Key Takeaways:

- YLDS being the first SEC-approved yield-bearing stablecoin provides a stable yield of 3.85% APR.

- YLDS holders can also earn interest on their holdings, with monthly payouts in either USD or YLDS.

- This approval from the SEC reflects its ever-growing acceptance of the fast-growing stablecoin market.

Figure Markets is the first U.S.-regulated firm to launch a yield-bearing stablecoin, YLDS, allowing users to earn interest on their balances. This marks a significant step in the evolving regulatory landscape for stablecoins. This indicates a possible regulatory sea change, whereby the burgeoning market for stablecoins might be viewed more favorably. However, the SEC isn’t the only jurisdiction to move to regulate stablecoins, with both the European Union and Hong Kong and Singapore making strides toward a comprehensive approach.

What is YLDS?

YLDS, a dollar-pegged stablecoin that offers an additional yield component, provides 3.85% APR to holders. The interest rate is equal to the Secured Overnight Financing Rate (SOFR), minus 0.50%. Interest compounds daily and is paid out monthly, giving users the flexibility to receive payments in either U.S. dollars or additional YLDS tokens.

Commenting on the approval, Mike Cagney, CEO of Figure Markets, said: “If I can hold this stablecoin, manage it myself, earn interest, and use it for transactions, then why do I need a bank?”. Stablecoins, like YLDS with their low transaction fees, also have the potential to introduce financial sovereignty to individuals and facilitate the movement of money domestically and internationally.

Figure’s application. Source: SEC

Administrative Roadblocks: STABLE Act

The approval of YLDS comes as the stablecoin market is booming and regulators the world over look to take steps toward regulating this new asset class. In the U.S., legislators are wrestling with a handful of regulatory themes — reserve management, transparency and integration with traditional financial systems.

A draft bill known as the STABLE Act, introduced by Republican lawmakers French Hill and Bryan Steil, aims to establish clearer regulatory guidelines for stablecoin issuers. But Timothy Massad, who served as Chairman of the Commodity Futures Trading Commission, argues that the draft is a useful beginning that nonetheless is lacking in some critical respects. He denounced it as “substantially weaker than what was negotiated between the former committee chair and the ranking member last fall.”

YLDS vs. Conventional Fixed-Income Products

At 3.85% APR, YLDS is a strong alternative to traditional fixed income products. For example, although it’s below the average high-yield savings account rate of 4.75 percent, it outpaces U.S. Treasury bonds, which currently yield about 2.89 percent on 10-year notes and an average of 3.24 percent for 30-year bonds. In today’s market, this is compelling for many, as investors’ incomes are more difficult to obtain on lower-yielding assets.

This can have a tangible impact on people’s lives, particularly retirees on fixed incomes. They need interest income to share with social security or a pension. It really depends on bond yields and interest rates on savings accounts — if they’re too low, then these people will probably have to go into their principal, which could put their long-term financial stability at risk. A marginally higher yield from YLDS or a stablecoin could allow them to sustain their standard of living without having to draw down their savings.

Effects on the Stablecoin Market

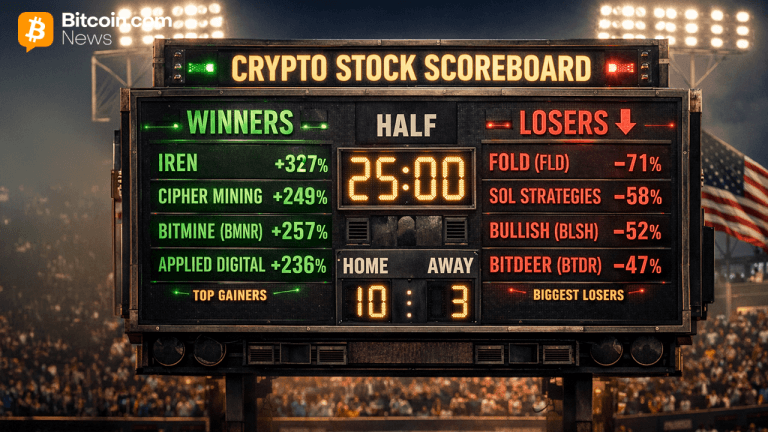

YLDS approval could lead to a domino effect throughout the stablecoin market. Reserves funds, usually U.S. Treasuries, typically do not generate yield for leading stablecoins such as USDT Tether and USDC USDC. This has led to the proliferation of tokenized money-market funds and investment vehicles such as BlackRock’s BUIDL and Franklin Templeton’s BENJI.

Yield-bearing stablecoins such as YLDS can potentially change the dynamics in play. This encourages stablecoin holders to spread their investments into yield-bearing assets that may bring new funds into crypto and limit market share of stablecoins not generating yield.

In addition, as YLDS has been classified as a security, it establishes a precedent for how regulatory bodies would address yield-bearing assets moving forward. This would hopefully pave the way for greater clarity and consistency in the regulatory framework for stablecoins, increasing investor confidence and fostering further innovation within the sector.

Potential Use Cases for YLDS

YLDS has potential use cases in exchange collateral, borderless remittances, and payment rails, according to Figure Markets. This allows for a world in which you can earn on your money whilst still being able to use a digitised form of cash in the form of a stablecoin for transactions.

Cagney said “We see tremendous applications for YLDS… Exchange collateral, cross-border remittances, and payment rails are immediate opportunities, but this is just the beginning of a larger shift of traditional finance to blockchain.”

Imagine a small business owner who frequently pays suppliers in other countries. By using YLDS, they could benefit from faster, cheaper cross-border transactions while also earning interest on their funds before making payments.

Market Reaction: Dynamic Performance Analysis

The SEC approved launch of $YLDS built by Figure on February 20, 2025. In the opening hour, $YLDS trading on DEXs exceeded 10 million $YLDS tokens compared to 2 million tokens daily average.

Just as at 1:00 PM EST, the Relative Strength Index (RSI) value for $YLDS showed up at the range of 65, meaning that the asset is still yet to reach overbought territory even after the initial rush for demand. At 12:30 PM EST, the Moving Average Convergence Divergence broke bullish on the 4 hour time frame. AI-driven trading algorithms could also use the new arbitrage potential, suggesting a 5% increase in trading volumes of AI-driven trading platforms since the $YLDS announcement.

More News: SEC Approves Bitcoin-Ether ETFs for Hashdex and Franklin Templeton

Current Competition and Future Outlook

The first US company to obtain SEC approval for a yield-bearing stablecoin, Figure Markets is not the only one making such a move. Reeve Collins, a co-founder of Tether, has announced plans for the launch of an interest-yielding decentralized stablecoin in the second half of the year, which has turned new doors of opportunity for stablecoin users.

The approval of YLDS is a significant milestone in the stablecoin sector. It creates a new class of interest-bearing digital assets, which could appeal to institutional investors looking for nonvolatile returns. This mini-ecosystem is a catalyst for further innovation in the sector, as it incentivizes more companies to experiment with yield-bearing stablecoins! The continued evolution of regulatory frameworks and increased investor demand will pave the way for more such assets to be created that will help shape the future of finance and usher in a new era of crypto adoption.

The post SEC Approves First Yield-Bearing Stablecoin: Great for Crypto? appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments