Signs of seller exhaustion are creating conditions that resemble a market bottom for bitcoin (BTC), according to a report from blockchain analysis firm Glassnode.

Realized losses, or the losses incurred by selling assets, show the extent of investor capitulation. The magnitude can be charted using blockchain data.

The stablecoin terraUSD (UST) and its companion token LUNA’s collapse in May triggered a wave of realized losses totaling $28 billion over 30 days, according to Glassnode. When crypto prices plunged below the 2017 all-time high on June 18th, realized losses jumped to a record high of $36 billion over 30 days.

The crypto market saw record monthly realized losses in June 2022. (Glassnode)

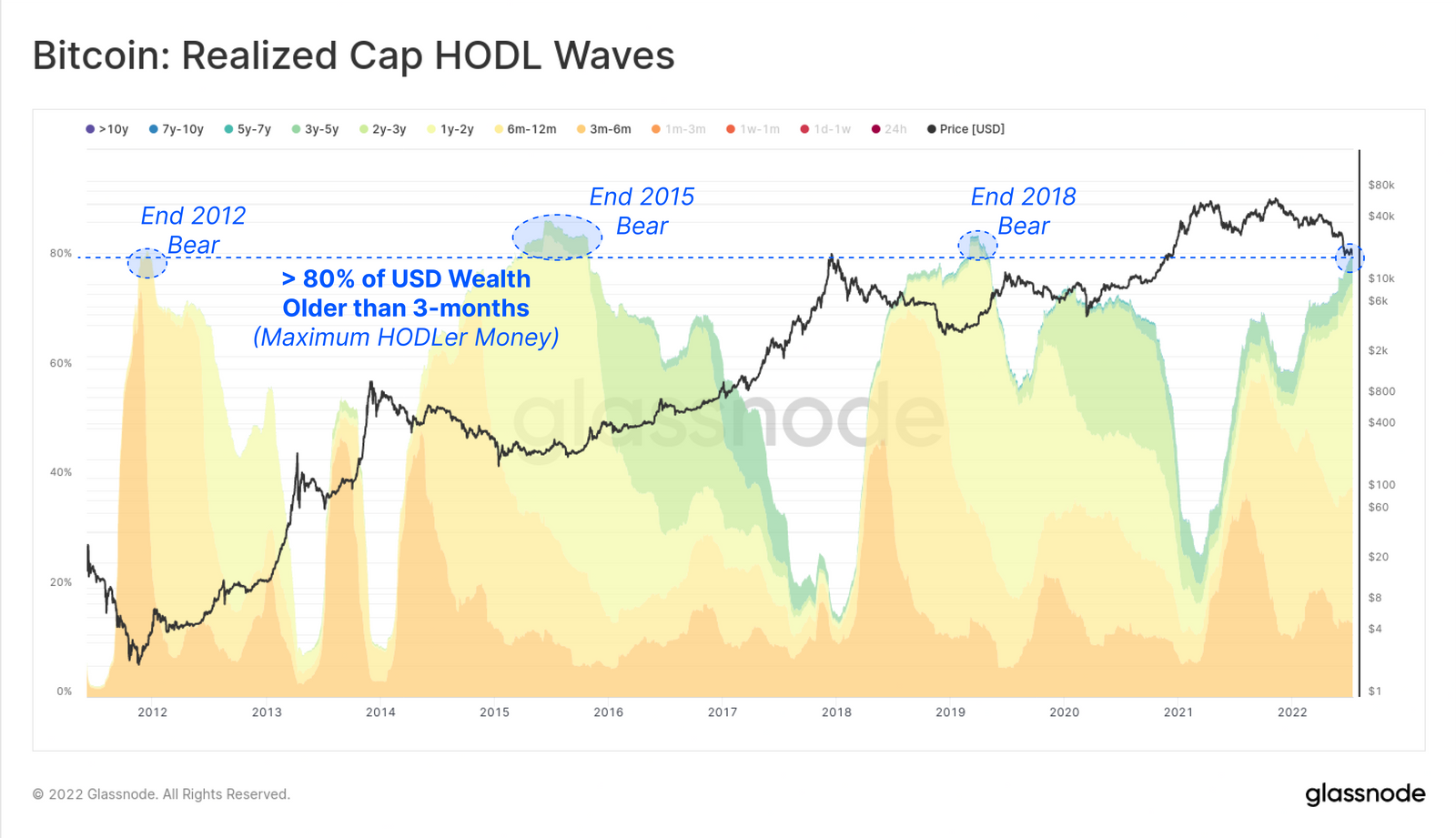

As retail and short-term investors are purged from the market during these mass sell-offs, the saturation of "HODLers," or the cohort of price-insensitive long-term investors, swells. The more HODLers there are, the stabler crypto prices become and the likelier it is that the market has bottomed out.

Over 80% of the dollar (USD) wealth stored in bitcoin is now older than three months, signaling the sell-off waves in May and June have exhausted nearly all short-term traders.

This percentage coincides with data from the end of the 2012, 2015 and 2018 bear market bottoms, which all occurred when the USD wealth older than three months climbed above 80%.

“Against a backdrop of extremely challenging macroeconomic and geopolitical turmoil, bitcoin is reaching peak investor saturation by high conviction HODLers, and it is becoming quite plausible that a genuine bottom formation could be underway,” Glassnode wrote.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments