Hi, I'm Jimmy He, here to take you through the day's crypto market highlights and news.

Bitcoin (BTC) surged above $22,500 early Monday, hitting its highest price in over a month.

The largest cryptocurrency by market capitalization was trading at $21,696, up 3.1% over the past 24 hours.

Oanda Senior Market Analyst Edward Moya said that crypto sentiment is improving amid signs that the global economy will remain on solid footing for the near future and that the U.S. central bank will raise interest rates at its next meeting by 0.75 percentage point, rather than by 1 percentage point as some monetary policy observers had predicted last week.

“If bitcoin continues to stabilize here over the next two weeks, the crypto winter could be over,” Moya said.

GlobalBlock CEO Rufus Round said that he is seeing greater investor commitment to cryptocurrency as markets experience relief.

“We, certainly at GlobalBlock, are seeing professional buyers load up on bitcoin and ether around these levels,” Round said. “It's such a collapse and there's been so much stress in the markets. The forced sellers are hopefully all done by now, and people are seeing value right here, especially given the macroeconomic backdrop.”

Most major altcoins outperformed bitcoin, with Polygon’s MATIC token leading the charts, up 18.4% over the past 24 hours. MATIC surged over 66% over seven days after Disney chose the Ethereum scaling tool as part of its 2022 Accelerator Program.

Ether (ETH) climbed 9% to $1,469. Last Friday, Ethereum’s ninth "shadow fork" went live as the second-largest cryptocurrency by market cap moved closer to its transition from proof-of-work to proof-of-stake.

Today’s edition of Market Wrap was produced by Sage D. Young.

Latest prices

●Bitcoin (BTC): $21,513 +1.8%

●Ether (ETH): $1,459 +7.6%

●S&P 500 daily close: 3,825.30 −1.0%

●Gold: $1,706 per troy ounce +0.2%

●Ten-year Treasury yield daily close: 2.96% +0.03

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

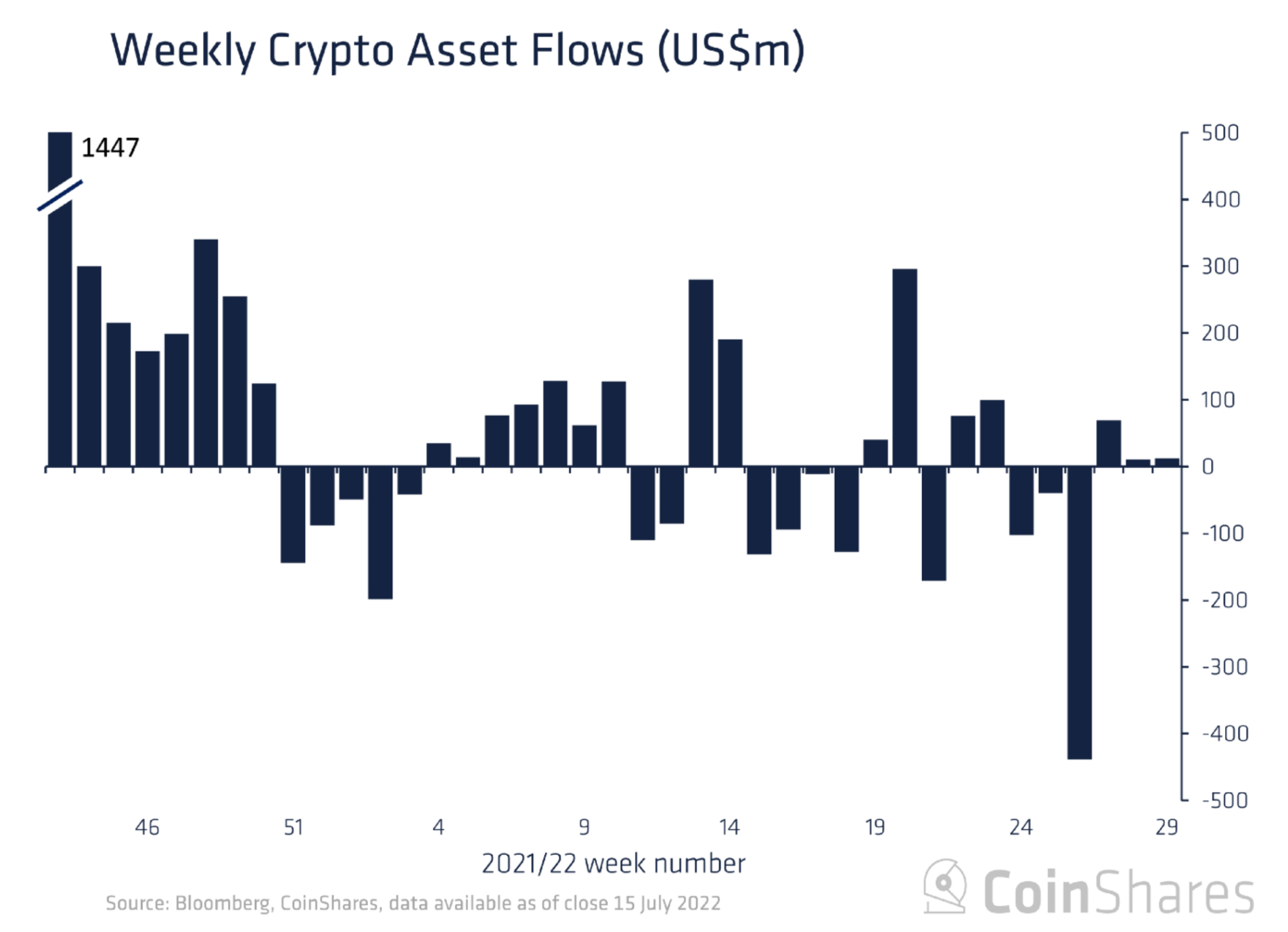

Short-Bitcoin Positions Dominate Inflows: CoinShares

Crypto assets had three consecutive weeks of inflows for the first time since March. (CoinShares)

Crypto funds had inflows for a third consecutive week with inflows of $12 million in the seven days through July 15, according to a CoinShares report. But a lot of those investments came from investors betting on further price declines in bitcoin.

Short-bitcoin positions, which bet on a price decline in BTC, generated $15 million in inflows. Short-bitcoin inflows reached a record four-week run of $88 million.

Net outflows for long investment products totaled $2.6 million. Traditional bitcoin investment products saw outflows amounting to $2.6 million, while ether-focused funds had $2.5 million of outflows.

“We believe this highlights new investors expecting further price downside, while those currently invested are not selling out of positions, believing crypto prices are close to a bottom,” the authors wrote.

Altcoin funds saw minor inflows with $500,000 of inflows for Solana, $300,000 for XRP and $100,000 for Tron.

Regionally, the U.S. inflows totaled $21 million, outperforming other countries. Canadian outflows totaled $13 million, pushing the country’s cumulative year-to-date outflows to $388 million.

Altcoin roundup

- Polygon, ApeCoin Tokens See Outsized Gains: MATIC and APE both surged as crypto market capitalization regained the $1 trillion mark early on Monday, up from around $800 million in June. Read more here.

- The 'Merge Trade' Has Begun, Experts Say: Renewed clarity about Ethereum's Merge timeline spurred investor interest in ether and its staked derivative on the Lido platform called staked ether (stETH). "ETH has undergone a rapid change in narrative over the past week, with speculators purely focused on the upcoming 'merge' as a catalyst for appreciation," one observer said. Read more here.

Relevant insight

Other markets

Biggest Gainers

Biggest Losers

There are no losers in CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments