Navigating the ever-changing crypto market can be challenging for investors, who often descend into the depths of the industry without any guidance. Some have taken on the task of developing tools to help traders steer their strategies and try to maximize their portfolio’s performance.

3Commas, a crypto trading bot automated platform, is one of those companies aiming to provide users with technology that helps their trading strategies. In a conversation with Bitcoinist, Yuriy Sorokin, 3Commas CEO, shared valuable insights on the role of automated trading tools in the market, what changed over the last couple of years, and where the industry might be headed in the next months.

Q: Can you tell us a bit about yourself and 3Commas for those unfamiliar with the platform?

A: I’m Yuriy Sorokin, the CEO and co-founder of 3Commas. Our platform launched in 2017 with the goal of empowering traders by making professional Wall Street class tools available to everyone.

Today, thousands of traders and developers use our platform to automate strategies and build their own products and services. And that is where we believe our core strength is – reliable and scalable infrastructure that simplifies complex trading operations for advanced and professional traders.

Q: If a trader is looking into an automated trading approach to navigate the different states of the market cycle, what must they consider before making their decision? How does 3Commas differentiate from similar tools available in the market?

A: When considering automated trading, traders need tools that offer precision, flexibility, and the ability to adapt to various market conditions. 3Commas is designed specifically for experienced traders who already know the market and need advanced solutions to optimize their strategies across multiple exchanges.

With flexible integration options like custom signals, webhooks, and TradingView strategies, we help traders focus on what really matters—executing their strategies efficiently without getting bogged down by technical hurdles. Our tools are built to make your trading life easier, which is why many traders trust 3Commas to keep them ahead of the curve. Since 2017, we’ve processed over $450 billion in trades, and that trust is what keeps experienced traders coming back to 3Commas as their go-to solution.

Q: Are you still “builders and tinkerers at heart”? You previously stated that 3Commas was born out of the need to manage your crypto portfolios, what has changed since the company’s inception, what new features and products are available for your users?

A: We’re definitely still builders and problem-solvers at heart. What started as a tool to simplify our own trading has evolved into a trusted solution used by thousands of traders. And we are now shifting towards institutional clients, such as fund managers and family offices, who require more advanced tools.

One of our biggest developments has been the launch of our Asset Management product, which is designed specifically for professionals managing multiple accounts. It enables them to implement advanced strategies efficiently at scale. And as we’ve grown, we’ve always kept reliability and performance at the heart of what we do. Our system now handles over one million active deals, giving advanced and institutional traders the speed, stability, and efficiency they need. We’re constantly working to stay ahead of the curve, building tools that evolve with the market and meet the changing demands of professional traders and investors.

Q: At EBC10, you discussed the future of asset management in a world where tokenization continues growing. What is most exciting about crypto and blockchain technology’s role in asset management? Do you feel tokenization will be the gateway for mainstream adoption in the long term?

A: I believe tokenization will be a crucial driver of mainstream adoption, particularly as it bridges traditional finance and the crypto space. What’s exciting is how blockchain technology can create greater liquidity and accessibility for assets that were previously illiquid or out of reach for many investors. This opens new possibilities for asset managers and institutional players, offering a more efficient and transparent way to manage and transfer assets.

For us at 3Commas, this shift aligns perfectly with the tools we’re building, particularly in the asset management space. As tokenization grows, we’re focused on providing advanced traders and institutions with the automation and infrastructure they need to capitalize on these opportunities efficiently.

Q: Where is the crypto industry in terms of adoption? This year, we’ve seen the sector take crucial steps toward mainstream recognition and adoption with the approval of crypto-based spot exchange-traded funds (ETFs). What do you consider to be the next milestone that could further attract traditional investors?

A: The crypto industry has seen two distinct types of adoption. In wealthier nations, it’s often part of an investment strategy, while in regions with less stable currencies and unreliable payment systems, crypto is becoming an essential part of the everyday economy.

This split adoption isn’t a disadvantage—it’s actually a testament to crypto’s versatility. For investors in developed markets, crypto offers portfolio diversification and a hedge against risks. In emerging markets, it provides a safer alternative to cash and allows access to global financial systems, enabling loans, currency transfers, and more.

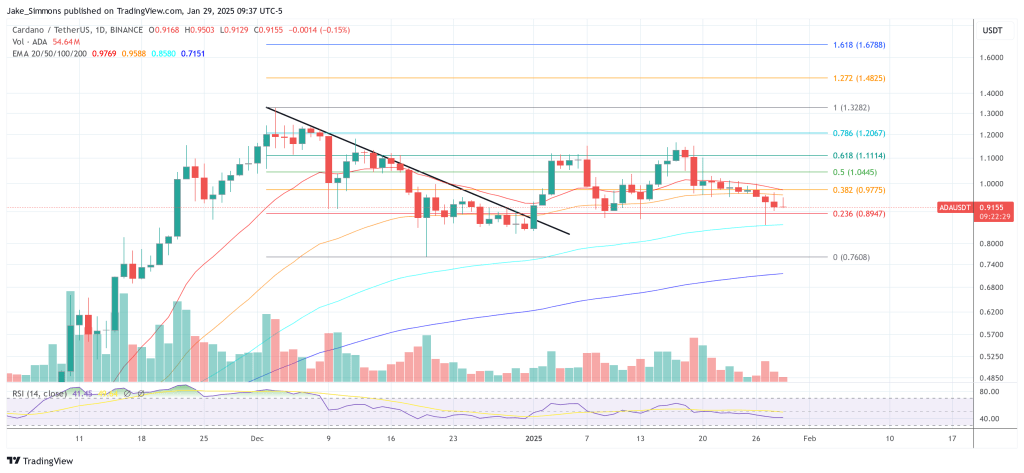

Now that the ETF barrier has been broken for Bitcoin and Ethereum, the next major milestone will be the creation of ETFs for other promising coins like Solana, XRP, and Cardano. Following that, I see the next big step as the integration of crypto into more traditional investment vehicles, such as allowing people to include crypto in their 401(k) or Roth IRA portfolios. These developments could significantly increase mainstream adoption and draw in traditional investors.

Q: Lastly, as we start navigating the last quarter of 2024, how can investors better take advantage of automated trading platforms during the second leg of the bull run?

A: Timing is critical in a bull run, and it’s easy to get caught up in the hype. This is where automation comes into place. The key is to let automation handle the emotional side of trading and optimize bots for cost efficiency with the amount of risk you’re comfortable with. There are a lot of peaks and valleys during a bull run, and those are opportunities for sophisticated traders to find a lot of success.

Maybe the best part of automation, besides being able to use strategies that simply aren’t possible with manual trading, is the ability to walk away from your computer and go do something else while your bots keep working. For professional traders and asset managers, it means more time for technical analysis and client relations and less time spent inputting deal parameters.

If trading is a strong interest of yours, or it’s your profession, I’m inviting you to see our software for yourself and learn how 3Commas automation can make your trading more efficient.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments