Maker

Maker

MKR is a cryptocurrency depicted as a smart contract platform and works alongside the Dai coin and aims to act as a hedge currency that provides traders with a stable alternative to the majority of coins currently available on the market. Maker offers a transparent stablecoin system that is fully inspectable on the Ethereum blockchain. Founded almost three years ago, MakerDao is lead by Rune Christensen, its CEO and founder. Maker’s MKR coin is a recent entrant to the market and is not a well known project. However, after today it will be known by many more people after blowing up 40% and it is one of the coins to rise to prominence during the recent peaks and troughs.

After being developed by the MakerDAO team, Maker Dai officially went live on December 18th, 2017. Dai is a price stable coin that is suitable for payments, savings, or collateral and provides cryptocurrency traders with increased options concerning opening and closing positions. Dai lives completely on the blockchain chain with its stability unmediated by the legal system or trusted counterparties and helps facilitate trading while staying entirely in the world of cryptocurrencies. The concept of a stablecoin is fairly straight forward – it’s a token that has its price or value pegged to a particular fiat currency. A stablecoin is a token (like Bitcoin and Ethereum) that exists on a blockchain, but unlike Bitcoin or Ethereum, Dai has no volatility.

MKR is an ERC-20 token on the Ethereum blockchain and can not be mined. It’s instead created/destroyed in response to DAI price fluctuations in order to keep it hovering around $1 USD. MKR is used to pay transaction fees on the Maker system, and it collateralizes the system. Holding MKR comes with voting rights within Maker’s continuous approval voting system. Bad governance devalues MKR tokens, so MKR holders are incentivized to vote for the good of the entire system. It’s a fully decentralized and democratic structure, then, which is an underutilized USP of blockchain tech.

Value volatility is a relative concept among both cryptos and fiat currencies. The US dollar, for example, was worth 110.748 yen on July 9, 2018. On July 4, 2011, $1 was worth 80.64 yen, and on March 18, 1985, $1 was worth 255.65 yen. These are major differences in exchange rates, and inflation within each country makes each currency worth different values even when compared to themselves. One USD in 1913 is worth the equivalent of $25.41 today, and even $1 in 1993 is worth the equivalent of $1.74 today. Stablecoins don’t negate these basic economic principles of value. Instead, both Tether and Dai have values pegged to the U.S. dollar. This is done to stabilize the price.

Cryptocoins News / CoinJournal - 2 years ago

Regulating the decentralised finance (DeFi) space and the broader crypto market remains tough for regulators, and Sam Bankman-Fried has now warned against locking in decisions that could impact the space.

Sam Bankman-Fried, the CEO of FTX crypto exc...

Bitcoin News / Bitcoin.com - 2 years ago

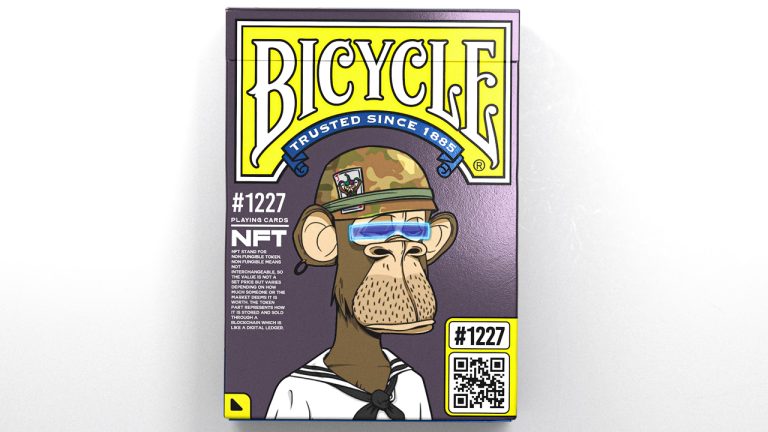

Last year, when the non-fungible token (NFT) industry was frothing over, the 137-year-old playing card manufacturer Bicycle issued NFTs called the Genesis Collection and in June, Bicycle purchased Bored Ape Yacht Club #1,227. Bicycle and parent compa...

Cryptocoins News / The Cointelegraph - 2 years ago

During her visit to the United States, the official highlighted the importance of a truly global regulatory effort. While the European Union proceeds with smoothly pa...

Cryptocoins News / Blockchain - 2 years ago

The total value locked (TVL) in DeFi rebonds to approximately $54 billion currently. The TVL has been down since October 12, trading between $53.7 and $53.29 billion level. (Read More)

Cryptocoins News / NewsBTC - 2 years ago

MKR’s price shows strength as the price breaks out of a downtrend with good volume with eyes set on $1,200.

MKR bounced from a low of $600 as the price rallied to a high of $1,000, preparing for a rally as the price eyes $1,200 key resistan...

Cryptocoins News / NewsBTC - 2 years ago

For the first time since 2020, MakeDAO has crashed in its quarterly net income. The DAO is the autonomous community that governs the Maker Protocol. The project is based on the Ethereum blockchain and supports the lending and borrowing of crypto asse...

Bitcoin News / Google News Bitcoin - 2 years ago

US Lawmaker Calls on SEC to Issue Crypto Regulations — Says 'a Formal Regulatory Process Is Needed Now' – Regulation Bitcoin News& & Bitcoin News

Bitcoin News / Bitcoin.com - 2 years ago

A U.S. senator has called on the Securities and Exchange Commission (SEC) to issue crypto regulations now “through a transparent notice-and-comment regulatory process.” He stressed that “some digital assets are securities, others ma...

Cryptocoins News / The Cointelegraph - 2 years ago

Messari research shows MakerDAO has experienced its first quarter of net income loss since 2020 following a huge fall in loan demand and few liquidations. MakerDAO, th...

Cryptocoins News / The Cointelegraph - 2 years ago

Senator Hickenlooper requested the SEC engage with the public by opening a “notice-and-comment period” to develop rules and regulations applicable to crypto. John Hick...

Bitcoin News / Bitcoin.com - 2 years ago

A number of Democratic U.S. policymakers have written a letter to the CEO of the Electric Reliability Council of Texas (ERCOT) in order to inquire about the cryptocurrency mining operations in the state. The letter that stems from senator Elizabeth W...

Cryptocoins News / Blockchain - 2 years ago

GSR, a prominent market maker and liquidity provider in the industry, has unemployed less than 10% of its staff during Q3 this year. (Read More)

Cryptocoins Exchanges / Binance - 2 years ago

The identical query about takeprofit, are they taking fees as maker or taker? submitted by /u/pon4ellos [link] [comments]

Cryptocoins News / The Cointelegraph - 2 years ago

$500 million of the funds currently collateralizing the Dai stablecoin will be reallocated to U.S. Treasurys and corporate bonds in an effort to provide the protocol low-risk additional y...

Cryptocoins News / Blockchain - 2 years ago

The move is an attempt by MakerDAO to diversify its holdings by allocating $500 million for investment in U.S. short treasuries and corporate bonds. (Read More)

Bitcoin News / Bitcoin.com - 2 years ago

Members of the European Parliament have called for “effective taxation” of crypto assets and “better use of blockchain” to counteract tax evasion. A resolution aiming to achieve both objectives has been app...

Cryptocoins News / EthereumWorldNews - 2 years ago

Summary:

MakerDAO will tap digital bank Sygnum for its diversification effort.This comes after the community voted to deploy excess funds and non-yield-bearing assets from Maker’s treasury into external investment vehicles.Majority of the...

Cryptocoins News / The Cointelegraph - 2 years ago

The House members claimed the “appropriate place for the discussion” on legislation concerning a digital dollar would be in the U.S. legislative branch. Republican mem...

Bitcoin News / Bitcoin.com - 2 years ago

Jared Huffman, a United States lawmaker who advocates for increased scrutiny of crypto-mining entities, has reportedly chastised U.S. energy agencies that he accuses of failing to act on the White House’s call on them to do “reliabi...

Cryptocoins News / Blockchain - 2 years ago

The European Parliament has voted in favour of leveraging blockchain technology for tax compliance, with a majority of 566 out of 620 members backing the motion. (Read More)

Cryptocoins News / NewsBTC - 2 years ago

Despite the general bearish trend in the cryptocurrency market at the moment, the Maker token continues to thrive. Maker is currently trading at $811.28 today. It represents an increase of up to 5.72% in the last day.

Despite positive moves in the l...

Cryptocoins News / The Cointelegraph - 2 years ago

“The report recommends the passage of legislation in providing a rulemaking authority for federal financial regulators over this market,” said economist Jonathan Rose....