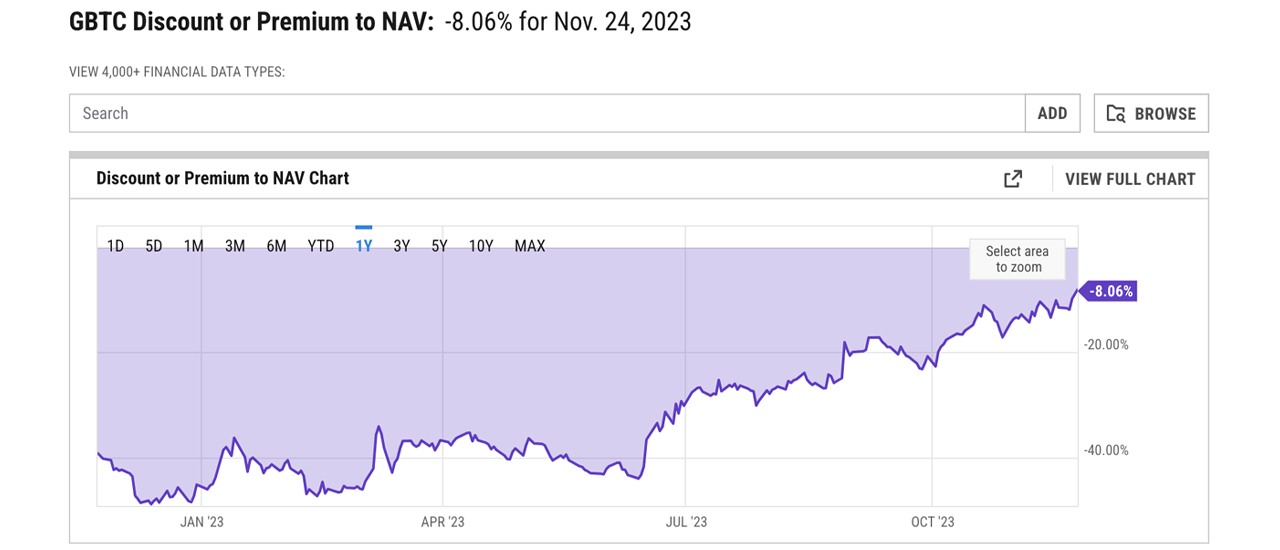

On Friday, data revealed a notable shift in Grayscale’s Bitcoin Trust, commonly referred to as GBTC, as its discount to net asset value (NAV) contracted to single digits for the first time in 2023. The figures indicate that GBTC’s discount reached 8.06%, a level last observed two years ago.

GBTC Discount to NAV Reaches Single-Digit Territory

Grayscale’s Bitcoin Trust (GBTC) is the largest bitcoin fund in the world and on November 24, 2023, the trust’s total assets under management (AUM) was approximately $23.50 billion. This year, GBTC suffered a significant discount to net asset value (NAV) and in September 2022, the discount widened by more than 35%. A discount or premium to net asset value (NAV) occurs when the market price of a fund’s shares is lower or higher, respectively than its NAV.

The NAV essentially represents the per-share value of the fund’s assets minus its liabilities, calculated daily. When a fund’s shares trade at a discount, it means they are selling for less than the fund’s per-share asset value. A significant discount like 35% to NAV is not favorable as it indicates that the fund’s shares are being traded at a significantly lower price than the actual value of the assets they represent.

Nevertheless, following Grayscale’s triumph over the U.S. Securities and Exchange Commission (SEC), there has been a significant reduction in the discount. Bitcoin.com News reported in mid-October that this margin had decreased to 16.59%. Marking a milestone, GBTC reached the single-digit territory at 9.77% on November 22, 2023, as reported by ycharts.com, for the first time in two years.

Statistics for November 24, 2023, indicate the discount to NAV dipped down to 8.06% on Friday afternoon. Upon reaching the noteworthy single-digit record, both the cryptocurrency community and financial analysts turned their attention to this development.

“GBTC’s discount is in single digits for the first time in over two years, it had been flirting [with] this barrier for a while and finally broke through 10% [Wednesday] night and is [currently] 8.6%, likely prompted by their updated filings/SEC meeting reported [Wednesday],” the senior ETF analyst for Bloomberg Eric Balchunas said on the social media platform X. Another observer remarked that they could “smell a spot ETF in the air” in response to the achievement of the discount to NAV milestone.

On the same Friday afternoon, Bloomberg ETF analyst James Seyffart echoed insights akin to those of Balchunas. “Right now GBTC is trading at a record low discount for the last few years of about 8.6%. Its official closing discount was 9.7% on Wednesday,” Seyffart wrote. “Hasn’t been this close to parity since July 2021 — just months after the premium broke into discount,” the ETF strategist added.

What do you think about GBTC’s discount tightening? Share your thoughts and opinions about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments