Summary:

- Bankruptcy documents filed unveiled loose corporate controls at Sam Bankman-Fried’s crypto exchange FTX.

- The filing also labeled SBF’s tweets as “disruptive” to proceedings.

- New CEO John Jay Ray III dubbed the lack of financial records as the worst he had seen so far in his 40-year career.

New revelations regarding how former billionaire Sam Bankman-Fried led his crypto exchange FTX into trouble emerged on Thursday thanks to the latest bankruptcy documents filed at the Delaware District Court.&

Ethereum World News reported that SBF resigned as CEO after submitting a chapter 11 filing on November 11, a little over a week after a report on Alameda’s balance sheets shook the crypto industry.&

The latest filing confirmed fears harbored by FTX customers and crypto users alike, revealing that Bankman-Fried’s crypto exchange adopted an “unconventional leadership style” with an “almost complete lack of dependable corporate records”.

Lawyers also described SBF’s Twitter posts since the filing as “incessant and disruptive”. Indeed, SBF was lambasted for allegedly trying to “undermine” the chapter 11 case and transfer assets that should stay put for now.&

Mr. Bankman-Fried, the co-founder, and controlling owner of all of the Debtors and of FTX DM, appears to be supporting efforts by the JPLs to expand the scope of the FTX DM proceeding in the Bahamas, to undermine these Chapter 11 Cases, and to move assets from the Debtors to accounts in the Bahamas under the control of the Bahamian government.

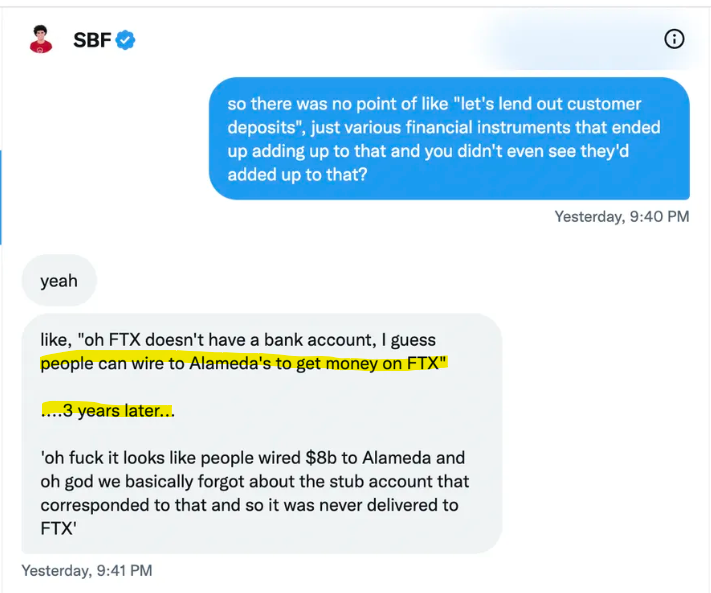

The document further scrutinized Bankman’s tweets, citing a recent interview with a Vox reporter via Twitter DMs. During the interview. SBF seemingly admits to leveraging “woke” tactics to deceive regulators and that Alameda’s balance sheet was intertwined with FTX.&

One reply from SBF during the conversation suggests that at one point, FTX user deposits were wired directly to Alameda’s bank account.&

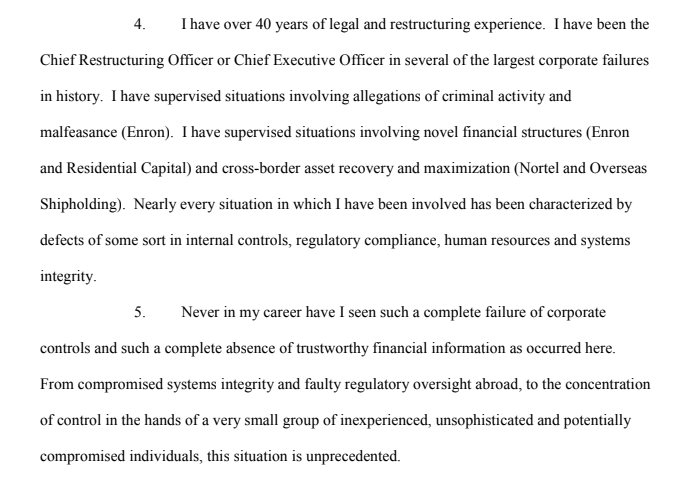

Statements in the filings from newly appointed CEO John Jay Ray III shed light on the state of affairs. Ray, who was brought in to resolve the crisis at Enron Energy, remarked that accounting procedures at Bankman-Fried’s entities were unreliable.

The company “did not maintain centralized control of its cash” and Ray highlighted “the absence of an accurate list of bank accounts and account signatories”. Also, financial statements gathered by SBF before his resignation did not include customer liabilities.

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information.

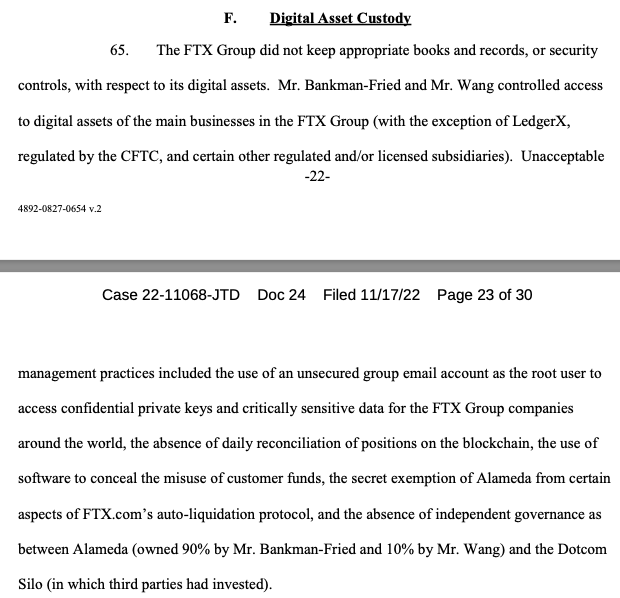

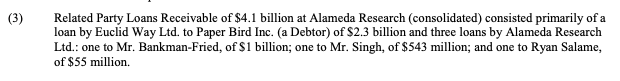

SBF and his co-founder Gary Wang used “unsecured” security tools for digital asset management, per Thursday’s court filing. Bankman-Fried also loaned $1 billion from himself, or rather from Alameda. Nishad Singh and Ryan Salame, top execs at the exchange and supposed members of SBF’s inner circle, also received loans of $543 million and $55 million respectively.

It’s unclear if the loan capital was generated from trading profits or funded with customer deposits.

Consolidating FTX Bankruptcy In A Single Court

A key argument fielded by lawyers proposed that all FTX bankruptcy proceedings take place in a single court. SBF first filed for chapter 11 in Delaware for some 130 companies affiliated with his crypto exchange.&

In addition, separate chapter 15 was filed in New York on behalf of FTX Digital Markets, an offshore division based in the Bahamas. Chapter 15 filings are commonly when the company has entities across several jurisdictions.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments