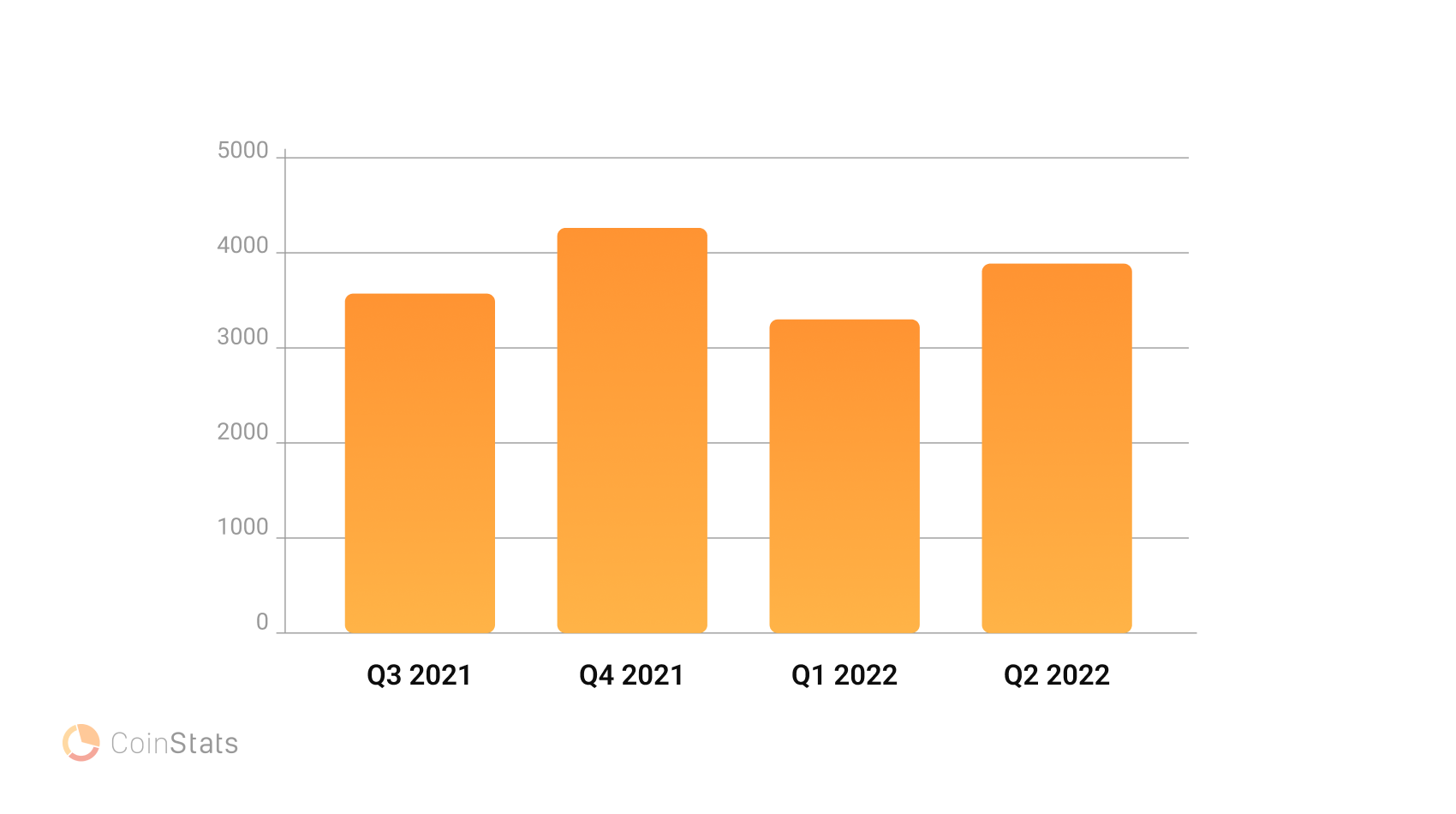

Large Ethereum Users

If we take a look at the number of Ethereum whales on CoinStats, we can see that the numbers between Q3 2021 and Q1 2022 don’t differ too much - and the same goes for Q4 2021 and Q2 2022.&

This means that, despite the market downturn and Ethereum being worth less, the number of actual whales held up quite well, even more so if we take into account that holders would need much more ETH to be considered whales in dollar value now.&

Ethereum Transfering to Proof-of-Stake

As we know, Ethereum has moved from its proof-of-work consensus algorithm to a proof-of-stake one. This transition was slow and painful, but the transition was fairly seamless.

While this event may not have had a direct impact on DeFi protocols and platforms, it's worth noting that it could potentially lead to increased interest in Ethereum and, as a result, DeFi protocols built on top of it.

This is because, once Ethereum 2.0 is fully operational (and the transition to the PoS consensus algorithm is just one part of it), the blockchain will support much more transactions, with its creator Vitalik Buterin mentioning a throughput of 100,000 transactions per second. If Ethereum comes even close to it, we may see more widespread adoption of DeFi because of drastically reduced fees.

Additionally, the barrier to entry for Ethereum's blockchain validation's "passive income" will be much lower as users won't be needing to expensive mining equipment, but rather simply stake their ETH and participate in the network's consensus. This could lead to an influx of new users, as well as an increase in the price of ETH (which would, in turn, lead to an increase in the value locked in DeFi protocols).

The Expansion of Other Blockchains

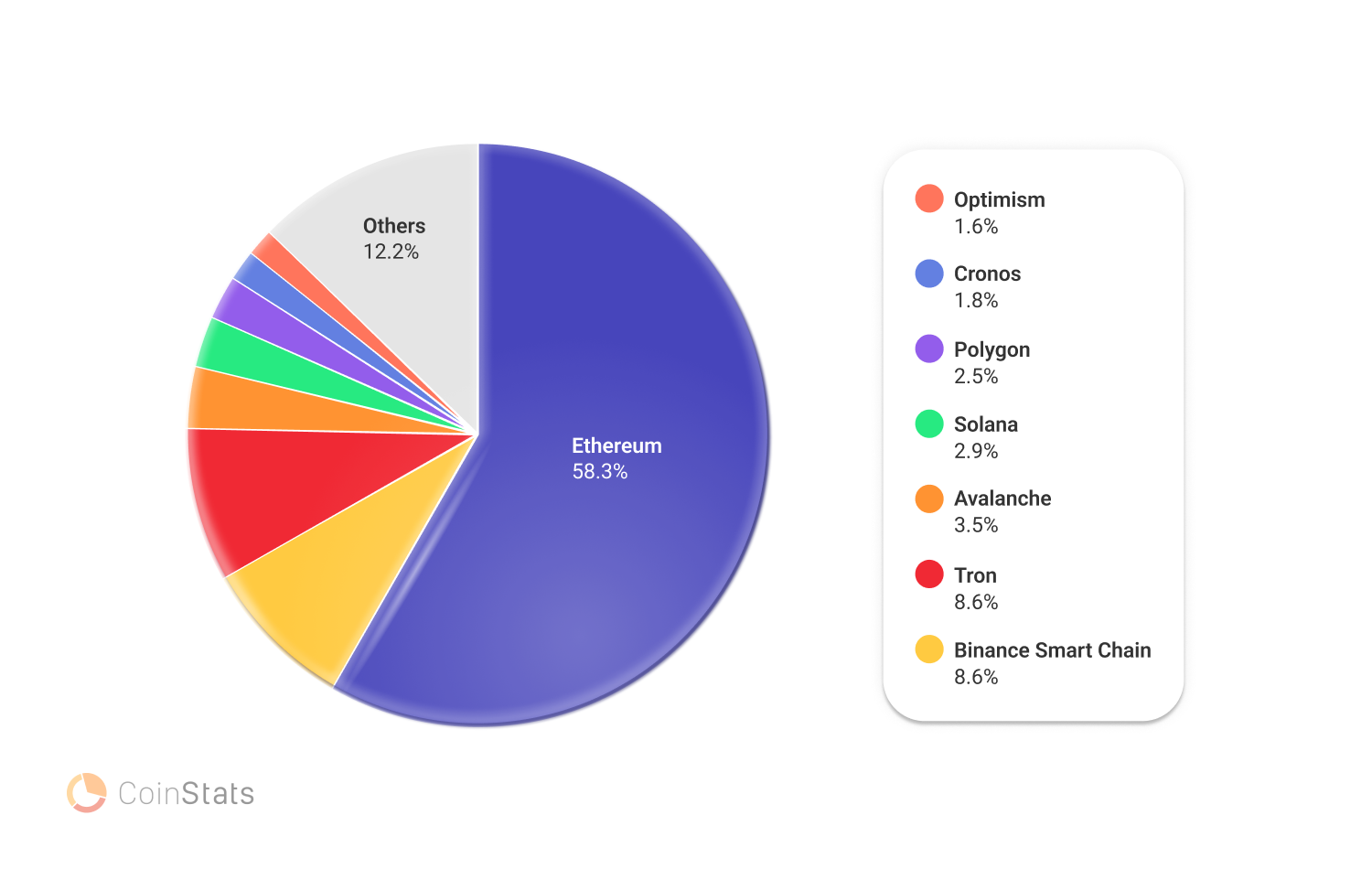

With the immense growth of DeFi protocols comes the need for other blockchains to offer similar services. While Ethereum still remains the go-to blockchain for most DeFi protocols, other chains are slowly but surely catching up.

Some of the most notable ones include Binance Smart Chain, Avalanche, and Solana, as well as layer 2 solutions like Polygon or non-EVM blockchains like Cosmos, with the market still waiting for Polkadot and Cardano. These protocols offer similar services to Ethereum, but with significantly lower fees. This is due to the fact that they use a different consensus mechanism (PoS vs. PoW), which requires less computational power and is thus cheaper to run.

These protocols are also able to handle more transactions per second than Ethereum, which is important for the scalability of DeFi protocols.

As more and more users are looking for alternatives to Ethereum, we may see a significant shift of DeFi protocols to these other blockchains in the coming months and years.

When taking a look at the total value locked by blockchain, we can see that both Binance Smart Chain and Tron are inching closer to the 10% mark. This is by no means an insignificant value, as it shows that people are taking into consideration non-Ethereum blockchains.&

Notable Blockchain Projects

Let's explore some of the different types of blockchains, and what they have to offer to the market.

Alternative EVM Blockchains

Interoperability between blockchains is one of the biggest hurdles that the industry is trying to cross. Ethereum virtual machine (EVM) compatibility is a good starting point in solving this issue, with some of the most notable blockchains currently being Avalanche, Binance Smart Chain, Fantom, and Polygon.&

Avalanche

Avalanche is an EVM-compatible blockchain that attempts to improve scalability without compromising speed or decentralization.

The platform consists of three blockchains, namely:

- The Exchange Chain (X-Chain) - used for creating and trading assets.

- The Contract Chain (C-Chain) - used for smart contract creation.

- The Platform Chain (P-Chain)- used for coordinating validators and Subnets.

Avalanche implements a Directed Acyclic Graph (DAG) optimized consensus protocol instead of the traditional PoW or PoS consensus mechanisms.

The core value proposition of Avalanche is that it improves and optimizes already-established principles, while also enabling users to create customized alternative blockchains called Subnets.

Avalanche's most popular DeFi platforms are Aave (a multi-chain lending platform), followed by Benqi, and Trader Joe.

Binance Smart Chain

Binance Smart Chain is Binance Exchange's version of Ethereum. Its functionalities are exactly the same, with slight changes only seen under the hood. It runs on a Proof of Stake Authority (PoSA), making it arguably slightly more centralized, but also more stable in terms of gas fees.

BSC became popular during the Ethereum gas fee hike, but has maintained relative popularity even though Ethereum's gas fees have been on the decline.

Binance Smart Chain's most popular DeFi platforms are Pancake Swap, followed by Venus and Alpaca Finance.

Fantom

Like other Ethereum alternatives, Fantom aims to provide more scalability and lower costs than Ethereum. However, Fantom comes with one unique functionality: users can create and deploy their own independent networks instead of relying only on Fantom’s main consensus layer. Each application built on the Fantom blockchain works as its own blockchain, while also enjoying the security, speed, and finality of the parent Fantom blockchain.&

Fantom runs on an Asynchronous Byzantine Fault Tolerant (aBFT) Proof of Stake (PoS) consensus mechanism, which maintains the operational efficiency of the entire network.

Fantom's most popular DeFi platforms are SpookySwap, followed by Beefy and Beethoven X.

Polygon

Polygon is a layer-2 network that adds to the Ethereum blockchain. This means that it aims to help Ethereum expand in throughput while not changing the original blockchain layer.

Polygon has announced numerous amazing partnerships, and has maintained a steady development path.& &

Polygon's most popular DeFi platforms are Aave, followed by Quickswap and Curve.

Polkadot

Polkadot is a blockchain network that provides security and interoperability through shared state.

This means that the layer of abstraction between Ethereum and Polkadot is remarkably different for developers.

In Ethereum, developers write smart contracts that all execute on a single virtual machine, called the Ethereum Virtual Machine (EVM). In Polkadot, however, developers write their logic into individual blockchains, where the interface is part of the state transition function of the blockchain itself.

However, there shouldn't be any major differences from the user perspective, as Polkadot could be considered an augmentation and scaling solution for Ethereum, rather than its competition.

Even though its core chain will not have smart contract functionality, Polkadot will support EVM smart contract blockchains to provide compatibility with existing contracts.

Alternative Non-EVM Blockchains

We also have to mention blockchains that are not Ethereum-compatible, as they are not using the same programming language. These blockchains are slightly different from the aforementioned ones as they have a larger difference in functionalities when compared to Ethereum.

Cosmos

While Ethereum has a rollup-centric roadmap, aiming to scale a single, highly-decentralized settlement layer via numerous of Layer 2’s, Cosmos aims to create an “internet of blockchains,” or an interoperable network of sovereign, application-specific blockchains.

Cosmos is highly suited for building application-specific blockchains that are optimized for running only one application. These include the largest Cosmos chain, Osmosis, as well as dYdX Chain.

Cardano

Cardano is a decentralized PoS blockchain designed to be a more efficient alternative to PoW networks. Created by Charles Hoskinson, one of Ethereum's co-founders, Cardano aims to improve scalability, interoperability, sustainability, growing costs, energy use, and slow transaction times of current blockchains.

The project has introduced smart contract functionality with its Alonso update in 2021, but the current infrastructure and an unpopular programming language are putting Cardano on the back foot, at least until future updates.

DeFi Hacks and Security Breaches

DeFi hacks have been a growing problem in the cryptocurrency space over the past few years. While many hacks have been carried out on centralized exchanges, DeFi protocols have also become a target for malicious actors.

Numerous hacks occurred in 2022, with hackers stealing $615.5 million from Ronin, $602.2 from Poly Network, $362 million from Wormhole, $181 million from Beanstalk, $140 million from Vulcan Forged, $570,000 from Curve, and most recently $100 million from BNB Chain and $100 million from Mango Markets.&

This puts the total funds stolen from DeFi protocols to over $3 billion just in 2022.

Decentralized finance as a whole is certainly a good alternative to traditional centralized finance, but it still has a ways to go in terms of safety and security.&

What Will DeFi Bring in the Future?

Traditional financial systems have been around for centuries, and they are unlikely to go away anytime soon. However, the rise of decentralized finance protocols built on top of blockchains represents a seismic shift in how we interact with financial services.

In the coming years, we are likely to see even more growth in the DeFi space, as more protocols are built, and more users flock to the space in search of better rates, lower fees, and increased security.

Let's check out the biggest contributors to the recent expansion of DeFi!

Traditional Finance is Entering DeFi

With the recent boom in DeFi protocols, it's no surprise that traditional finance is starting to take notice.

One of the most notable examples is the entry of big banks into the space. JPMorgan, for instance, has been actively involved in developing Quorum, an Ethereum-based enterprise blockchain platform. The bank is also a member of the Enterprise Ethereum Alliance, which is working on standards for businesses using Ethereum.

Similarly, HSBC has been testing a blockchain platform for trade finance, while ING has been involved in multiple blockchain-based supply chain financing projects.

The entry of traditional finance into the DeFi space is a sign that the industry is maturing, and that these institutions are recognizing the potential of blockchain-based financial protocols.

It's also worth noting that, as traditional finance enters the space, we are likely to see an influx of new users and an increase in the amount of assets being locked into DeFi protocols.

Traditional Finance entering the DeFi space is certainly one thing we should look for in the coming months and years.

The Rise of Decentralized Exchanges

One of the most important components of the DeFi ecosystem are decentralized exchanges, which allow users to trade cryptocurrency without the need for a centralized intermediary.

Uniswap, 0x, and Kyber Network are some of the most popular protocols in this space, and they have been crucial in the recent expansion of DeFi. This is because they provide users with an easy way to trade crypto assets, without having to go through a centralized exchange.

What's more, these protocols are also integrated with many DeFi protocols, which allows users to trade between different assets easily.

For instance, Kyber Network is integrated with MakerDAO, allowing users to convert DAI into ETH easily. This is important because it allows users to trade between different assets without having to leave the MakerDAO ecosystem.

Similarly, Uniswap is integrated with a number of protocols, including Compound, Balancer, and Curve. This allows users to trade between different assets easily, without having to leave the DeFi ecosystem.

The rise of decentralized exchanges is a sign that the DeFi ecosystem is maturing, and that users are becoming more comfortable with trading in a decentralized environment.

What's more, it's likely that we'll see even more growth in this space in the coming months and years, as more protocols are built, and more users flock to the space.

The Growth of Governance Tokens

Another sign of the maturity of the DeFi ecosystem is the rise of governance tokens. These tokens give holders a say in how a protocol is run, and they are an important part of the DeFi space.

MakerDAO, for instance, has the MKR token, which gives holders the ability to vote on things like the interest rate for the DAI stablecoin. They can also participate in auditing the protocol. Compound has the COMP token, which operates in a very similar way.

The rise of governance tokens is a sign that users are becoming more comfortable with decentralized protocols, and that they are willing to put their trust in these protocols. What's more, it's likely that we'll see even more growth in this space in the coming months and years, as more protocols launch their own governance tokens, and try to push away from centralized governance.

DeFi and Blockchain Gaming

There are more than 2 billion gamers worldwide, spending over $159 billion per year. By 2025, that number is expected to grow to roughly $256 billion. With more and more people dedicating hours to this medium of entertainment, both players and creators would naturally want to monetize the industry further.

One way that game studios and developers are trying to monetize the sector would be through blockchain gaming. In the case of blockchain gaming, the video games are connected to a blockchain, not a central server, with players “mining” tokens by performing certain tasks in the game.

Popular DeFi protocols will be needed to allow for in-game transferability, and game-based cryptocurrency owners would probably want to earn a return on their assets.

A survey by Toptal showed that 62% of gamers and 82% of developers stated they were interested in creating and investing in digital assets that are transferable between games. Since then, the crypto world has caught up to their desires.

In 2019, Ubisoft created HashCraft, the first blockchain video game published by a large studio. Nowadays, multiple titles have been released.&

Since then, the space has shifted more towards the Metaverse, with major players like Decentraland and the Sandbox leading the game. Additionally, as NFTs have presented themselves as the backbone of the Metaverse space, we could see countless large companies creating their own NFT projects, including Coca-Cola, Pepsi, Adidas, McDonald's, Nike, Disney, and many more.

While many perceive it as quirky, the space of blockchain gaming (and especially the Metaverse and NFTs) is certainly something we should look out for in the coming months and years.

Final Word

We believe that the DeFi ecosystem will continue to grow in both size and complexity, offering users a wide variety of options. As the space matures, we expect to see a number of protocols emerge as leaders in their respective fields, while others will be forced to adapt or die.

In the end, DeFi is still in its early days, and it remains to be seen what the future holds for this revolutionary new sector. However, one thing is for sure - decentralized finance is here to stay.

If you want to read more insightful content, head over to our blog or sign up for our newsletter.&

Thank you for reading!

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments