The crypto market’s intraday outlook on Friday morning largely portrays a market trying to recover from Wednesday’s overnight bloodbath.

An illustration with Dogecoin and TRON highlighted among major coins.

Heading into the weekend, it’s not clear what direction the broader market is likely to take. Signals of possible rebound are there as seen in intra-hour performances across all the major coins.

However, Bitcoin (BTC) at $32,889; Ethereum (ETH) $2,120, and Binance Coin (BNB) $310 are still vulnerable to fresh declines to suggest the market could see some selling pressure over the next two days.

Coins traders might want to keep an eye on include DOGE, LINK and TRX.

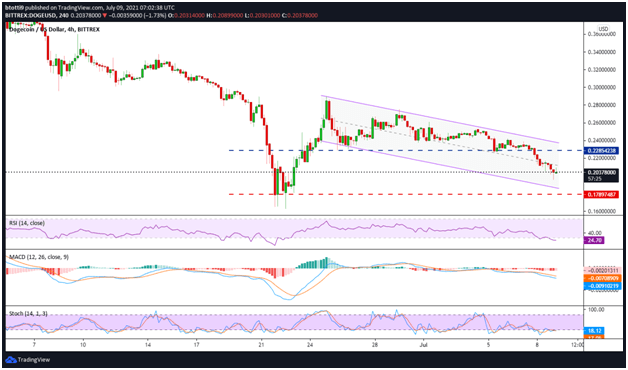

Dogecoin price

DOGE is trading at $0.2054 as of writing, about 5.8% and 14% down in the past 24 hours and 7 days respectively. This latest breakdown in Dogecoin’s price has pushed the value of the original meme coin 72% off its 8 May peak, recorded at $0.7376.

Dogecoin could pump again as tweets begin to flow, including from DOGE’s number 1 supporter Elon Musk.

However, the 4-hour chart shows DOGE/USD is likely to revisit a support level below $0.2000 as happened when bears breached the anchor last month. The RSI is in oversold territory and significantly sloping, as is the Stochastic RSI and the MACD that’s showing increased weakness after a bearish crossover.

DOGE may rebound to the highlighted line (blue). However, if it breaks below $0.2000, it could nose-dive to support levels near $0.1789.

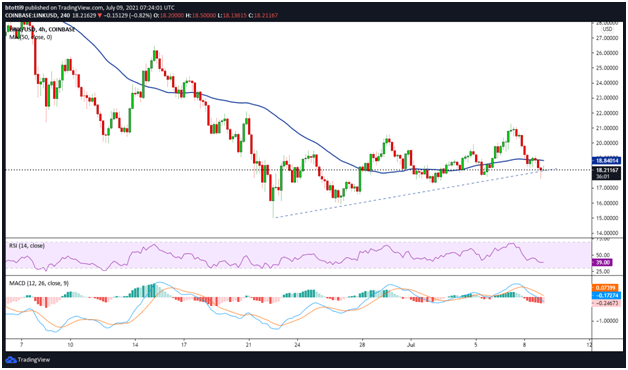

Chainlink price

Chainlink’s price of $18.24 as of writing is 3.5% down on its 24-hour opening, but +3.25% in the green on the weekly timeframe.

Technical indicators, though, suggest bears have the upper hand and could result in price heading lower or seeing a bout of sideways action over the weekend.

The 4-hour chart shows that the RSI is below the equilibrium point and dipping, while the MACD continues to strengthen in the bearish zone.

If bulls breach the supply wall at the 50-day moving average at $18.83, LINK could test the $20.00 range. Contrary to that would be a revisit of the $16.00 level.

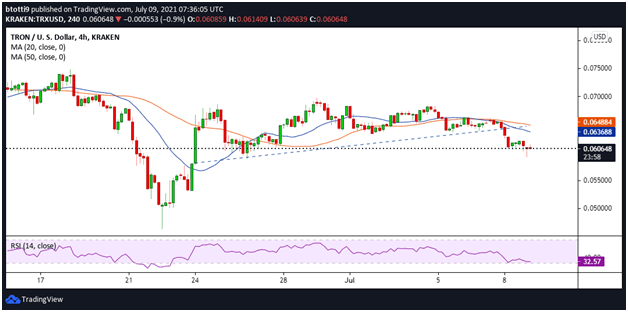

TRON price

Tron (TRX) is trading with a bearish outlook, currently changing hands at $0.0607 after declining 5% over the past 24 hours. TRX is also below the 20-day and 50-day moving averages.

The 4-hour chart also shows a negative divergence in the RSI, which is observed to be sloping towards the oversold region. Intraday sell volume also remains high to confirm the potential for a further breakdown.

Key price levels to watch are $0.0598 and $0.0530 on the downside. If sentiment flips positive, traders may target gains at $0.0622 and $0.0648 in the short term.

The post Price Analysis: Dogecoin (DOGE), Chainlink (LINK), Tron (TRX) appeared first on Coin Journal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments