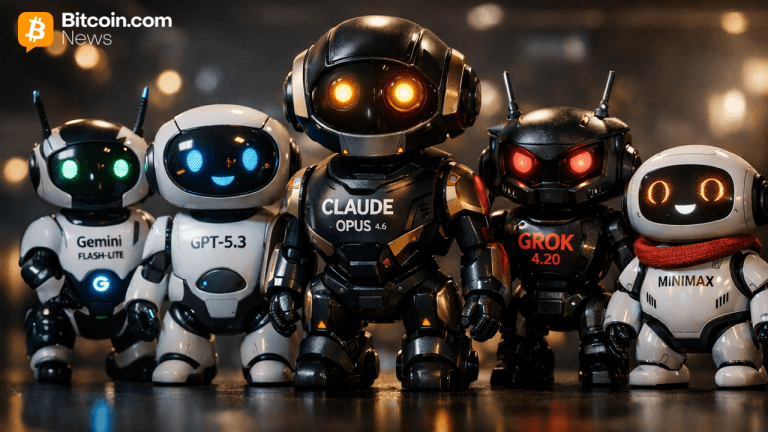

Crypto sponsorships have grown in popularity in recent years as a popular way for brands to engage with the cryptocurrency community and benefit on the growing interest in digital assets. However, this new kind of sponsorship has distinct regulatory issues for both companies and bitcoin ventures.

In this article, we will look into the legislative landscape around crypto sponsorships and offer advice on how to approach these issues while remaining compliant with applicable regulations.

Understanding Bitcoin Sponsorships

Collaborations between brands and cryptocurrency projects involve collaborations in which companies contribute financial support or resources in exchange for marketing exposure and brand identification with the project.

This can take many different forms, such as brand endorsements by bitcoin influencers, sponsored events, or collaborations between companies and cryptocurrency exchanges.

Increasing Regulatory Scrutiny

As cryptocurrency sponsorships have grown in popularity, regulators throughout the world have begun to pay greater attention to this type of brand involvement. The regulatory environment surrounding cryptocurrencies is still growing, and there are worries about consumer protection, investor dangers, and potential money laundering.

As a result, businesses and cryptocurrency initiatives that engage in sponsorship must be aware of and adhere to the applicable rules and regulations.

Navigating Regulatory Obstacles

To successfully handle the regulatory constraints of crypto sponsorships, companies and cryptocurrency projects should keep the following crucial factors in mind:

Financial Regulation Compliance

Financial rules are important in the crypto sponsoring space. Brands and cryptocurrency initiatives must ensure compliance with anti-money laundering (AML) rules, know-your-customer (KYC) standards, and financial licensing obligations.

Brands can reduce the risk of associating with cryptocurrency initiatives involved in illegal activity by completing adequate due diligence on potential partners and implementing comprehensive AML and KYC procedures. Understanding the licensing requirements in relevant jurisdictions can also assist brands in avoiding legal hazards and maintaining a valid sponsorship deal.

Transparency and consumer safeguards

Transparency in crypto sponsorships is critical for protecting customers and maintaining trust in the brand-crypto project collaboration. Brands should guarantee that their engagement and any financial interests in the cryptocurrency initiative they are promoting are clearly disclosed.

This transparency allows consumers to make more informed selections while also reducing the possibility of misleading or deceptive actions.

Furthermore, while endorsing or promoting cryptocurrency ventures, companies should take caution, completing rigorous due research on the project's authenticity, regulatory compliance, and long-term viability.

Brands can maintain consumer trust and defend their reputation by working with reliable projects and disclosing the dangers connected with cryptocurrency publicly.

Regulatory Differences Between States

The regulatory environment for cryptocurrencies and cryptocurrency sponsorships differs by jurisdiction. To guarantee compliance in the locations where they operate or target clients, brands and cryptocurrency initiatives must manage these variances.

It is critical to consult with legal specialists who are knowledgeable about both banking regulations and cryptocurrency-related laws. These experts can advise on unique legal needs in each area, guaranteeing compliance with local rules and avoiding potential legal ramifications.

Guidelines for Advertising and Endorsement

Brands that participate in cryptocurrency sponsorships should also examine the advertising and endorsement guidelines established by regulatory agencies. Advertising guidelines may require clear and prominent disclosures about the nature of the sponsorship and any financial interests involved.

Following these standards assists firms in maintaining openness and integrity in their crypto sponsorships, avoiding any regulatory sanctions or customer reaction as a result of misleading or non-compliant advertising methods.

Monitoring and Compliance on an ongoing basis

To maintain compliance with changing legislation, cryptocurrency sponsorships must be monitored on an ongoing basis. Both brands and cryptocurrency initiatives should implement rigorous compliance systems, which include frequent risk assessments, internal controls, and regulatory training for workers.

Regularly analyzing sponsorship agreements and assessing changes in regulatory landscapes aids brands and cryptocurrency initiatives in adapting to and remaining compliant with the most recent legal standards.

Collaboration and Best Practices in the Industry

Collaboration among brands, cryptocurrency initiatives, and regulatory agencies is critical for successfully navigating regulatory issues. Industry associations and self-regulatory organizations are critical in developing best practices and self-regulatory norms for crypto sponsorships.

Brands and cryptocurrency initiatives may assist influence the regulatory landscape and create a more transparent and compliant environment for crypto sponsorships by actively participating in industry debates, following to best practices, and collaborating with regulatory agencies.

Could it be Time for a Global Unified Regulatory Framework for Crypto?

The rapid growth and increasing prominence of cryptocurrencies have posed significant challenges for regulators worldwide. The decentralized nature of cryptocurrencies, coupled with their borderless nature, has resulted in a fragmented regulatory landscape. As the global adoption of cryptocurrencies continues to expand, the question arises: Should countries push for a unified regulatory framework on cryptocurrencies?

The Need for Regulatory Clarity

Cryptocurrencies have attracted a diverse range of participants, from individual investors to institutional players. However, the absence of a comprehensive and unified regulatory framework has led to confusion and uncertainty. Regulatory clarity is essential to address concerns surrounding consumer protection, money laundering, market manipulation, and investor confidence. A global unified regulatory framework could provide consistency, establish clear guidelines, and promote responsible innovation within the crypto space.

Advantages of a Global Unified Regulatory Framework

1. Consistency and harmonization: A global unified regulatory framework would promote consistency and harmonization across jurisdictions. This would streamline compliance processes for businesses and reduce the burden of navigating varied and sometimes conflicting regulations. Additionally, it would facilitate cross-border transactions and promote global cooperation in combating illicit activities.

2. Investor protection: A robust regulatory framework can enhance investor protection by establishing minimum standards for disclosure, custody, and security practices. Clear rules and regulations would increase investor confidence, attract more traditional investors, and potentially reduce fraudulent activities. Strengthened investor protection would contribute to the long-term stability and growth of the crypto industry.

3. Market integrity: A unified regulatory framework would address concerns related to market integrity and combat market manipulation. By imposing standardized rules on exchanges, trading practices, and reporting requirements, regulators can foster fair and transparent markets. This would mitigate risks associated with price manipulation, insider trading, and fraudulent activities, promoting market integrity and safeguarding investor interests.

4. Innovation and adoption: Clear and balanced regulations can foster innovation and responsible growth within the crypto industry. A unified framework that provides regulatory certainty would encourage businesses to invest in research and development, driving technological advancements and expanding use cases for cryptocurrencies. Moreover, streamlined regulations would reduce barriers to entry, fostering greater adoption of cryptocurrencies worldwide.

Conclusion

Crypto sponsorships provide brands one-of-a-kind possibilities to interact with the cryptocurrency community and capitalize on the growing interest in digital assets. However, understanding the regulatory issues associated with cryptocurrency sponsorships is critical for ensuring compliance and protecting both companies and customers.

Brands and cryptocurrency projects can successfully navigate the regulatory landscape by understanding and adhering to financial regulations, prioritizing transparency and consumer protection, taking into account jurisdictional variations, adhering to advertising and endorsement guidelines, and implementing robust compliance programs.

Collaboration among industry stakeholders and involvement with regulatory agencies will help shape the future of cryptocurrency sponsorships, ensuring a compliant and transparent environment that promotes the growth of this new type of brand engagement.

This article was written by FM Contributors at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments