The global cryptocurrency market size was valued at $1.49 billion in 2020 and is projected to reach $4.94 billion by 2030. According to the latest estimates, there are more than 17000 cryptocurrency tokens available in the world. An increase in the need for operational efficiency and transparency in financial payment systems, data security, and improved market cap are the major factors that drive the growth of the global cryptocurrency market. The number of altcoins in the market has exploded, and with Ethereum hitting its all-time highs in 2021, the future looks promising as more adoption of blockchain technology takes place.

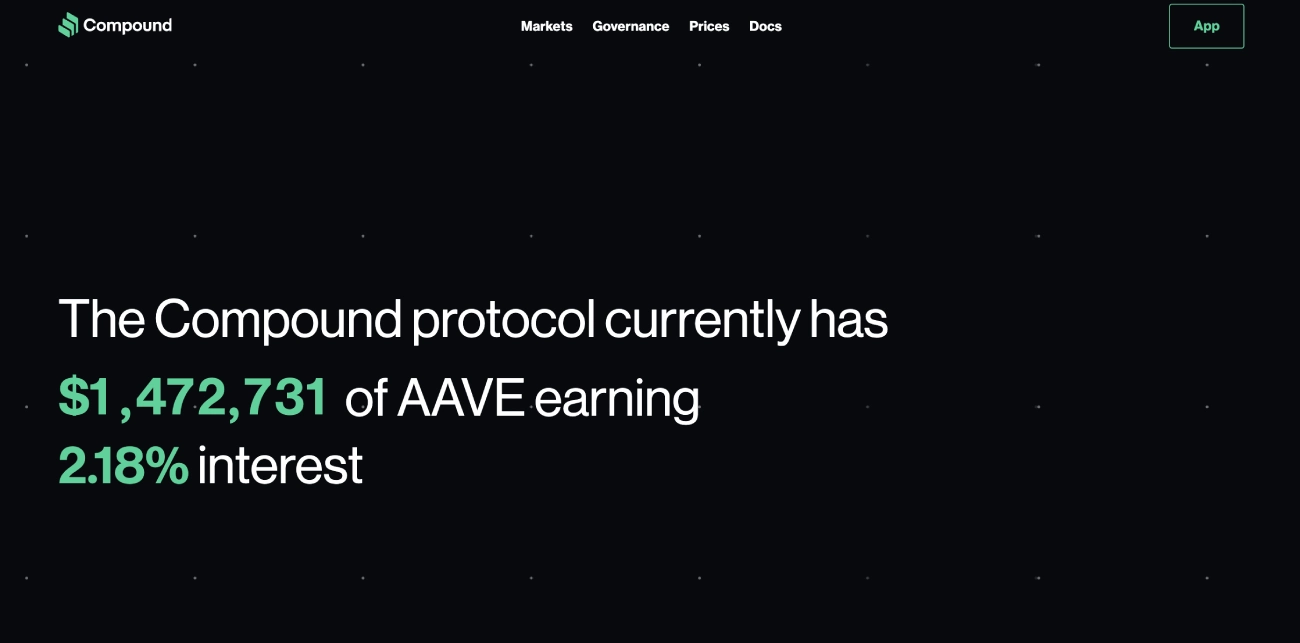

One such DeFi protocol and altcoin with massive potential is Compound (COMP). Compound is an open-source platform for decentralized lending running on the Ethereum network. It collateralizes crypto assets to provide various financial services and is powered by COMP, its native ERC-20 token.

Check the Compound current price, market cap rank, circulating supply, trading volume, historical prices, etc., along with in-depth information on several of the biggest and fastest-growing cryptocurrencies on CoinStats, one of the best crypto platforms around.

Read on for our ultimate guide on the Compound network and learn how to buy Compound in a few simple steps.

Let's jump right in!

Step #1: Select a Crypto Exchange

Compound Coin (COMP) tokens are available on a growing number of cryptocurrency exchanges. Visit the market page on CoinStats to view the exchange platforms supporting COMP. Compare the exchanges’ security, user experience, fee structure, supported crypto assets, etc., to choose the one with the features you need, such as affordable transaction fees, top-notch security, high trading volume, an intuitive platform, round-the-clock customer service, etc. Also, consider whether the cryptocurrency exchange is regulated by the Financial Industry Regulatory Authority (FINRA) and allows you to buy COMP using your preferred payment method.

To trade cryptocurrencies, you must use a centralized or decentralized crypto exchange, so let's look into the details of each type below.

Centralized Exchange

A centralized crypto exchange or CEX, such as Coinbase, eToro, Binance, etc., functions as a middleman between buyers and sellers and charges specific fees for using their services. Most crypto transactions are conducted on centralized exchanges, allowing users to buy and sell cryptocurrencies for fiat currencies such as the US dollar or digital assets like BTC and ETH. Centralized exchanges require their users to follow KYC (know your customer) and AML (anti-money laundering) rules by providing some information and personal identification documents. However, the drawback of trading on a CEX is that it’s highly vulnerable to hacking or cybersecurity threats.

Decentralized Exchange

On the other hand, a decentralized exchange (DEX), like Uniswap, SushiSwap, Shibaswap, etc., is a non-centralized alternative to a centralized exchange and isn’t governed by any central authority. Instead, it operates over blockchain and charges no fee except for the gas fee applicable on a particular blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use smart contracts to let people trade crypto assets without needing regulatory authority. They deploy an automated market maker to remove any intermediaries and give users complete control over their funds. This method is safer since no security breach is possible. However, decentralized exchanges are less user-friendly in terms of interface and currency conversion. For instance, they don't always allow users to trade crypto with fiat currency; users have to either already own crypto or use a centralized exchange to get crypto. Another drawback of decentralized exchanges is that it has failed to achieve liquidity levels comparable to centralized exchanges. It also takes longer to find someone looking to trade with you as DEX engages in peer-to-peer trade, and if liquidity is low, you may have to accept concessions on price and quickly sell or buy low-volume crypto.

You can list anything on a DEX, which means you have access to new, in-demand assets while also taking on more risk.&

Step #2: Create an Account

After you've chosen a cryptocurrency exchange that suits your investment needs, you must register with the exchange using a valid email or mobile number. A link will be sent to your address, and you must click it to verify your account. Once the account is activated, you must create an elaborate password, and you’re good to go.& &

Some exchanges have strict KYC and AML requirements, and in order to get verified, you must provide personal information such as:

- Full name

- Residential address

- Date of Birth

- ID Document.&

In some cases, you might also need to upload a selfie or undergo video verification to finalize the verification process.

Once your identity verification is complete, it’s recommended to activate two-factor authentication (2FA) for an extra layer of security.

Step #3: Deposit Funds

The next step is to deposit funds into your account. Many crypto exchanges support fiat currencies like USD, EUR, etc. Simply select your preferred deposit method, such as a bank transfer, wire transfer, credit or debit cards, e-wallets, PayPal, etc., and the currency you wish to deposit. Tap on “Deposit Funds,” enter the amount you want to deposit and click “Deposit.”&

Some deposit methods are extremely fast, while others, depending on the amount, require a confirmation from authorities. Remember to evaluate the fees of different deposit methods since some have larger fees than others.

- Credit or Debit Card

Linking your debit card to your crypto account is advantageous as it lets you make instant or recurring purchases, but be aware that it attracts an additional fee.

- Bank Account

It's usually free to make a bank transfer from your local bank accounts, but you should still double-check with your exchange.

- Cryptocurrency

& COMP can be traded for another cryptocurrency or a stablecoin; the trading pairs vary between exchanges. So, you must search for & COMP on the spot market to select a pair from the list of available trading pairs.

Step #4: Buy COMP

Follow the steps below to place a market order to buy& COMP instantly at the current market price:&

- Click the search bar, enter& COMP, and select “Buy& COMP” or the equivalent.

- Select a trading pair you wish to buy& COMP against.&

- Choose the payment method, the currency you wish to use, and input the amount of& COMP or the fiat amount to be spent. Most exchanges will automatically convert the amount to show you how many COMP tokens you’ll get.

- Double-check the transaction details and click “Confirm.”

- The COMP tokens will be displayed in your balance once the transaction is processed.&

You can also place a limit order indicating that you want to buy& COMP at or below a specific price point. Your broker will ask you the number of coins you wish to acquire and the maximum price you're ready to pay for each once you've placed an order. The coins will only appear in your wallet if your broker fulfills your order at or below your requested pricing. The broker may cancel your order at the end of the day or leave it open if the price increases over your limit.

If you're planning to keep your newly purchased coins for an extended period, we highly recommend securely storing them in a hardware wallet.

To trade COMP on spot markets, go to the Trade page and search for the COMP pairs ( COMP/USD or& COMP/USDT). Select the trading pair and check the price chart. Click "Buy& COMP," select the "Market," enter your amount or choose what portion of your deposit you'd like to spend by clicking on the percentage buttons. Confirm and click "Buy& COMP."

Congratulations on adding& Compound Coin (COMP) tokens to your crypto portfolio!&

Step #5 (Optional): Store COMP

While your COMP tokens can be stored in your brokerage exchange wallet, experts highly recommend storing your precious coins away from exchange wallets, as those might be susceptible to hacks and interference.&

We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets:&

Software Wallets

If you’re looking to trade COMP regularly, software or hot wallets provided by your selected crypto exchange will suit you. The strength of software wallets lies in their flexibility and ease of use. A software wallet is the most easy-to-set-up crypto wallet and lets you easily interact with several decentralized finance (DeFi) applications. However, these wallets are vulnerable to security leaks because they're hosted online. So, if you want to keep your private keys in a software wallet, conduct due diligence before choosing one to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security.

Examples of software wallets include CoinStats Wallet, MetaMask, Coinbase Wallet, Trust Wallet, and Edge Wallet, amongst others.

Hardware Wallets

Hardware or cold wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. These are more suitable for experienced users who own large amounts of tokens.

Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your digital assets. The Nano X is designed for advanced users and offers more storage space and advanced features than Ledger Nano S,& designed for crypto beginners.

A hardware wallet is more expensive than a hot wallet, with prices ranging between& $50 - $200.

Examples of cold wallets are Trezor Model T, Ledger Nano X, CoolWallet Pro, KeepKey, Ellipal Titan, and SafePal S1, amongst others.&

Step #6 (Bonus Step): Track COMP Tokens

The crypto market is volatile, and managing your portfolio could get tricky if you hold multiple assets. Utilizing a portfolio tracker will help you keep track of your COMP tokens and all your crypto investments from one platform at all times. CoinStats offers one of the best crypto portfolio trackers in the market; you can find more information here.&

You can also monitor the profit, loss, and liquidity of & COMP across several exchanges on CoinStats.

CoinStats supports over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It offers charting tools, analytical data, advanced search features, and up-to-date news. Here you have the opportunity to connect an unlimited number of portfolios (wallets and exchanges), including:

- Binance

- MetaMask

- Trust Wallet

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.&

To connect, go to the CoinStats Portfolio Tracker page and:

- Click Add Portfolio and Connect Wallet.

- Click the wallet you want to connect to (e.g., Ethereum Wallet).

- Input the wallet address and press Submit.

History of Compound

The Compound protocol is built on the Ethereum network and is powered by COMP, its native token. COMP is an ERC-20 token designed to reward users for their participation and allow its holders to vote on decisions concerning the future of the software.

The Compound (COMP) decentralized finance (DeFi) protocol aims to enable completely decentralized and autonomous borrowing and lending by the use of decentralized applications. It allows users to deposit funds they own into lending pools to earn interest on their deposits when other users borrow them. Once lenders deposit cryptocurrency, Compound awards them a new cToken, i.e., cETH, cDAI, and cBAT, which can then be traded without restriction. However, they are only redeemable for the cryptocurrency locked in the protocol for which it represents.

The Compound protocol runs this entire process through the use of smart contracts, allowing users to withdraw their deposits at any time they choose.

The protocol aims to revolutionize the finance and lending industry by removing the need for any middlemen or financial institutions acting as intermediaries. Compound was the first platform to introduce yield farming to the market in 2020.

The co-founders of Compound (COMP) are veteran entrepreneurs Robert Leshner and Geoffrey Hayes.

What Is Compound?

The Compound protocol acts as a lending platform/lending pool that connects lenders with borrowers using a combination of powerful smart contracts on the Ethereum blockchain.

Compound rewards lenders with its ERC-20 COMP tokens based on the amount of cTokens held in their wallets and a pre-determined rate. The more liquidity a particular token has, the lower the interest rate generated. Lenders can also take out a loan in any other cryptocurrency supported by the Compound protocol.

The lending, borrowings, or repayments of debts on the platform are incentivized by rewarding users with the Compound tokens. COMP is also a governance token, and each holder of the Compound (COMP) tokens has voting rights in proportion to their holdings. This empowers the users to participate in the decision-making processes of the platform.&

Users can also get their hands on the Compound tokens on various cryptocurrency exchanges. The market for Compound tokens and Compound users has grown by leaps and bounds over the past few years.

COMP tokens have a total supply of 10 million and are available to trade on many decentralized and centralized cryptocurrency exchanges such as Binance Futures, Binance, Coinbase Pro, etc.

According to an analysis by CoinStats, the COMP token has a market cap of 937 million USD, with $142.88 per token at the time of writing. It has a trading volume of around $79 million. The price of COMP token reached an all-time high of $855.2 on the 12th of May 2021, and since then, it has come down by more than 60 percent.

Now, let's look into ways of buying Compound.

Buy COMP on Binance

One of the easiest ways of buying Comp is on Binance. Binance is among exchanges offering the lowest fees in the industry and high liquidity, allowing you to sell and buy digital assets rapidly to take advantage of market possibilities.

To buy Compound (COMP) on Binance, you need to create a retail investor account on the platform and verify your identity by uploading identity proof documents. Once the retail investor accounts are created and verified, Binance will let you buy Compound (COMP) or any other crypto of your choice either through digital assets or fiat deposits using a credit or debit card and bank transfer.

Compound (COMP) is available on Binance in 3 trading pairs, namely COMP/USDT, COMP/BUSD, COMP/BTC. Therefore,& you will need to first buy Bitcoin, USDT, or BUSD through peer-to-peer trading, a bank transfer, or a credit/debit card to purchase COMP. You could also use the CoinStats app comparison service to select what asset you want to trade COMP against.

Once you have selected the asset you wish to trade COMP against, e.g., USDT (TETHER), the next step is to purchase the required amount of USDT needed for purchasing COMP. After you’ve added USDT(TETHER) to your wallet, go to COMP/USDT trade and buy as many coins as you wish. Once the transaction is completed and your order has been fulfilled, the new coins should be displayed in your wallet.

Buy COMP on Coinbase

Coinbase is the largest cryptocurrency exchange in the United States, supporting approximately 100 cryptocurrencies. Coinbase fees, on the other hand, might be perplexing and higher than some of its rivals. While Coinbase's security features are appealing, cryptocurrency trading is highly volatile, so always evaluate the risk.

This exchange currently allows trading for residents of the United States, except Hawaii.

Here is how to buy COMP on Coinbase:

Create a Coinbase Account

If you don't have a Coinbase account already, you need first to set up an account and verify your identity. Once your account is verified, you are free to buy COMP and other cryptocurrencies to build your crypto portfolio.&

Link a Payment Method

Once you have created your Coinbase account, the next step is to link a payment method to your account. Choose your favored fiat currency and payment method ranging from credit debit cards to bank or wire transfers, etc., depending on your country. There are no transaction fees on bank transfers; however, you won't be able to withdraw your funds for 5 days.

Buy Compound (COMP)

After adding funds to your account, click on "Withdraw" and input the amount you want to buy Compound for, then go to "Trade" to choose your market, e.g., if you are buying from the US, select "COMP-USD." Then input the amount of COMP you want to buy and click on purchase. Your COMP tokens should then be reflected in your Coinbase wallet.

Other Exchanges

In addition to Binance and Coinbase, there are a lot of cryptocurrency exchanges where one can buy, sell, and trade Compound. The steps for buying COMP or other cryptocurrencies on various platforms are very similar to Binance and Coinbase. Most of these exchanges allow for purchasing crypto assets via credit/debit card or a bank transfer. The trading fees on exchanges may vary, so make sure to compare them before deciding where to buy Compound(COMP).

Storage of Compound Tokens

Once you've successfully managed to buy COMP, the next question is where you should hold COMP. Most users leave their crypto on the exchanges' wallets, i.e., Binance's and Coinbase's hot wallets. Major exchanges such as Coinbase and Binance keep most of their users' tokens offline to avoid hacks. However, if you want to put your mind at ease and keep your cryptocurrencies as safely as possible, a hardware wallet is perhaps the best option.

Types of Cryptocurrency Wallets

There are two sorts of wallets: Software Wallets or hot storage wallets (digital) and Cold Storage wallets, also known as Hardware Wallets (physical). Both have their advantages and disadvantages:

Software Wallet: A software wallet, also known as a Hot Wallet, is connected to the internet at all times. Several software wallets are available for free download from the App Store or Google Play. Consider the advantages of the CoinStats Wallet, which lets you buy or track your crypto from a single place.

Although software wallets offer substantial protection, they're still vulnerable because they offer online storage.

Hardware Wallets: Hardware wallets, also known as Cold Wallets, are a safer alternative. A Hardware wallet is a secure form of storing your private keys offline, thereby reducing the chances of a hack. Remember that recovering your funds might be impossible if you lose your private key.

The most popular hardware wallets are& Ledger Nano X, Ledger Nano S, Trezor Model T, etc.

There is no right or wrong answer when it comes to determining which crypto wallet is ideal for you. The ideal option for you is defined by your typical trading patterns and the level of security in your circumstances.

Disclaimer: The information contained on this website is provided to you solely for informational purposes and do not constitute a recommendation by CoinStats to buy, sell, or hold any security, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market, do your independent research and only invest what you can afford to lose.& Performance is unpredictable, and the past performance of COMP is no guarantee of future performance.

There is a high risk involved in trading CFDs, stocks, and cryptocurrencies. You should consider your own circumstances and take the time to explore all your options before making any investment.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments