While quality of life in 2022 might seem better in many regards, energy use per capita was higher years ago, painting a bleak picture for millennials.

This is an opinion editorial by Andy LeRoy, the founder of Exponential Layers which is a Lightning Network analytics platform and explorer.

This beautiful three bedroom, 1.5 bath house in Charlotte, North Carolina, is a millennial’s dream. Complete with a backyard and a porch for enjoying a coffee, it is in a prime neighborhood just down the street from a brunch spot with an all-day avocado toast special. For just $730,000, it can be all yours.

We all recognize this house is expensive. A $4,000 monthly payment, even after putting $150,000 down, would represent nearly 70% of the median U.S. household income, and this house is about 1.7 times higher than the U.S. median home price of $440,000.

Why Is This House So Expensive?

The house was built in 1938, and its latest available records show its sale history, the earliest being for $88,500 in 1987.

This jump from $88,500 to $730,000 is a 725% increase over 35 years, and reflects a compound annual growth rate (CAGR) of 6.2%. That’s quite an increase. Over the same time the S&P 500 is up 465% at a CAGR of 5.1%, so is it really that big of a jump in comparison?

What about gross domestic product (GDP), the go-to for measuring economic output? GDP is up from $4.7 trillion to $24.8 trillion in nominal terms, another triple-digit increase of 427% over 35 years.

So everything is up … it makes sense, right?

Charlotte’s population has grown from 424,000 to 2.2 million over this same time period — 5% CAGR — and this house is in a great neighborhood, so supply and demand? Plus our economy is more productive, so the rise in price is inevitable?

All of this checks out on paper, except for one metric: energy.

U.S. energy consumption in 1987 was 21,056 TWh of energy, which adjusted for population at the time represents about 87,000 kWh per person. Of this energy consumption, electricity usage was around 11,500 kWh per capita.

Compare that to today — the latest figures in 2022 for the United States show per capita energy consumption of 76,632 kWh, with a slight increase in the amount consumed as electricity at 12,466 kWh per person.

For all of the talk of “walking uphill both ways” in previous generations, it actually turns out that more energy was consumed per capita 35 years ago in the U.S. than it is today.

The Energy Breakdown

There are a number of forms for how energy (and then electricity) is created.

If you ride a bike at a reasonable pace, you will generate 100 watts. Keep this up for 10 hours and you will have generated 1 kWh worth of energy. A load of laundry done with a washer and a dryer will consume around 6 kWh of energy.

If we ignore the monetary denomination of housing prices and just look at the U.S. economy as the output and consumption of energy, we now consume less per capita than we did in 1987.

As we saw in USD prices, this particular house is eight times as expensive, while energy consumption per capita is flat. By this logic, if it took you one month of riding your bike for 10 hours a day to generate the energy to buy the house in 1987, you would now need to ride your bike for eight months to buy the same house. Eight times as much energy for the same product? Better get out that Peloton subscription.

This is a cherry-picked example of one house in a growing city; it has probably been renovated many times and is worth the extra work, especially considering Charlotte’s population and job growth.

Let’s zoom out and look at another example.

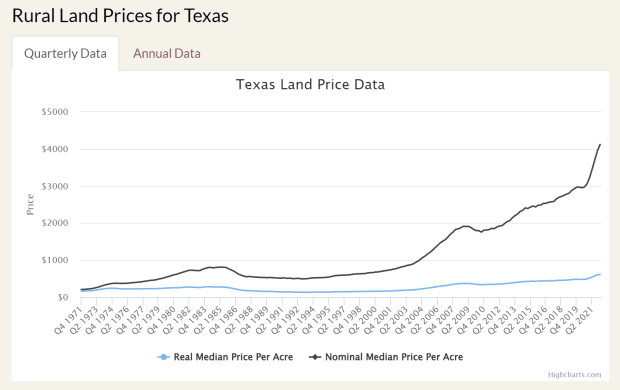

The Texas A&M Real Estate Center publishes aggregated rural land prices. From their chart, we can see that an acre of land in Texas in 1987 was $553. That same land in 2021 is now nearly $4,000/acre (an eightfold increase over a 35-year period).

An acre of land, with no improvements, in the middle of nowhere, now requires eight times as much energy output to purchase?!

Land can improve in value with higher population, utility (farming or hunting) or lower tax rates and/or some kind of subsidized incentive. But a 362% price increase after adjusting for U.S. population growth? Texas forever, but something doesn’t add up here.

Is Energy The Correct Metric?

The idea of energy-based money is nothing new. Henry Ford was an early proponent of energy as currency, and as many Bitcoiners and Redditors have pointed out, he was also a believer in reincarnation (H.F. anyone?). The idea of a money denominated in energy terms, kWh for example, held great promise for getting us out of the fiat system.

We intuitively recognize the concept of energy. We either work longer hours or we focus efforts or use better tools to leverage our output, and the abstractions simply go on. The corporate world is full of internal rate of return analysis, resource staffing, budgets and timelines. Earnings reports and financial statements offer the scorecard to the market, which weeds out businesses that do not generate economic value over time.

Our system of capitalism has worked quite well. Thanks to the incredible ingenuity, output and work of everyone in the world, and despite inflation, so many things now have lower prices.

In 1956, the ENIAC computer weighed 27 tons, consumed 150 kW, ran about 100,000 operations per second and cost the equivalent of $6 million today. Today, a new Macbook weighs 3.5lbs, consumes around 40 watts, and cranks out 3.2 billion operations per second — all for $2,000.

Airliners have increased their fuel efficiency at a compound rate of 1.3% between 1968 and 2014.

In many cases, we are getting much more efficient with all of our energy consumption, so things should be getting even more inexpensive?

What’s The Problem?

To be able to have a rich life and so many improvements while using the same energy per capita is a benefit to us all, but how that economic value is measured is susceptible to changing rules.

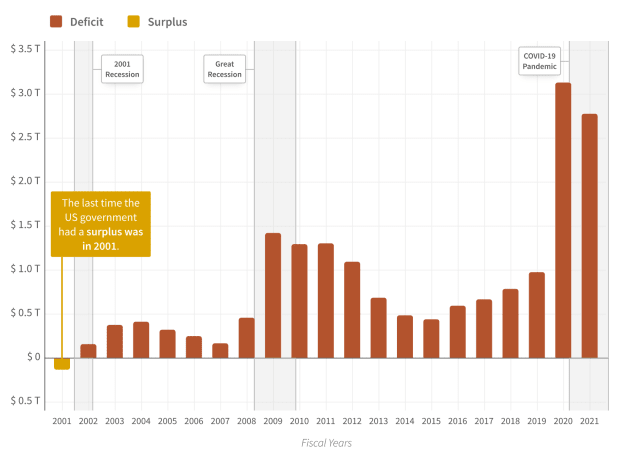

If we have gotten more efficient with our energy and have better technology, how is it that a piece of rural land costs eight times more? This is where the Federal Reserve’s expanding money supply comes into play. For all of the talk about “transitory inflation,” the Fed (with the help of banks) has managed to expand the M2 money supply by around 680% over the past 35 years.

So while our nominal GDP is up 427%, it hasn’t outpaced money supply growth, and we have already seen that energy consumption per capita is flat over 35 years.

The problem here is what we all can tangibly feel: The output of our work denominated by the energy we put in is worth significantly less over time.

When we as individuals or corporations are unable to preserve the efforts of our energy output, we must continually find ways to preserve our purchasing power through assets like land, commodities and equities. If the pace at which stored energy degrades is faster than innovation and output, we have problems. Physical limits come into play: We can print all the money in the world, but we can’t fake energy production and consumption.

Yes, our energy may be consumed more efficiently — as evidenced earlier by the airplane requiring 45% less fuel for the same trip — thus providing more value to society. If our society has been so efficient, why has debt to GDP risen from 47% in 1987 to 123% today? How is it that we have needed to borrow against the future so much in an environment of increased productivity? At some point this all breaks.

What Breaks?

Unlike with fiat or any proof-of-stake altcoins, you cannot fake energy creation. Doing more work in the past does not magically create new work in the future. However, the cover-up in fiat money printing, combined with every U.S. government administration’s propensity to spend, has left us in debt.

Supposedly this is fine, because we can always print our way out of debt. But can we really?

In 2021, the federal government brought in $4.05 trillion in revenue with GDP at $22.4 trillion. It spent $6.82 trillion. The pandemic payments made up $570 billion on top of other category staples such as social security ($1.1 trillion), health ($797 billion) and defense ($755 billion). Interest paid by the government was $352 billion — 5% of total spending (in a pandemic year).

Over time, the government has spent more as a percent of GDP — 32% in 1987 compared to 55% at the height of the pandemic — and now to 34% in 2022. Even after capturing the value hidden in inflation all these years!

In attempts to quell record inflation (9.1% in the latest report), the Fed hiked interest rates to 2.5% in July; an increase of 75 basis points (.75%).

While this may “slow” the economy, it has two negative effects on being able to balance the budget. With a slower economy, they have a lower tax revenue to draw from. The latest 0.75% interest rate increase also adds another approximately $130 billion in interest expense to a budget that already can’t be balanced. This comes in the form of added expense on debt rollover, and this great article from Allan Sloan walks through an estimated calculation.

Using his rollover debt totals of about $7.1 trillion, every 100 basis point increase in the federal funds rate that feeds through to market yields on Treasuries adds another $70 billion to required government spending. If rates ever get up to a 5% range, that puts interest expense (on just current debt) at somewhere close to $500 billion. More than transportation, education, training, employment and social services combined.

The Fed can also continue their attempts for quantitative tightening, but this has the same problem: higher interest rates (and interest expense), and a presumably reduced tax base given economic slowdown.

The last remaining option would be to cut federal spending or increase taxes. With names like the “Inflation Reduction Act,” we already see the government attempting to mask their increased taxation attempts. Other “hidden” taxation attempts will likely come: increasing the age at which you can begin receiving social security benefits, adding additional taxes for “wealthy” people withdrawing from their 401(k) or IRA, putting in carbon taxes under the guise of “ESG” (environmental, social and governance). Things will need to be creative to offset the competing incentives of a surplus and (re)election.

At some point, this model breaks. We cannot cut energy production and consumption, cut interest rates to encourage growth and run continued deficits. The numbers don’t add up and eventually no one — individuals, companies or governments — can fake the energy output required to keep pace. We have seen a number of debt-ceiling showdowns over the past decade, but this time seems different, especially with 25% of the world living in countries with 10%-plus inflation.

What’s Next?

Money is just a tool for valuing goods and services over time — and has key properties. It doesn’t create “yield” by itself. Only productive assets, which provide positive economic value, can do this. When it all breaks down, whoever holds the productive assets can determine the role of money, provided they have the resources and means to enforce and defend the rules.

But, as all of you are well aware, we finally have an alternative option. Instead of it coming from top-down enforcement, backed by the military, Bitcoin is adopted bottom-up — in the very order that its properties become beneficial to the people and companies providing economic value.

How Bitcoin adoption plays out will be interesting and exciting to watch. Bitcoin is already used worldwide, with a $410 billion market cap, settling some $60 trillion in value.

Now, with the Lightning Network, Bitcoin can be sent peer-to-peer instantaneously, without a central authority. July saw the highest monthly Lightning Network capacity, and every metric is up and to the right for providing a payment layer that offers continued utility and helps clear the medium of exchange hurdle present in the Bitcoin system.

Defining success metrics relies on a whole host of factors, and at Exponential Layers you can take a look at preliminary Lightning Network metrics that give insight into network growth (among other data), as Lightning moves to take the role of Visa’s $10.4 trillion yearly payment volume.

This is a guest post by Andy LeRoy. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments