Recently, Elizabeth Warren and other senators have sent letters to Treasury and IRS officials demanding they pass regulation to close the supposed "$50 billion" tax gap present in crypto. After working within the crypto tax space the last 5 years at CoinLedger, I can tell you this number is unbelievably ridiculous and completely made up. Here is why 1099 information reporting (which Senator Warren is urging) will not solve crypto tax problems:

Form 1099-B // 1099-DA Is Not the Solution To Cryptocurrency Tax Problems

With the passage of the American Infrastructure Bill two years ago, “crypto brokers” (i.e. cryptocurrency exchanges and other third parties that facilitate the transfer of digital assets) will be required to report customer’s cryptocurrency transactions to the IRS and taxpayers via Form 1099-B in the future.

Form 1099-B is being framed as a “solution” to your crypto tax problems by regulators and financially incentivized market participants.

Unfortunately, this couldn’t be further from the truth.

The rollout of Form 1099-B among America’s largest cryptocurrency exchanges will create one of the biggest tax headaches for cryptocurrency users you’ve ever seen.

What is Form 1099-B?

1099 information reporting has existed for a long time in the ‘traditional’ financial world, and all 1099 reporting serves the same general purpose: to report non-employment related income to the IRS – i.e. income earned outside of a W2.

1099-B is a specific type of 1099 that reports capital gains and losses from securities or property involved in a transaction handled by a broker.

Some examples of brokers you may be familiar with from the traditional finance world include eTrade, Charles Schwab and Robinhood. These securities brokers are required to send you and the IRS a copy of your 1099-B at the end of each year reporting your cost basis, proceeds, and associated gains or losses from each of your transactions that occurred on the broker’s platform. (“Cost basis” refers to the original value of an asset or investment for tax purposes.)

You as the taxpayer use this 1099-B to report your capital gains or losses on your taxes, and the IRS uses it to verify that you reported the correct amount of income.

Why are things different for crypto-brokers?

At first glance, it makes sense for regulators to want the same 1099 requirements for Coinbase and Kraken as Charles Schwab and Robinhood..

Both platforms broker the sale or exchange of capital assets that result in capital gain income.

But, from a technical perspective, cryptocurrency and digital assets operate completely differently than equities. It’s this fundamental difference that makes 1099-B a poor solution for crypto transaction reporting, and it’s this difference that is going to lead to immense pain for taxpayers as 1099-B reporting gets rolled out across all major U.S. cryptocurrency exchanges in the years to come.

Digital assets and cryptocurrencies are interoperable

Unlike equities, cryptocurrencies and digital assets are built to be interoperable. This is fundamental to the technology underpinning them – blockchains.

The interoperability enabled by blockchains is what enables a crypto user to freely send digital assets from one wallet to another, without the need for a third-party to “validate” or “facilitate” the transaction.

This is one of the huge technological breakthroughs of blockchains. The cost associated with running third-party entities to be middlemen for “transferring value” can now be removed, and those economic resources can be deployed more efficiently across the economy.

Peer-to-peer interoperability is a massive technical breakthrough.

Unfortunately, it’s this interoperability that makes 1099-B a terrible solution for tax information reporting for cryptocurrency exchanges.

Cryptocurrency exchanges don’t have cost basis information

Because you can send cryptocurrencies and digital assets freely into or out of your cryptocurrency exchange from any wallet, exchanges won’t always have the cost basis information for your digital assets held on their platform.

Remember, digital assets like bitcoin know no physical boundaries. You can freely send your bitcoin or eth from a wallet that you self-custody, into your exchange of choice, without friction.

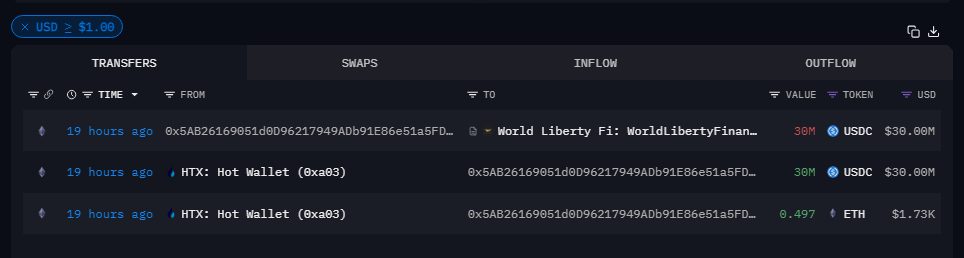

These wallet-wallet digital asset transfers happen millions of times every single day.

As a result, when you transfer your cryptocurrency assets into your exchange of choice, your exchange typically does not know the original cost basis for that cryptocurrency .

This is critical to understand. If your cryptocurrency exchange accepts wallet transfers into its platform, your exchange will not always be able to fully complete a 1099-B for you, as it’s missing a critical component for reporting: cost basis.

Let’s look at an example

Say you buy 1 Bitcoin for $20,000 from Cryptocurrency Exchange A. Immediately after the purchase, you send it to your self-custodied wallet for safe-keeping. Months later, after bitcoin has skyrocketed in price, you decide it’s time to sell, so you send your bitcoin from your self-custodied wallet to your other exchange, Cryptocurrency Exchange B, and sell it for $50,000.

In this simplistic example, Cryptocurrency Exchange B has no idea that your cost basis for your 1 Bitcoin is $20,000. Cryptocurrency Exchange B only sees a transfer of 1 bitcoin into its platform from a third-party wallet and a sale of this BTC for $50,000.

With the passage of the American Infrastructure Bill, Cryptocurrency Exchange B will be required to report this disposal of BTC on a 1099-B to the IRS. However, it will be reported with a blank, or null, cost basis field:

- Proceeds: $50,000

- Cost basis: UNKNOWN

- Gain: …. $50,000 ?

When the IRS receives a copy of this 1099-B, they will see that you sold $50,000 of bitcoin on Cryptocurrency Exchange B. However, they will not be able to see that your true capital gains for this transaction were actually only $30,000, and it will be up to you to prove to them that your cost basis was indeed $20,000. If you can’t prove it, you could be stuck with a zero-dollar cost basis and face a $50,000 capital gain tax bill.

This of course is going to happen at scale, for millions of taxpayers, with millions of 1099-Bs, all with blank or unknown cost basis fields.

Cost basis transfer reporting

I know what you’re thinking.

“We should just require exchanges to report cost basis information to each other whenever customers transfer digital assets to and from their platform! That’s how it works for equity brokers!”

Naturally, this is exactly how the regulators see the issue, and this is why a component of this new legislation for cryptocurrency brokers requires exactly that: cryptocurrency brokers to report cost basis information to each other.

However, this approach does not solve the fundamental problem.

Remember, at their core, cryptocurrencies and digital assets operate in a completely decentralized fashion – very different from equities. They don’t depend on centralized third-party companies to exist or operate. Yes, many centralized companies (crypto exchanges) have popped up to make it easier for users to interact with blockchains themselves, but these centralized exchanges are not the only players in this market.

The ecosystem consists of thousands of decentralized wallets, protocols, NFT marketplaces, and other applications that enable users to interact with these same blockchains – whether using a centralized third-party or not.

For 1099-B reporting to be truly effective (in the way that it is effective for traditional equities brokers), cryptocurrency brokers would have to operate in a silo’d, walled-garden fashion. They wouldn’t be able to allow transfers into or out of their platforms if the counterparty couldn’t pass along or store sensitive customer data for them. If they did, they wouldn’t be able to accurately report cost basis and thus gains/losses to users.

Is Coinbase going to shut down the ability for its users to accept wallet deposits from DeFi protocols, self-custodied wallets, DAOs and other decentralized market participants that don’t have the ability to report a user’s cost basis, name, address, and social security number upon a transfer into a Coinbase custodied wallet?

Given its mission of enabling an open financial system, I hope not.

Next steps

1099-B is not the solution for cryptocurrency tax reporting.

Financially-incentivized market participants that have raised hundreds of millions of dollars of venture capital will try to convince you that it is, but alas, it is not.

Digital assets will continue to operate in an open and decentralized fashion whether or not regulators force the hand of America’s largest cryptocurrency brokers. The genie is out of the bottle, and decentralized applications used by millions of people all over the world are only going to become more developed in the years ahead.

So, instead of enforcing 1099 reporting that was developed for a completely different asset-class, what if we came up with new, more sensible rules?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments