Maker

Maker

MKR is a cryptocurrency depicted as a smart contract platform and works alongside the Dai coin and aims to act as a hedge currency that provides traders with a stable alternative to the majority of coins currently available on the market. Maker offers a transparent stablecoin system that is fully inspectable on the Ethereum blockchain. Founded almost three years ago, MakerDao is lead by Rune Christensen, its CEO and founder. Maker’s MKR coin is a recent entrant to the market and is not a well known project. However, after today it will be known by many more people after blowing up 40% and it is one of the coins to rise to prominence during the recent peaks and troughs.

After being developed by the MakerDAO team, Maker Dai officially went live on December 18th, 2017. Dai is a price stable coin that is suitable for payments, savings, or collateral and provides cryptocurrency traders with increased options concerning opening and closing positions. Dai lives completely on the blockchain chain with its stability unmediated by the legal system or trusted counterparties and helps facilitate trading while staying entirely in the world of cryptocurrencies. The concept of a stablecoin is fairly straight forward – it’s a token that has its price or value pegged to a particular fiat currency. A stablecoin is a token (like Bitcoin and Ethereum) that exists on a blockchain, but unlike Bitcoin or Ethereum, Dai has no volatility.

MKR is an ERC-20 token on the Ethereum blockchain and can not be mined. It’s instead created/destroyed in response to DAI price fluctuations in order to keep it hovering around $1 USD. MKR is used to pay transaction fees on the Maker system, and it collateralizes the system. Holding MKR comes with voting rights within Maker’s continuous approval voting system. Bad governance devalues MKR tokens, so MKR holders are incentivized to vote for the good of the entire system. It’s a fully decentralized and democratic structure, then, which is an underutilized USP of blockchain tech.

Value volatility is a relative concept among both cryptos and fiat currencies. The US dollar, for example, was worth 110.748 yen on July 9, 2018. On July 4, 2011, $1 was worth 80.64 yen, and on March 18, 1985, $1 was worth 255.65 yen. These are major differences in exchange rates, and inflation within each country makes each currency worth different values even when compared to themselves. One USD in 1913 is worth the equivalent of $25.41 today, and even $1 in 1993 is worth the equivalent of $1.74 today. Stablecoins don’t negate these basic economic principles of value. Instead, both Tether and Dai have values pegged to the U.S. dollar. This is done to stabilize the price.

Bitcoin News / Bitcoin Magazine - 2 years ago

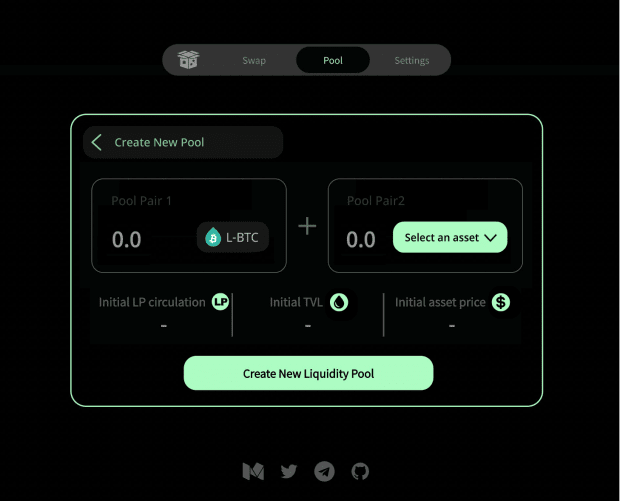

The automated protocol will launch with new features allowing bitcoiners to create their own liquidity pools, fees, and perform trustless swaps.Bitmatrix, an automated market maker (AMM) protocol, has released its mainnet beta which will allow bitcoi...

Bitcoin News / Google News Bitcoin - 2 years ago

Bitcoin, Binance Coin, Maker, and Fantom Daily Price Analyses – 21 September Morning Price Prediction& & Cryptopolitan

Cryptocoins News / The Cointelegraph - 2 years ago

The CEO of Wintermute has stated that it is “open” to treating the hack as a white hat hack and would speak to the attacker. Wintermute, a cryptocurrency market maker...

Cryptocoins News / The Cointelegraph - 2 years ago

The CEO of Wintermute has stated that they are “open” to treating the hack as a white hat hack and would speak to the attacker. Wintermute, a cryptocurrency market mak...

Cryptocoins News / Finance Magnates - 2 years ago

<p>Wintermute, a cryptocurrency market maker, has become the latest victim of hackers as $160 million worth of digital currencies were siphoned from its decentralized finance (DeFi) operations.</p><p>The Founder and CEO, Evgeny Gaev...

Cryptocoins News / EthereumWorldNews - 2 years ago

Summary:

Senator Andrew Bragg proposed a crypto bill to facilitate tight disclosure requirements.The bill targets China’s Digital Yuan as Beijing tests cross-border utility for the central bank’s digital currency.Nine U.S. lawmakers a...

Bitcoin News / Bitcoinist - 2 years ago

Two former executives of the leading investor in the world’s financial markets, Citadel Securities, Leonard Lancia and Alex Casimo have raised $50 million for their own crypto market maker. The company also plans to invest in crypto assets via...

Cryptocoins Exchanges / Binance - 2 years ago

The zero maker payment promotion will apply to all spot and margin BUSD buying and selling pairs. The promotion does NOT apply to all BUSD-Margined Futures Contracts on Binance Does the second level imply it does apply to some futures contracts? I...

Bitcoin News / Bitcoin.com - 2 years ago

Russian companies may start transacting in cryptocurrency with partners abroad as early as next year and will be free to pick the coin they want to use, officials in Moscow have indicated. The sanctioned country is preparing to legalize foreign trade...

Cryptocoins News / Blockchain - 2 years ago

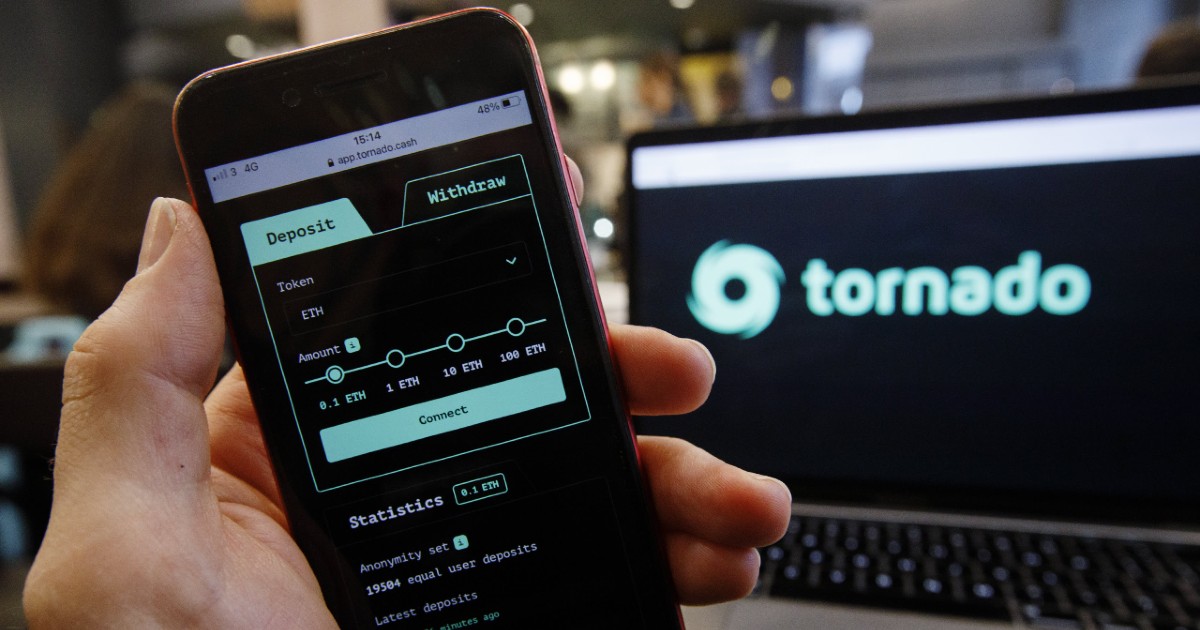

Blockchain Security Company PeckShield and Crypto Security Specialist, CertiK have announced that a hacker laundered $500, 000 DAI stablecoins via Tornado Cash (Read More)

Bitcoin News / Bitcoin.com - 2 years ago

On September 8, the crypto security and smart contract auditing firm Certik revealed that 500,000 DAI was sent through the Tornado Cash mixing platform after the funds were stolen in August 2021. The digital assets originally stemmed from the DAO Mak...

Cryptocoins News / The Cointelegraph - 2 years ago

A Federal Trade Commission report from June identified Facebook, Instagram and WhatsApp among the top platforms for crypto fraud originating on social media. A group o...

Bitcoin News / Bitcoin.com - 2 years ago

A high-ranking member of the Russian parliament has urged for the adoption of a relevant legal framework to properly regulate cross-border crypto payments. His proposal comes after key regulators in Moscow said that Russia needs to allow the use of c...

Cryptocoins News / The Cointelegraph - 2 years ago

The House members asked for clarification on whether the Fed may be considering an “intermediated model” for a digital dollar that could require authorization from Congress....

More / Etherum Reddit - 2 years ago

Uniswap uses x * y = k where x and y represents the quantity of each token. I can understand that when a trader is trading token A against token B, the formula determines the price (rate) as it ensures k value remains the same. But when a liquidity p...

Bitcoin News / Google News Bitcoin - 2 years ago

US Lawmaker Says 'Too Much Money and Power' Behind Crypto to Ban It – Regulation Bitcoin News& & Bitcoin News

Bitcoin News / Bitcoin.com - 2 years ago

U.S. Representative Brad Sherman says Congress has not banned crypto because “there’s too much money and power behind it.” He elaborated: “Money for lobbying and money for campaign contributions works, or peopl...

by COINS NEWS - 2 years ago

I'll try to explain in short as possible according to my understanding. The cryptocurrency trading platform MEXC introduced 0 maker fee rate offering for all spot trading users from since August 31st. Binance, Bybit and few other cryptocur...