It's time to start stacking bitcoin again. That's the message from indicators tracking tokens sold by miners and comparing the cryptocurrency's market value to its fair value.

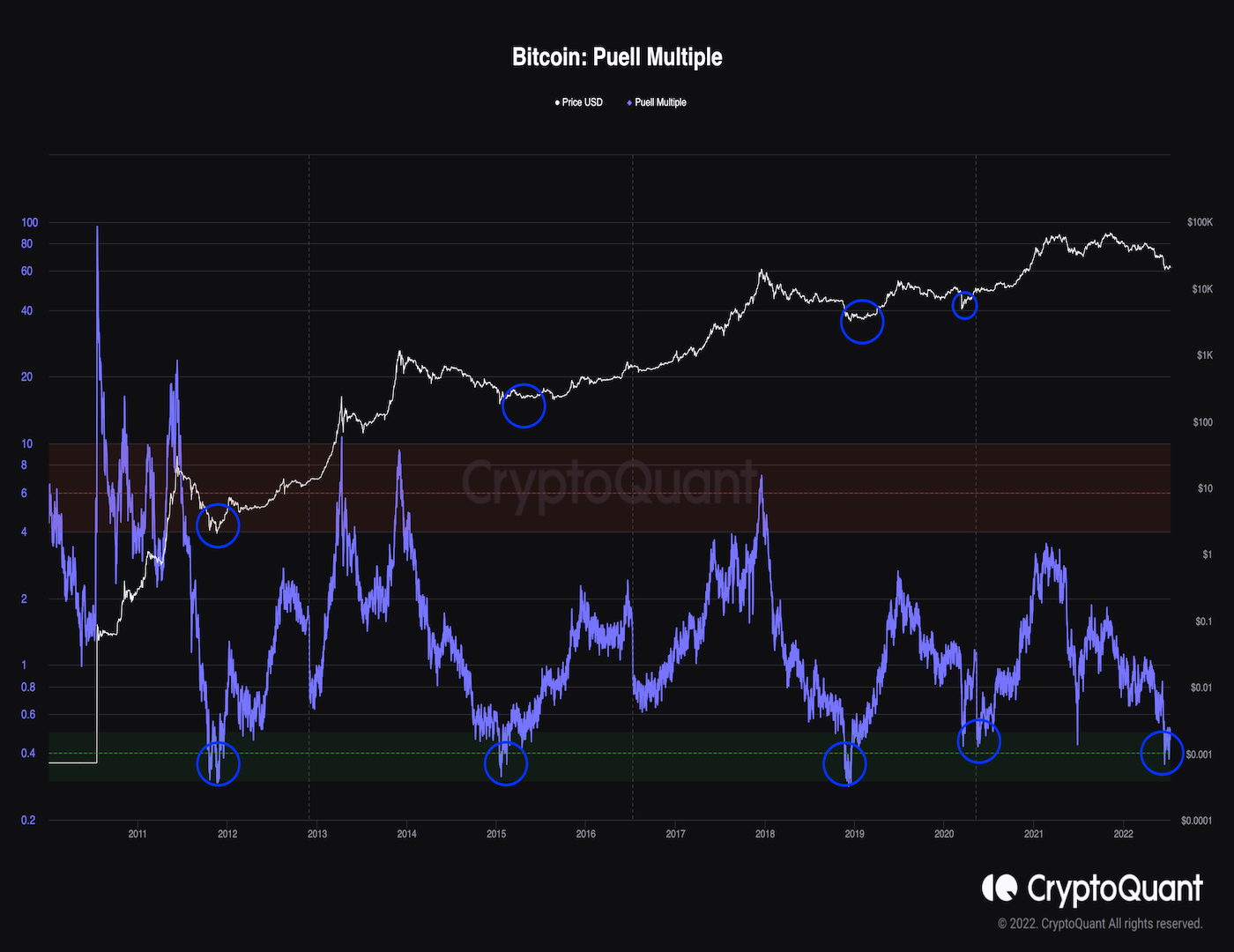

The Puell Multiple, calculated by dividing the daily issuance of bitcoins in U.S. dollar terms by the 365-day average of the value, has dropped into a "green zone" below 0.5, indicating the newly minted coins are undervalued relative to the yearly average.

In other words, the current profitability of those responsible for minting coins is relatively low. In the past, that's indicated a perfect opportunity to build long-term exposure to the cryptocurrency.

"Entering the green zone is a good time to average in, and for those more conservative, you can also wait for confirmation with a move out of the accumulation zone," analysts at Blockware Intelligence said in a newsletter published on Sunday.

The daily issuance refers to coins added to the ecosystem by miners, who receive them as rewards for verifying a new block of bitcoin transactions. Recently, many miners have reduced their crypto holdings to stay afloat as the value of the reward has fallen.

Undervalued readings on the Puell Multiple have marked previous bear market bottoms.

"The Puell Multiple has reached a territory consistent with market bottoms in the past (below 0.5 and even touching levels below 0.4 a few weeks ago)," said Julio Moreno, a senior analyst at South Korea-based blockchain data from CryptoQuant.

The Puell Multiple has dropped into the green zone between 0.3 to 0.5, signaling the undervaluation of new coins. (CryptoQuant)

Previous sub-0.5 readings observed between March 2020 and May 2020, November 2018 and January 2019, November 2014 and April 2015 and during the final quarter of 2011 coincided with peak selling and bear market bottoms. While China's mining ban in June 2021 perhaps distorted the indicator, it still coincided with a market bottom.

Essentially, the metric entered the green zone in the last leg of the bear market, following which the downward momentum weakened, allowing for weeks of price consolidation and a subsequent revival.

One question is whether signals from miner flows are reliable, given the sales now constitute a only small portion of overall flows. "If all newly issued bitcoin were immediately sold on the market each day, it would equate to only 900 BTC of selling pressure, which represents just 1%-1.5% of total daily volume," crypto exchange Coinbase said in a recent research report.

Analysts, however, retain confidence in the multiple's predictive powers. "Mining is still the backbone of the network, whether the portion [of miner flows] is small or not. This is why the metric gets higher importance in our opinion, irrespective of narratives. The metric is not invalidated yet," cryptocurrency intelligence firm Jarvis Labs told CoinDesk.

CryptoQuant's Moreno said, "Miner flows continue to represent an important volume of bitcoin flowing to exchanges, and the Puell multiple is calculated using the USD value of new bitcoin issued, which is higher on average than it was in 2018 or 2014-15."

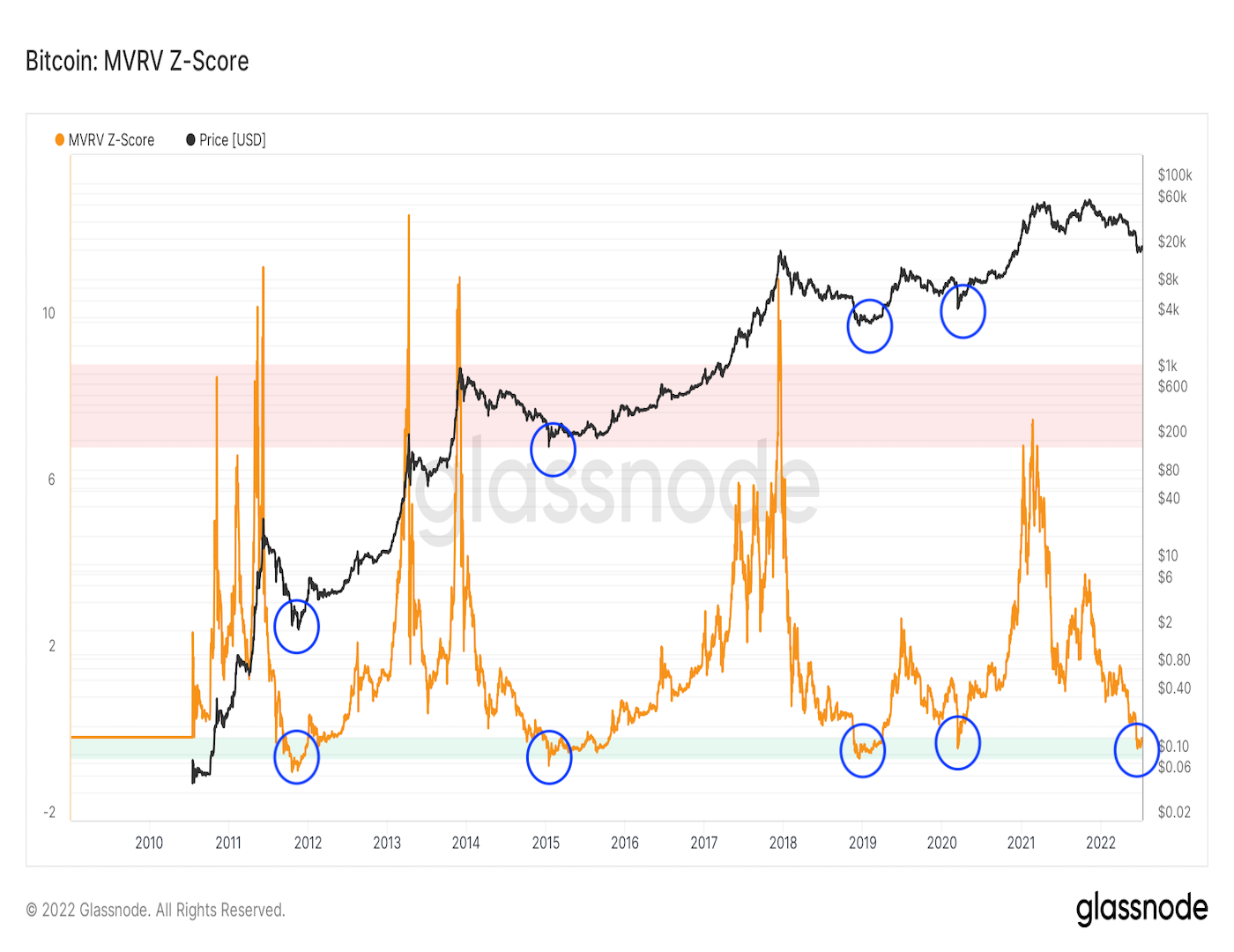

Indicators including the market value to realized value (MVRV) Z-score and long-term moving average crossovers also indicate the time is ripe for accumulation.

The MVRV Z-score, which measures the deviation of market value from realized value and is another indication of undervaluation, turned negative in mid-June.

Bitcoin's market value or capitalization refers to the total dollar value of the supply in circulation, as calculated by the daily average price across major exchanges. The realized value approximates the value paid for all coins in existence by summing the market value of coins at the time they last moved on the blockchain.

The realized value adjusts for lost coins and is closer to the fair value of the cryptocurrency. Therefore, the Z-score representing the deviation of market value from the realized or fair value and is tracked to gauge whether the cryptocurrency is undervalued or overvalued.

Historically, an MVRV Z-score below zero has marked bear market lows, while a reading above seven has marked major bull market tops.

Bitcoin was last trading near $20,400, down 1% on the day. The cryptocurrency has dropped 55% this year, according to CoinDesk data.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments