A guide to the multi-chain future, sidechains, and layer-2 solutions

Around the Block from Coinbase Ventures sheds light on key trends in crypto. Written by Justin Mart & Connor Dempsey.

As of late 2021, Ethereum has grown to support thousands of applications from decentralized finance, NFTs, gaming and more. The entire network settles trillions of dollars in transactions annually, with over $170 billion locked on the platform.

But as the saying goes, more money, more problems. Ethereum’s decentralized design ends up limiting the amount of transactions it can process to just 15 per second. Since Ethereum’s popularity far exceeds 15 transactions per second, the result is long waits and fees as high as $200 per transaction. Ultimately, this prices out many users and limits the types of applications Ethereum can handle today.

If smart-contract based blockchains are to ever grow to support finance and Web 3 applications for billions of users, scaling solutions are needed. Thankfully, the cavalry is beginning to arrive, with many proposed solutions coming online recently.

In this edition of Around The Block, we explore the crypto world’s collective quest to scale.*

To compete or to complement?

The goal is to increase the number of transactions that openly accessible smart contract platforms can handle, while retaining sufficient decentralization. Remember, it would be trivial to scale smart contract platforms through a centralized solution managed by a single entity (Visa can handle 45,000 transactions per second), but then we’d be right back to where we started: a world owned by a handful of powerful centralized actors.

The approaches being taken to fix this problem come twofold: (1) build brand new networks competitive to Ethereum that can handle more activity, or (2) build complementary networks that can handle Ethereum’s excess capacity.

Broadly, they break out across a few categories:

- Layer 1 blockchains (competitive to Ethereum)

- Sidechains (somewhat complementary to Ethereum)

- Layer 2 networks (complementary to Ethereum)

While each differs in architecture and approach, the goal is the same: let users actually use the networks (eg, interact with DeFi, NFTs, etc) without paying exorbitant fees or experiencing long wait times.

Layer 1s

Ethereum is considered a layer 1 blockchain — an independent network that secures user funds and executes transactions all in one place. Want to swap 100 USDC for DAI using a DeFi application like Uniswap? Ethereum is where it all happens.

Competing layer 1s do everything Ethereum does, but in a brand new network, soup to nuts. They’re differentiated by new system designs that enable higher throughput, leading to lower transaction fees, but usually at the cost of increased centralization.

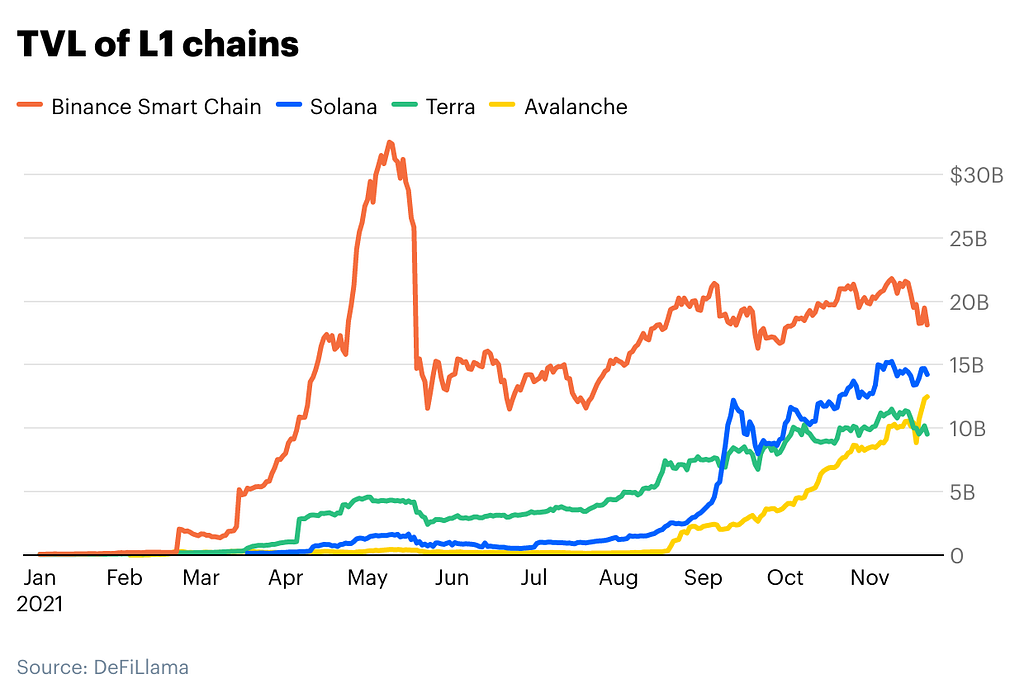

New layer 1s have come online in droves over the last 10 months, with the aggregate value on these networks rocketing from $0 to ~$75B over the same time period. This field is currently led by Solana, Avalanche, Terra, and Binance Smart Chain, each with growing ecosystems that have reached over $10 billion in value.

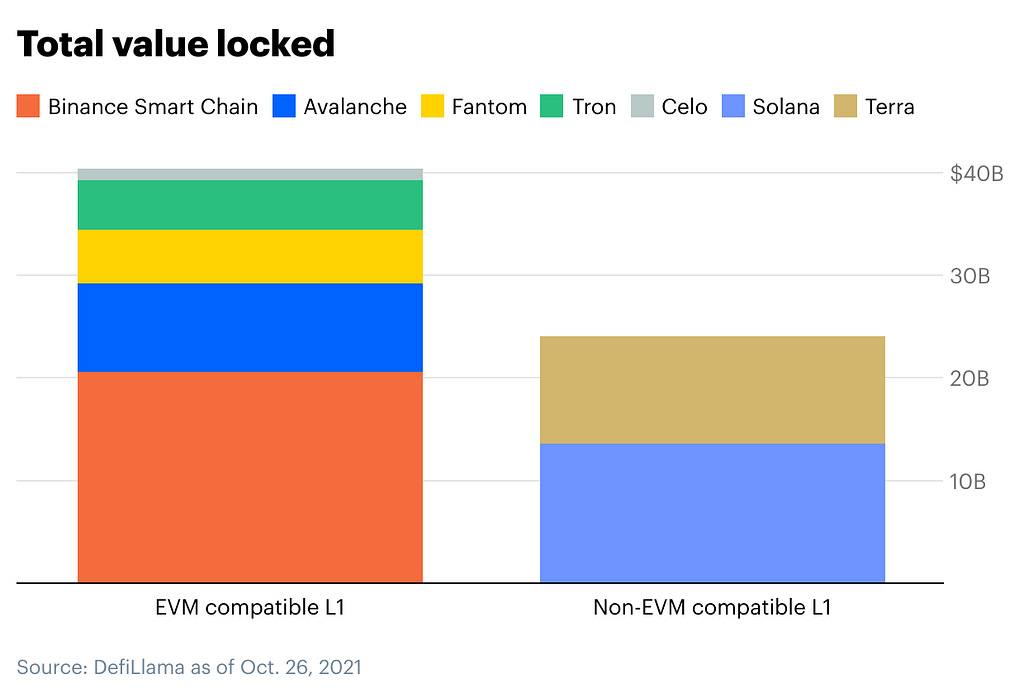

All layer 1s are in competition to attract both developers and users. Doing so without any of Ethereum’s tooling and infrastructure that make it easy to build and use applications, is difficult. To bridge this gap, many layer 1s employ a tactic called EVM compatibility.

EVM stands for the Ethereum Virtual Machine, and it’s essentially the brain that performs computation to make transactions happen. By making their networks compatible with the EVM, Ethereum developers can easily deploy their existing Ethereum applications to a new layer 1 by essentially copying and pasting their code. Users can also easily access EVM compatible layer 1s with their existing wallets, making it simple for them to migrate.

Take Binance Smart Chain (BSC) as an example. By launching an EVM compatible network and tweaking the consensus design to enable higher throughput and cheaper transactions, BSC saw usage explode last summer across dozens of DeFi applications all resembling popular Ethereum apps like Uniswap and Curve. Avalanche, Fantom, Tron, and Celo have also taken the same approach.

Conversely, Terra and Solana do not currently support EVM compatibility.

Interoperable Chains

In a slightly different layer 1 bucket are blockchain ecosystems like Cosmos and Polkadot. Rather than build new stand-alone blockchains, these projects built standards that let developers create application specific blockchains capable of talking to each other. This can allow, for example, tokens from a gaming blockchain to be used within applications built on a separate blockchain for social networking.

There is currently over $100B+ sitting on chains built using Cosmos’ standard that can eventually interoperate. Meanwhile, Polkadot recently reached a milestone that will similarly unite its ecosystem of blockchains.

In short, there’s now a diverse landscape of direct Ethereum competitors, with more on the way.

Sidechains

The distinction between sidechains and new layer 1s is admittedly a fuzzy one. Sidechains are very similar to EVM-compatible layer 1s, except that they’ve been purpose built to handle Ethereum’s excess capacity, rather than compete with Ethereum as a whole. These ecosystems are closely aligned with the Ethereum community and host Ethereum apps in a complementary fashion.

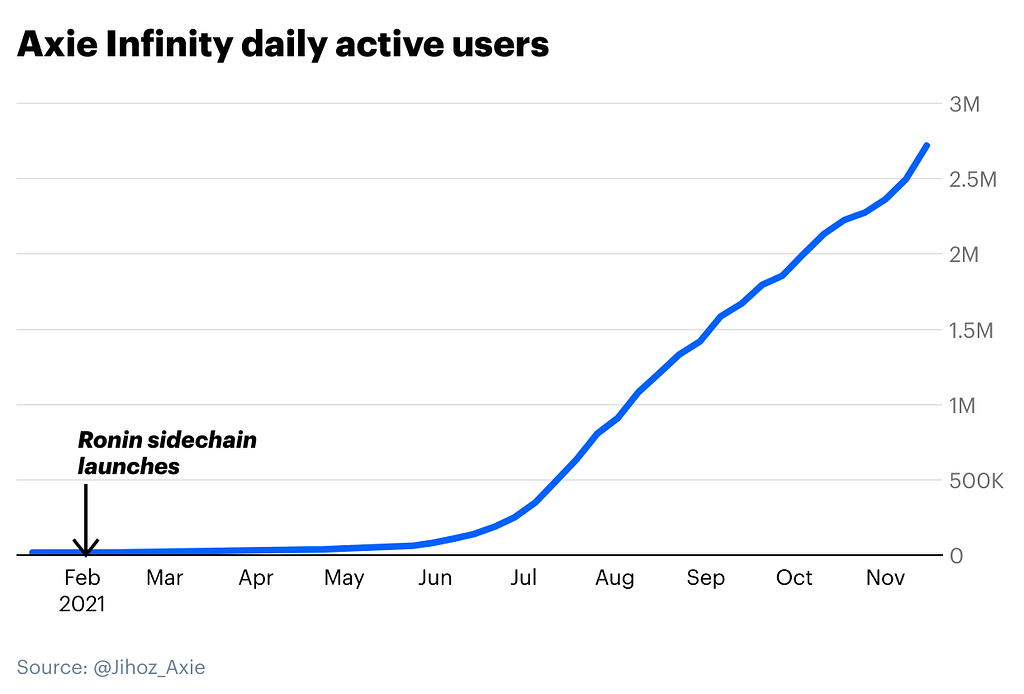

Axie Infinity’s Ronin sidechain is a prime example. Axie Infinity is an NFT game originally built on Ethereum. Since Ethereum fees made playing the game prohibitively expensive, the Ronin sidechain was built to allow users to move their NFTs and tokens from Ethereum to a low fee environment. This made the game affordable to more users, and preceded an explosion in the game’s popularity.

As of this writing, users have moved over $7.5B from Ethereum to Ronin to play Axie Infinity.

Polygon POS

Where sidechains like Ronin are application specific, others are suited for more general purpose applications. Right now, Polygon’s proof-of-stake (POS) sidechain is the industry leader with nearly $5B in value deployed over 100 DeFi and gaming applications including familiar names like Aave and Sushiswap, as well as a Uniswap clone called Quickswap.

Again, Polygon POS really doesn’t look that different from an EVM compatible layer-1. However, it’s been built as part of a framework to scale Ethereum rather than compete with it. The Polygon team sees a future where Ethereum remains the dominant blockchain for high value transactions and value storage, while everyday transactions move to Polygon’s lower-cost blockchains. (Polygon POS also maintains a special relationship with Ethereum through a process known as checkpointing).

With transaction fees of less than a penny, Polygon’s vision of the future looks plausible. And with the help of incentive programs, users have flocked to Polygon POS with daily transactions surpassing Ethereum (though spam transactions inflate this number).

Layer 2s (Rollups)

Layer 1s and sidechains both have a distinct challenge: securing their blockchains. To do so, they must pay a new cohort of miners or proof of stake validators to verify and secure transactions, usually in the form of inflation from a base token (e.g. Polygon’s $MATIC, Avalanche’s $AVAX).

However, this brings notable downsides:

- Having a base token naturally makes your ecosystem more competitive rather than complementary to Ethereum

- Validating and securing transactions is a complex and challenging task that your network is responsible for indefinitely

Wouldn’t it be nice if we could create scalable ecosystems that borrowed from Ethereum’s security? Enter layer 2 networks, and “rollups” in particular. In a nutshell, layer 2s are independent ecosystems that sit on top of Ethereum in such a way that relies on Ethereum for security.

Critically, this means that layer 2s do not need to have a native token — so not only are they more complementary to Ethereum, they are essentially part of Ethereum. The Ethereum roadmap even pays homage to this idea by signaling that Ethereum 2.0 will be “rollup centric.”

How rollups work

Layer 2s are commonly called rollups because they “rollup” or bundle transactions together and execute them in a new environment, before sending the updated transaction data back to Ethereum. Rather than have the Ethereum network process 1,000 Uniswap transactions individually (expensive!), the computation is offloaded on a layer 2 rollup before submitting the results back to Ethereum (cheap!).

However, when results are posted back to Ethereum, how does Ethereum know that the data is correct and valid? And how can Ethereum prevent anyone from posting incorrect information? These are critical questions that differentiate the two types of rollups: Optimistic rollups, and Zero Knowledge rollups (ZK rollups).

Optimistic Rollups

When submitting results back to Ethereum, optimistic rollups “optimistically” assume that they’re valid. In other words, they let the operators of the rollup post any data they want (including potentially incorrect / fraudulent data), and just assume it’s correct — an optimistic outlook no doubt! But there are ways to fight fraud. As a check and balance, there is a window of time after any withdrawal where anyone watching can call out fraud (remember blockchains are transparent, anyone can watch what’s happening). In the event that one of these watchers can mathematically prove that fraud occurred (by submitting a fraud proof), the rollup reverts any fraudulent transactions and penalizes the bad actor and rewards the watcher (a clever incentive system!).

The drawback is a brief delay when you move funds between the rollup and Ethereum, waiting to see if any watchers catch any fraud. In some cases this can be up to a week, but we expect these delays to come down over time.

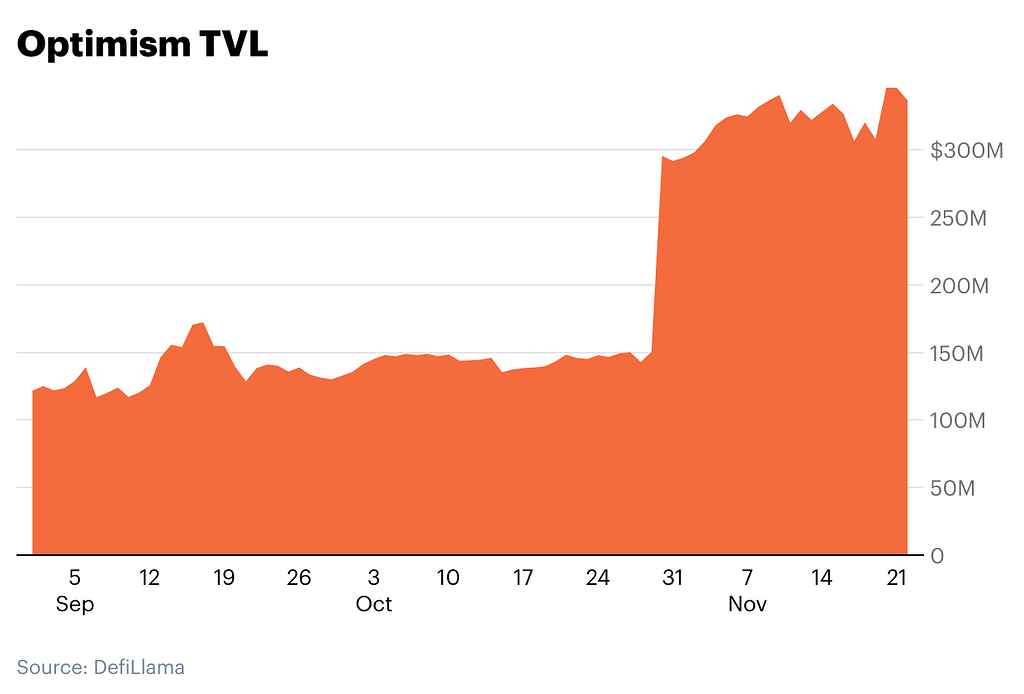

The key point is that optimistic rollups are intrinsically tied to Ethereum and ready to help Ethereum scale today. Accordingly, we’ve seen strong nascent growth with many leading DeFi projects moving to the leading optimistic rollups — Arbitrum and Optimistic Ethereum.

Arbitrum & Optimistic Ethereum

Arbitrum (by Off-chain Labs) and Optimistic Ethereum (by Optimism) are the two main projects implementing optimistic rollups today. Notably, both are still in their early stages, with both companies maintaining levels of centralized control but with plans to decentralize over time.

It’s estimated that once mature, optimistic roll ups can offer anywhere from a 10–100x improvement in scalability. Even in their early days, DeFi applications on Arbitrum and Optimism have already accrued billions in network value.

Optimism is earlier in its adoption curve with over $300M in TVL deployed across 7 DeFi applications, most notably Uniswap, Synthetix, and 1inch.

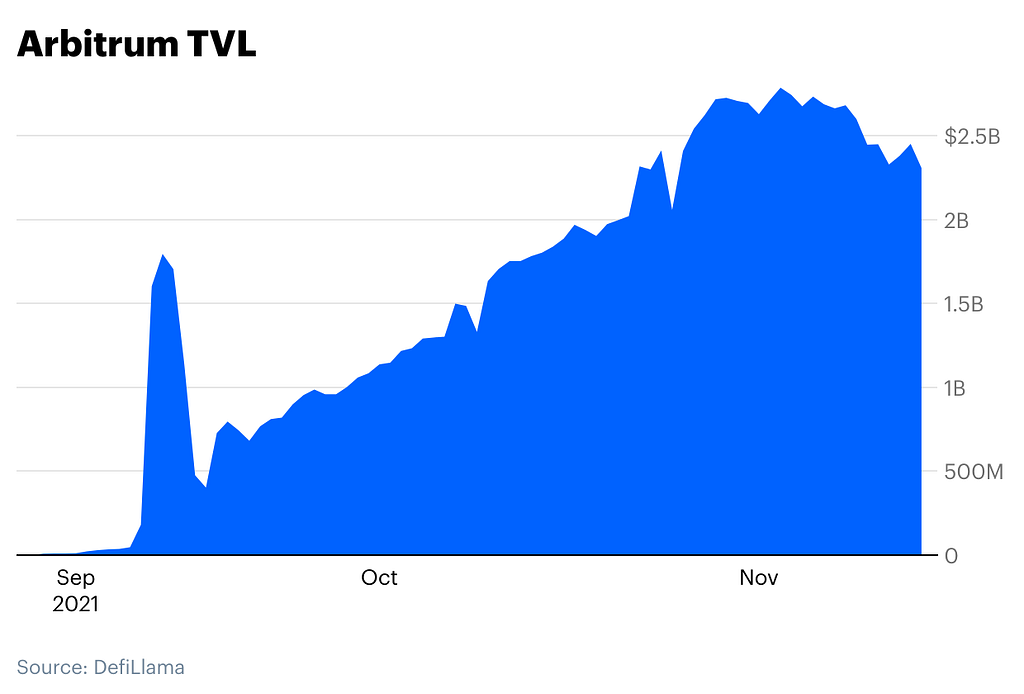

Arbitrum is further along, with around $2.5B in TVL across 60+ applications including familiar DeFi protocols like Curve, Sushiswap, and Balancer.

Arbitrum has also been selected as Reddit’s scaling solution of choice for their long awaited efforts to tokenize community points for the social media platform’s 500 million monthly active users.

ZK Rollups

Where optimistic rollups assume the transactions are valid and leave room for others to prove fraud, ZK rollups do the work of actually proving to the Ethereum network that transactions are valid.

Along with the results of the bundled transactions, they submit what’s called a validity proof to an Ethereum smart contract. As the name suggests, validity proofs let the Ethereum network verify that the transactions are valid, making it impossible for the relayer to cheat the system. This eliminates the need for a fraud proof window, so moving funds between Ethereum and ZK-rollups is effectively instant.

While instant settlement and no withdrawal times sound great, ZK rollups are not without tradeoffs. First, generating validity proofs is computationally intensive, so you need high powered machines to make them work. Second, the complexity surrounding validity proofs makes it more difficult to support EVM compatibility, limiting the types of smart contracts that can be deployed to ZK-rollups. As such, optimistic rollups have been first to market and are more capable of addressing Ethereum’s scaling woes today, but ZK-rollups may become a better technical solution in the long run.

ZK Rollup Adoption

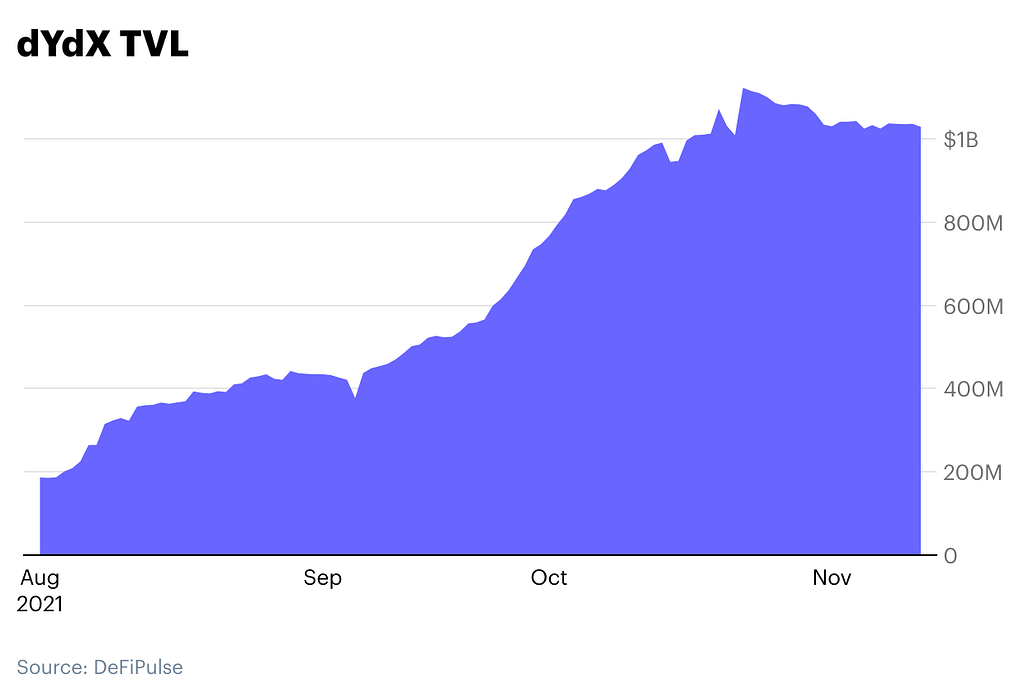

The ZK rollup landscape runs deep, with multiple teams and implementations in the works and in production. Some prominent players include Starkware, Matter Labs, Hermez, and Aztec. Today, ZK-rollups mainly support relatively simple applications such as payments or exchanges (owing to limitations on what types of applications ZK-rollups can support today). For example, derivatives exchange dYdX employs a ZK rollup solution from Starkware (StarkEx) to support nearly 5 million weekly transactions and $1B+ in TVL.

The real prize however, is ZK rollup solutions that are fully EVM compatible and thus capable of supporting popular general applications (like the full suite of DeFi apps) without the withdrawal delays of optimistic rollups. The main players in this realm are MatterLab’s zkSync 2.0, Starkware’s Starknet, Polygon Hermez’s zkEVM, and Polygon Miden, which are all currently working towards mainnet launch. (Aztec, meanwhile, is focused on applying zk proofs to privacy).

Many in the industry (Vitalik included) are looking at ZK rollups in conjunction with Ethereum 2.0 as the long term solution to scaling Ethereum, mainly stemming from their ability to fundamentally handle hundreds of thousands of transactions per second without compromising on security or decentralization.The upcoming rollouts of fully EVM compatible ZK rollups will be one of the key things to watch as the quest to scale Ethereum progresses.

A fragmenting world

In the long run, these scaling solutions are necessary if smart contract platforms are to scale to billions of users. In the near term, these solutions, however, may present significant challenges for users and crypto operators alike. Navigating from Ethereum to these networks requires using cross-chain bridges, which is complex for users and carries latent risk. For example, several cross-chain bridges have already been the target of $100+ million dollar exploits.

More importantly, the multi-chain world fragments composability and liquidity. Consider that Sushiswap is currently implemented on Ethereum, Binance Smart Chain, Avalanche, Polygon, and Arbitrum. Where Sushiswap’s liquidity was once concentrated on one network (Ethereum), it’s now spread across five different networks.

Ethereum applications have long benefited from composability — i.e. Sushiswap on Ethereum is plug-and-play with other Ethereum apps like Aave or Compound. As applications spread out to new networks, an application implemented on one layer 1/sidechain/layer 2 is no longer composable with apps implemented on another, limiting usability and creating challenges for users and developers.

An uncertain future

Will new layer 1s like Avalanche or Solana continue to grow to compete with Ethereum? Will blockchain ecosystems like Cosmos or Polkadot proliferate? Will sidechains continue to run in harmony with Ethereum, taking on its excess capacity? Or will rollups in conjunction with Ethereum 2.0 win out? No one can say for sure.

While the future is uncertain, everyone can take solace in the knowledge that there are so many smart teams dedicated to tackling the most challenging problems that open, permissionless networks face. Just as broadband ultimately helped the internet support a host of revolutionary applications like YouTube and Uber, we believe that we’ll eventually look at the winning scaling solutions in the same light.

- This post focuses on scaling smart-contract based blockchains. Bitcoin scaling is best saved for a future post.

This website does not disclose material nonpublic information pertaining to Coinbase or Coinbase Venture’s portfolio companies.

Disclaimer: The opinions expressed on this website are those of the authors who may be associated persons of Coinbase, Inc., or its affiliates (“Coinbase”) and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase. This website contains links to third-party websites or other content for information purposes only. Third-party websites are not under the control of Coinbase, and Coinbase is not responsible for their contents. The inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

Scaling Ethereum & crypto for a billion users was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments