In a significant development leading up to the impending decision on the approval or rejection of the first spot Bitcoin ETF in the United States, FOX reporter Eleanor Terret has shed light on a key development.

According to Terret’s report on X (formerly Twitter), the US Securities and Exchange Commission (SEC) will hold talks today to discuss the final comments on the 19b-4s applications submitted by Bitcoin ETF issuers.

SEC Consults Exchanges On Bitcoin ETF Applications

Terret stated that the SEC is currently holding meetings with Nasdaq, CBOE, and NYSE exchanges to address the submitted 19b-4s applications by BTC Spot ETF issuers.

The SEC has previously engaged in discussions with issuers and exchanges, including BlackRock and Nasdaq Stock Market, regarding the proposed rule change to list and trade shares of the iShares Bitcoin Trust.

While these discussions occur amidst Matrixport’s prediction of the potential rejection of the index funds by the SEC, the exact deadline and confirmation of this prediction remain unknown.

However, this meeting holds great significance as it allows issuers to address application shortcomings and potentially gain approval for Bitcoin ETFs.

Matrixport’s belief is rooted in SEC Chair Gary Gensler’s well-known negative stance toward the industry and an undisclosed requirement that Matrixport believes the applicants currently lack.

Given the series of meetings and the involvement of asset managers like BlackRock, it is unlikely that the SEC’s requirements would remain uncommunicated or unfulfilled.

The outcome and implications of this meeting remain uncertain. It is unclear whether the exchanges or the SEC will issue any statements following the discussions, leaving the decision to approve or reject the Bitcoin ETF applications hanging in the balance.

As the deadline approaches, market participants eagerly await further updates to gain insights into the stances of the exchanges and the SEC, shaping the path forward in the quest for a regulated Bitcoin ETF in the United States.

Potential BTC Price Correction?

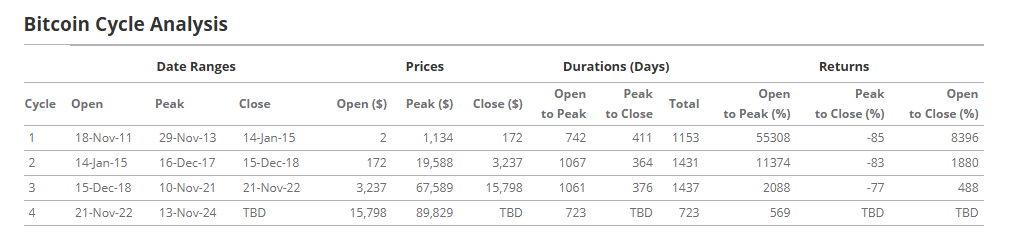

Renowned analyst Crypto Con has drawn attention to the “overheated state” of Bitcoin data, suggesting that the recent move above $45,000 was “short-lived” and has once again brought the cryptocurrency’s valuation into focus.

While various indicators had indicated that Bitcoin may have reached its peak in December at $45,000, longer-term time frames may have allowed for a small push that was witnessed recently.

Despite attributing the drop to the news of Matrixport and 10x Research that predicted rejection of the Bitcoin ETF applications, Crypto Con argues that the underlying data had already signaled the possibility.

Several indicators shared by Crypto Con on X have remained overextended, including the Puell Multiple, 2 Week leading moving average convergence divergence (LMACD), monthly relative strength index (RSI), 2-week stochastic momentum indicator (SMI), weekly RSI, and weekly directional movement index (DMI).

These indicators suggest a correction of over 30% is still anticipated, potentially bringing the price down to the low $30,000 range in the coming months.

While Crypto Con believes this correction to be a likely outcome shortly, he intends to hold onto his Bitcoin and patiently await the “true cycle top.”

Bitcoin has rebounded to the $43,000 level, recovering from its drop to $40,800 on Wednesday morning.

Featured image from Shutterstock, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments