As Binance continues to be surrounded by FUD, here’s what the CryptoQuant head thinks regarding the possibility of a bank run.

Can Cryptocurrency Exchange Binance Go The Way Of FTX?

In a new post on X (formerly Twitter), Julio Moreno, the Head of Research at the on-chain analytics firm CryptoQaunt, has talked about whether Binance is experiencing a bank run or not.

Binance has been a hot topic in the news lately, as the platform has been under regulatory fire from the US Securities and Exchange Commission (SEC), with the latest development being that an action from the Department of Justice (DOJ) may be imminent.

There were also earlier rumors that the exchange had been involved in a Bitcoin selloff, in order to prop up the value of its native token, BNB, after the market had gone through a crash. Changpang Zhao (CZ), the platform’s CEO, however, has shot down these allegations.

Amid these events, there has been growing concern in the market about the exchange’s future and whether it may end up like FTX, an exchange that went belly up back in November 2022, leading to a market-wide crash.

In order to check for this, the CryptoQuant head has made use of the “exchange reserve” metric, which measures the total amount of Bitcoin that a specific centralized exchange is currently holding in its wallets.

More particularly, the exchange’s reserves are not of interest, but rather the percentage change in the indicator from its last all-time high (ATH) is.

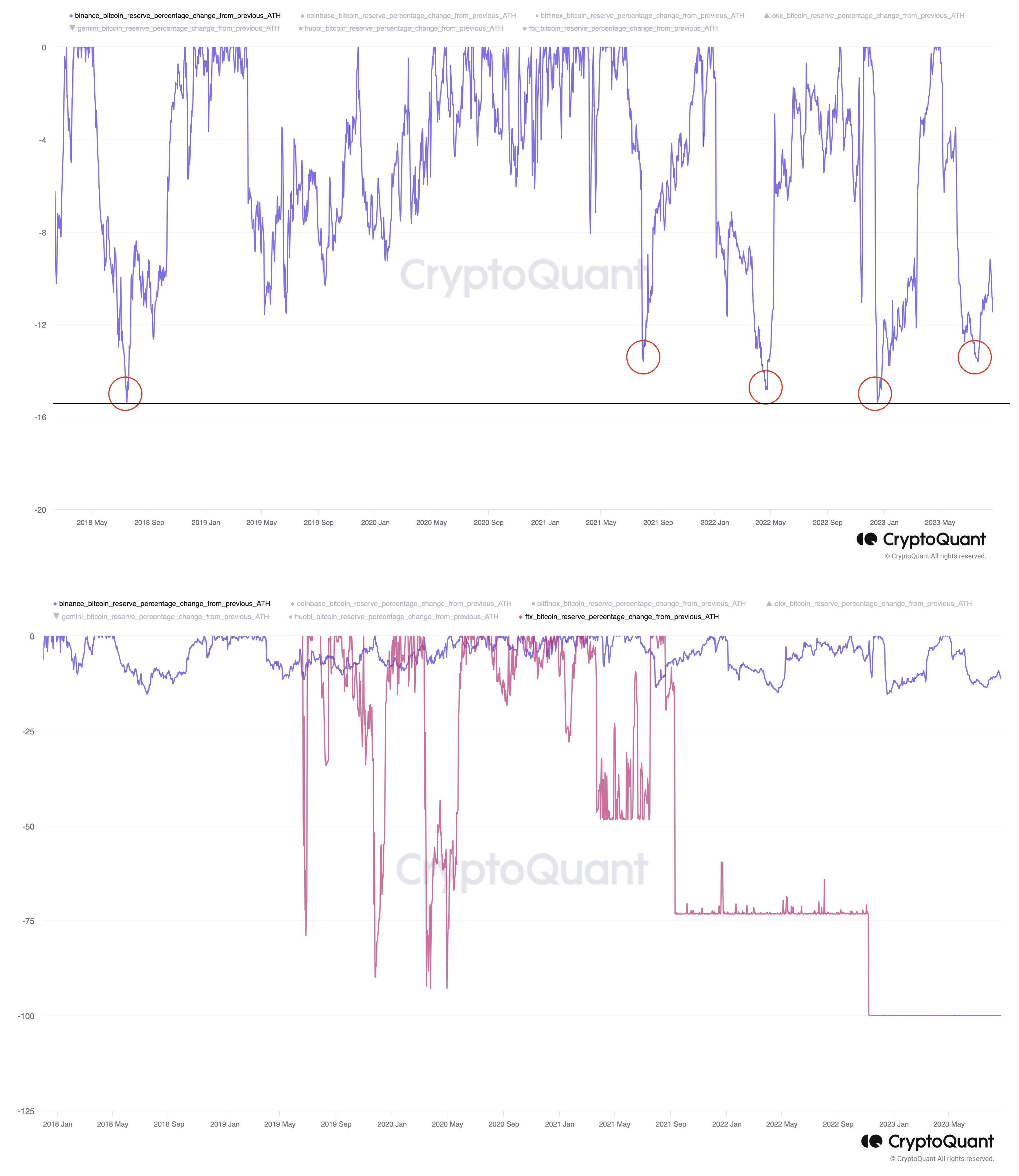

The below chart shows the trend in this BTC indicator for Binance, as well as for FTX, over the last few years.

As displayed in the graph, the Binance Bitcoin exchange reserve had declined from its most recent ATH and had hit a low recently, but the indicator’s drawdown had been within the bounds of historical periods of major withdrawals.

Interestingly, since the year 2018, the platform’s reserves have never seen a decline of more than 16% from the ATH, before surging back up and potentially setting a new ATH.

The Binance exchange reserve has been declining in the last few days, but it’s still at a drawdown value of less than 12%, which is even lower than the bottom that the metric has most recently observed.

A stark difference is noticeable in the case of FTX, where the exchange’s reserves declined by more than 50% from the ATH in the August-September 2021 period and never made any recovery. Moreno notes that on top of this, the behavior of the FTX Bitcoin exchange reserve was erratic, certainly different from how the metric has looked for Binance.

FTX’s reserve also remained locked in sideways movement around these lows for a while, until eventually, the metric’s drawdown suddenly reached the 100% mark, as the reserves were cleaned out in a bank run.

Based on these clear differences in the Bitcoin exchange reserves of the two platforms, the analyst doesn’t believe that Binance is currently going through what FTX did.

BTC Price

At the time of writing, Bitcoin is ranging around $26,086, down 2% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments