Sweeping across the shores of Latin America comes a scheme from some of the most predatory figures in the venture capital ecosystem of the United States. It is a brazen attempt to assert foreign influence across Latin America and threatens to reshape the very fabric of the region and the day to day lives of its people. At its core is a serpentine set of contractual obligations, held at the municipal level, cast throughout Central and South America, upheld by an intelligence-linked satellite company, and controlled by a private sector consortium of green-washed financiers aiming to turn the region’s forests into equity and carbon credits. At the same time, it obliges local governments to spend “conservation” funds on projects that further financialize nature and aid the construction of an inter-continental “smart” grid. One of its key ambitions appears to be further entrenching the debt load of the region through the multi-lateral development banks and the dollarization of the continent from the subnational level up through carbon markets upheld by a digital ledger. What seems like a technological marvel aimed at progress and connectivity harbors a darker agenda — one that intertwines planetary surveillance, financial predation, geopolitical maneuvering, and the domination of a resource-rich continent buried in debt.

This grand design, known by the acronym GREEN+ and conceived by stalwarts of the digital dollar and debt schemes of the private sector, has quietly taken root through a web of political entanglements at the local level. Even a key figure in the Drexel Burnham Lambert junk bond scandal plays a role. Astonishingly, every capital city of Latin America has eagerly signed on, apparently unaware of the strings attached to these seemingly benign partnerships, while a majority of municipalities in the region have also made commitments with these same groups that will push them to join GREEN+, potentially in a matter of weeks. The (hopefully) well-meaning regional governments have unwittingly paved the way for a sweeping surveillance apparatus tied to American intelligence that threatens to erode privacy and civil liberties under the guise of progress and combating the climate crisis.

Upon further observation, GREEN+'s connections reveal a disturbing narrative of financial interests melding with geopolitical ambitions. The backers of the satellite company share ties with former members of the highest offices of US financial policy and regulation alongside the key architects and profiteers of private capital creation, aiming to consolidate control over monetary flows in Latin America within the redistribution of distressed government debt from the public to the private sector. As this two-part series will show, this concerted effort is not merely about surveillance – it's a calculated move towards further dollarization, tightening the grip of corporate and technological monopolies over the economic landscape of the Americas.

The scheme's proponents also speak of how it will significantly advance the "economic" and "regional" integration of the Americas, invoking visions of unity while obscuring the true nature of their agenda for economic domination and stronger regional governance. Their model, eerily reminiscent of the EU's transition from a free trade union to a bureaucratic behemoth yoked to the US through the Eurodollar, sets the stage for unelected entities to enforce policies through programmable money, enabled by smart contracts on blockchains and designed to benefit the few at the expense of the many. What materializes before us is not just a technological evolution but a quiet banker coup — one that lays the groundwork for land grabs and invasive surveillance under the guise of progress and conservation. It's a narrative that echoes throughout history, where intelligence-linked figures and predatory financial interests converge to prey upon the Global South, leaving a trail of economic exploitation and geopolitical manipulation in their wake. What masquerades as progress for individuals and the environment at large may very well be the harbinger of a new era of subjugation and control.

The GREEN+ Program

In 2022, several groups came together to launch the GREEN+ (Government Reduction of Emissions for Environmental Net + Gain) Jurisdictional Programme, the “first program that will monitor by satellite all subnational protected areas of the planet” and – through contracts with numerous local and state governments – propel and deepen the economic integration of the Americas through the quiet imposition of a continent-wide, blockchain-based carbon market.

GREEN+ has been piloted in a handful of Latin American cities since its founding and is due to launch globally in just a few weeks time. Most of the GREEN+ agreements with “subnational” governments have remained focused on Latin America. Per the program, the subnational agreements have established the “rules and requirements to enable accounting and crediting with GREEN+ policies and measures and/or nested projects, implemented as GHG mitigation activities,” with GREEN+ being described as “the planet's new subnational government advisory mechanism.”

Key to the program are the services provided by GREEN+ founding member Satellogic, an Argentina-founded company closely aligned with Peter Thiel’s Palantir and Elon Musk’s SpaceX that specializes in sub-meter resolution satellite surveillance. Satellogic, a contractor to the US government and whose founders were also previously contactors for the US’ DHS, NSA and DARPA, will provide surveillance data of the entire world’s “protected areas” to GREEN+’s governing coalition, composed of the NGOs CC35, the Global Footprint Network, The Energy Coalition and other “respected stakeholders.”

According to the press release that details Satellogic’s alliance with GREEN+, the satellite surveillance data “will enable individuals, organizations, and global markets to accurately monitor the compliance of signatory jurisdictions to avoid deforestation.” However, other information in the press release reveals that forests will actually be monitored for the purpose of generating “credible” carbon credits to be traded on exchanges by GREEN+ on behalf of subnational governments. The press release also states that the GREEN+ alliance with Satellogic will “advance the future measurement of energy emissions in the most populated areas of the planet,” i.e. the surveillance of carbon emissions from space. Satellogic launched some GREEN+-affiliated satellites in 2022 as part of its pilot and is due to launch the remainder this April during Miami Climate Week. Satellogic’s past and upcoming launches of GREEN+ satellites were/will be conducted in collaboration with Elon Musk’s SpaceX, also a contractor to the US military and US intelligence agencies.

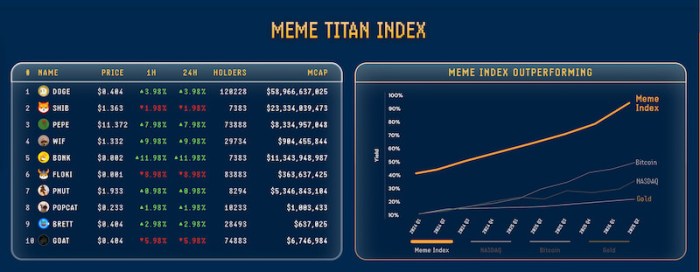

Though framed as a way to develop economic incentives to mitigate climate change, the program is based on California’s controversial and grift-prone cap and trade program and has been created (and is being implemented by) individuals and companies that are seeking to covertly dollarize Latin America and/or have deep ties to US intelligence. Its ultimate ambitions go far beyond carbon markets and seek to use satellite surveillance to enforce carbon emission levels in both urban and rural areas. It also seeks to impose a new financial system centered around energy, commodity, and natural resource “credits” that are underpinned by extensive and invasive surveillance, underscored by the motto: “Earth observation is preservation.”

The alliance that created GREEN+ includes the NGOs CC35, the Global Footprint Network (GFN), Arnold Schwarzenegger’s Catalytic Finance Foundation (CFF, formerly R20) and The Energy Coalition (TEC); the Gibraltar-based law firm Isolas; the global insurance giant Lockton; the satellite company Satellogic; the “green” blockchain company EcoRegistry; the dominant carbon credit certifier in Latin America, Cercarbono; and Rootstock (RSK), the bitcoin side-chain protocol responsible for “smart BTC.” Several members of the alliance, though how many is unclear, now operate as part of a consortium linked to a company called Global Carbon Parks, which is discussed in greater detail later in this article and now manages major aspects of GREEN+. The NGOs (i.e. CC35, GFN, CFF and TEC) involved in founding GREEN+ are those who actually govern the GREEN+ program from California.

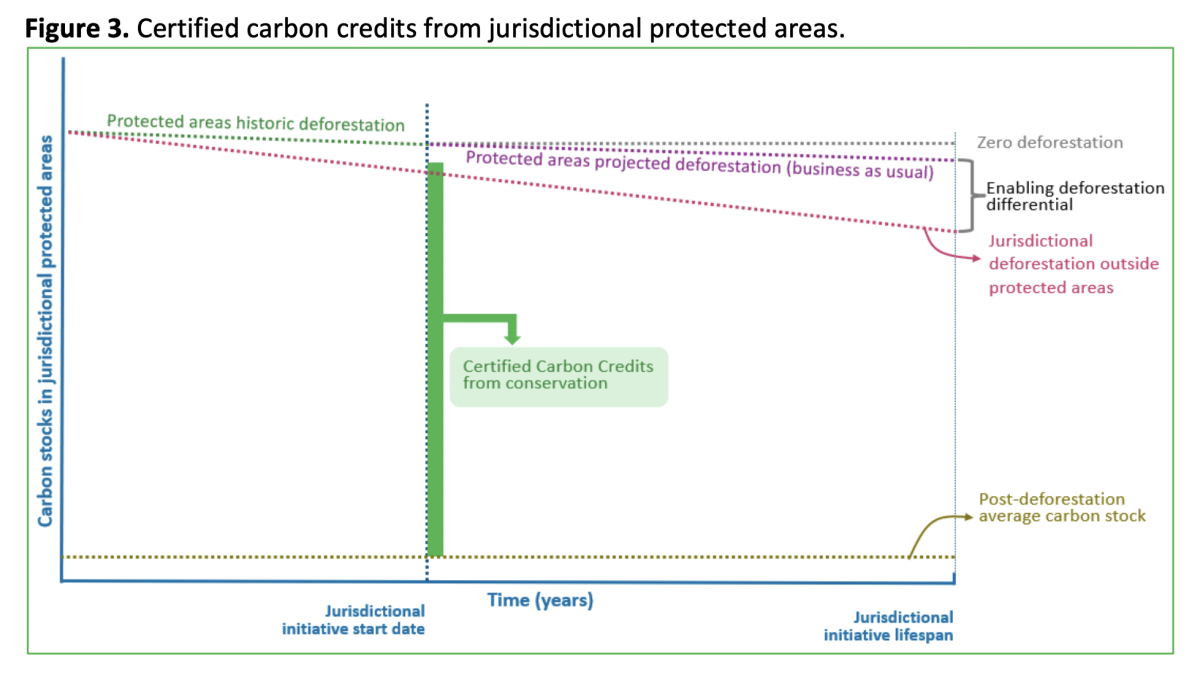

As previously mentioned, the program takes carbon in “effectively conserved protected areas of a sub-national jurisdiction”, i.e. a city, county, province, or state/region, and converts them into carbon credits. Per the program, “these credits are traded on the [carbon] offset market, and income is deposited in a trust fund” that is controlled by GREEN+ and is known as the GREEN+ Trust. That trust is run by unspecified individuals who work for Lockton, Isolas and Rootstock. Alejandro Guerrero, head of Lockton’s Argentina & Uruguay branch, is the only publicly acknowledged member of the trust.

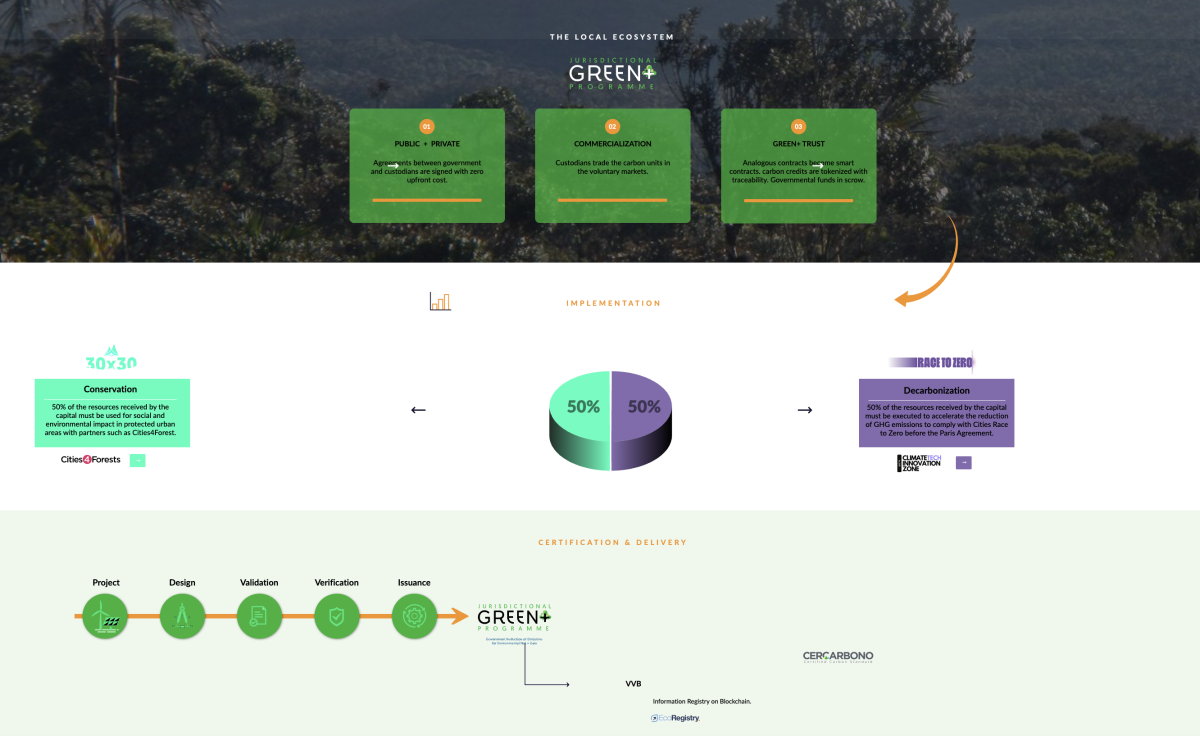

Another website tied to the GREEN+ initiative describes the initial process as follows:

- Public and private agreements between [a subnational] government and custodians are signed with zero upfront cost.

- Custodians trade the carbon units that are produced by the subnational governments (the public sector) signing contracts with the private sector in voluntary carbon markets.

- Those contracts signed by the subnational governments become smart contracts and carbon credits are then tokenized for traceability.

- The GREEN+ Trust holds government funds in escrow.

Subsequently, “a partial release of trust funds is made periodically during the crediting period of the jurisdictional initiative.” From this “partial release,” “a percentage operational fee” is deducted (the percentage is undisclosed in the program’s documents) and paid to the GREEN+ program while a separate (and also undisclosed) fee is also deducted “for the operation of the GREEN+ Trust.” Disbursements of what remains are made annually over a ten year period and, per graphs produced by GREEN+, those payments remain the same, fixed value even if the value of the carbon credits of the protected areas grows.

Between 40% and 60% of the funds actually received by subnational governments can be used to “design and execute projects” aimed at conservation, while the rest “is allocated for new jurisdictional decarbonisation initiatives” that can produce additional or “consequential” carbon credits. These “consequential” credits are then “offered as a preferred option to the investors who initially purchased the conservation credits at a 50% discounted price calculated at the current market price.” However, later in the same document, the program says that “the amount required for the initial implementation” of conservation projects “may not exceed 20% of the funds allocated [from the GREEN+ Trust] to the jurisdictional initiative.” Clearly, the amount of funds actually being generated for conservation-related projects is minimal and, even in the best case scenario, is less than half of the capital generated by the carbon credits themselves. However, as we shall see, these “conservation” projects must be done in conjunction with approved partners of Global Carbon Parks, which – like the organization itself – are tied to predatory financial interests and oligarchs with questionable motives.

Of the funds that governments actually receive as part of GREEN+, half are officially meant to go toward conservation-related projects while the other half are meant to go toward decarbonization-related projects. However, on the Global Carbon Parks-GREEN+ website, it notes that the decarbonization projects must be conducted alongside Community Electricity, which forms part of Global Carbon Parks and is closely connected to the GREEN+ alliance member The Energy Coalition (TEC). As will be discussed later, TEC and Community Electricity are together attempting to build an inter-continental “smart” grid in the Americas and are also involved in efforts to develop “smart” cities and suburbs.

As for GREEN+’s conservation projects, the website states that “50% of the resources received by the capital [city as part of GREEN+] must be used for social and environmental impact in protected urban areas with partners such as Cities4Forests.” Cities4Forests was founded by the World Resources Institute (WRI), a World Economic Forum affiliate and contractor to suspected CIA front USAID that is focused on resource “sustainability.” WRI is funded by the US and several European governments, billionaires Bill Gates, Jeff Bezos and Mike Bloomberg as well as Google, Meta/Facebook, the Soros family’s Open Societies Foundations, the UN, Walmart, the World Bank and the World Economic Forum, among others. WRI’s Cities4Forests shares many of the same funding sources, such as the governments of the UK, Germany, Denmark and the US as well as the World Bank and the Caterpillar Foundation. Other funders include the Wall Street giant Citi Group, the Rockefeller Foundation and the Inter-American Development Bank (IDB). Notably, the Rockefeller Foundation and the IDB recently teamed up to create the Intrinsic Exchange Group, which has spearheaded the financialization of nature via the creation of Natural Asset Corporations (NACs). As Unlimited Hangout previously reported, NACs create corporations that take control of natural assets that were previously part of the “commons," such as forests, rivers and lakes, and then sell shares of those assets to Wall Street asset managers, sovereign wealth funds and other financial institutions in order to generate profit under the guise of “conserving” the asset they target.

Unsurprisingly, most of Cities4Forests’ projects, such as those that would be built with GREEN+ funds, are similar to NACs in that they focus on using natural assets and “natural capital” to produce new financial and insurance products. Examples of Cities4Forests “conservation” projects include the development of a Forest Resilience Bond and the India Forum for Nature-based Solutions. One of the India-based forum’s “core partners” is the Nature Conservancy, which has been run by Wall Street bankers for years and has pioneered the modern iteration of the controversial “debt for conservation” swap among other “nature-based solutions.” The funders of Cities4Forest and its creator the WRI are also deeply affiliated with groups like the Glasgow Alliance for Net Zero (GFANZ) and UN-backed climate finance initiatives that openly seek to use debt imperialism to herd the global economy, with a focus on emerging markets, into a new system of global financial governance.

Thus, the “conservation” and “decarbonization” efforts that subnational governments must enact as part of their contractual agreements with GREEN+ will go towards projects tied to either the smart grid/smart city developer Community Electricity or a “conservation” organization backed by Western oligarchs, multi-national corporations and banks that seeks to financialize and monetize nature under the guise of conserving it.

CC35 and the Subnational Pivot

CC35, or Ciudades Capitales de las Americas frente al Cambio Climático (American Capital Cities Facing Climate Change), is the most visible organization behind the GREEN+ program and one of the members of its governance committee. CC35’s goal is the economic integration of the Americas (North, South and Central) through coordinated climate change policies, specifically the creation of an Inter-American carbon market, with GREEN+ being the means of implementing that market. The group focuses on “subnational” governments, namely capital cities of the Americas, thereby circumventing national governments with respect to Climate Change-related policy.

Regarding GREEN+, Sebastián Navarro, the secretary general of CC35, stated of the program that: “We will be relentless from the governance of the GREEN+ program with those who want to continue playing with the future of humanity,” adding that their “relentless” approach would be greatly aided by Satellogic’s satellite surveillance capabilities, which would also “generate unprecedented credibility among investors of the carbon credits produced by conservation.” Navarro’s promise to be “relentless” in governing a satellite surveillance regime of American forests for the purpose of producing “high-credibility” carbon markets.

While framed as an initiative “born out of Latin America,” CC35 is registered in Miami; Florida (Coral Gables, specifically) and has long been funded and partnered with US-based interests. For instance, CC35’s first partners were R20 (Regions of Climate Action, now the Catalytic Finance Foundation), a group created by former California governor Arnold Schwarzenegger in partnership with the UN, and the Leonardo DiCaprio Foundation. From there, CC35 partnered with UN and UN-linked organizations as well as Pegasus Capital Advisors, which also finances CC35 and Schwarzenegger’s R20/Catalytic Finance Foundation. R20/Catalytic Finance, like CC35, focuses its attention on “subnational” governments.

Pegasus Capital is the firm created by Craig Cogut, a key figure in the “junk bond” financial scandal at the now defunct Drexel Burnham Lambert. Drexel’s junk bond department, led by Michael Milken, engaged in blatantly illegal activity and used junk bonds to help fuel the takeovers of major corporations by the era’s infamous “corporate raiders” before the bank’s collapse. Specifically, Cogut was the lawyer who advised the Milken-run and scandal-ridden junk bond department on the legality of transactions, including those that saw Milken become a convicted felon. Following Drexel’s collapse, Cogut teamed up with a group of Drexel alumni led by Leon Black – now best known for his close association with the deceased sex trafficker and "financial adviser" Jeffrey Epstein – to co-found Apollo Advisers (now Apollo Global Management) in 1990. Cogut left Apollo to found Pegasus in 1996 and Pegasus has since became a key player in several UN-supported “green” finance initiatives. Cogut is also financially entangled with Satellogic’s co-founder, Emiliano Kargieman, as will be discussed later.

Cogut subsequently became a board member of Arizona State University’s Global Institute of Sustainability, which was created by Michael Crow (and who served on the board alongside Cogut). Crow is chairman of the board of trustees In-Q-tel, the CIA’s venture capital arm. Cogut also served on the board of ASU’S McCain Institute, named for the late Senator John McCain, which has links to Ashton Kutcher’s CIA-linked charity Thorn. Current board members of the McCain Institute include both Crow and former CIA director David Petraeus on its board, as well as Lynn Forester de Rothschild, who co-created the Council for Inclusive Capital with the Vatican. Cogut was also on the board of the Clinton Health Access Initiative (CHAI), part of the Clinton family philanthropies, and CHAI was largely shaped and influenced by notorious sex trafficker and “financial advisor for billionaires” Jeffrey Epstein, having been the chief reason for former president Bill Clinton’s flights on Epstein’s plane in the early 2000s.

Notably, Cogut is not the only Drexel alum to be involved in “green finance.” The field of “green finance” itself was essentially invented by Richard Sandor, who made millions at Drexel during the 1980s, pioneering “innovative” products like the collateralized mortgage obligation (CMO), which would later contribute to the 2008 financial crisis. Sandor had previously been deemed the “father of financial futures” and is also credited with helping create derivatives. After Drexel’s collapse, Sandor moved on to pioneering carbon emissions trading and carbon markets with the vision of creating “an all-electronic exchange for carbon trading,” a vision that has since taken shape.

CC35 has long been led by Sebastián Navarro. Under his leadership, CC35 helped broker the creation of the Subnational Climate Fund, which is backed by Cogut’s Pegasus Capital along with BNP Paribas, the Rockefeller Foundation, the Bloomberg Philanthropies and the governments of Germany, the UK, Australia and the Netherlands. That fund focuses on financing infrastructure projects in the Global South at the subnational (e.g. city, state) level, again bypassing national governments. Indeed, the main modus operandi of CC35 is brokering contracts between small, subnational governments and “green” finance entities that are tied to centers of US/European political or financial power.

Navarro is listed as a director of CC35 as are two prominent, right-leaning Latin American politicians: Felipe Alessandri Vergara, mayor of the Chilean capital Santiago from 2016 to 2021, and Nasry Asfura Zablah, former mayor of the Honduran capital Tegucigalpa and former Honduran presidential candidate. Alessandri is a well-known figure in Chilean center-right politics and an ally of the recently deceased former Chilean president Sebastián Piñera. Alessandri is controversial within the Chilean right for his covert support of initiatives generally favored by the left and publicly shunned by his party while serving as Santiago’s mayor, such as climate finance/regional economic integration (via CC35) and his financing of initiatives related to illegal immigration. Alessandri’s successor and supposed political nemesis, Irací Hassler of Chile’s Communist Party, has since taken over for Alessandri as CC35’s Vice President for South America. As for Nasry Asfura, he was the subject of a Honduran political scandal due to his appearance in the Pandora Papers and his alleged involvement in suspicious offshore finance activities. He was also indicted on money laundering and fund embezzlement, but charges were dropped under Asfura’s successor Jorge Aldana, who is now president of CC35.

The current vice president of CC35 for Central America is Mario Durán, the mayor of San Salvador and a close ally of El Salvador’s president Nayib Bukele as well as a member of Bukele’s Nuevas Ideas party. Durán is poised to take over the leadership of CC35 per a recent announcement from the group. In 2021, Durán signed a contract with CC35 regarding education about the use of Bitcoin in all metropolitan region municipalities in El Salvador, and is the only mention of CC35 promoting the use of Bitcoin. As will be noted again later on, the CC35-led GREEN+ initiative is partnered with Rootstock, which created and develops a Bitcoin sidechain that enables smart contracts on the Bitcoin blockchain. Presumably, the goal is to run GREEN+’s digital carbon market on the same blockchain.

While it may seem odd to an American audience that “regional integration” efforts under the guise of climate change would be led largely by right-leaning politicians, it is important to point out that such integration efforts have historically been led by both left and right factions in Latin America, who compete for dominance over the region. For instance, right-leaning efforts at economically and/or politically integrating the Americas include Mercosur (the Southern Common Market, now championed by the “anti-globalist” Javier Milei) and Prosur (Forum for the Progress and Integration of South America, launched by Chile’s center-right Piñera). Left-leaning efforts include ALADI (Latin American Integration Association) and UNASUR (Union of South American Nations). All of these efforts have failed due to geopolitical disagreements mainly centered around whether to grant membership to countries like Venezuela, Cuba and others with governments estranged from the so-called “Washington consensus” or, more recently, efforts to forge closer ties to Russia and/or China. Given that several important Latin American countries can suddenly change what side of the “consensus” they are on depending on presidential election results, such as recently happened in Brazil and Argentina, these regional integration efforts have failed to gain significant traction over the last several decades. Nevertheless, the end goal of economic integration begetting political integration remains the same. Thus, as CC35 shows, the push to regionally integrate Latin America has now, very quietly, pivoted away from engagement at the national level to the subnational level.

The Club of Rome’s Global Footprint

While CC35 is the most visible face of GREEN+’s governing body, it is actually chaired by a group called the Global Footprint Network (GFN). The GFN exists to promote “the Ecological Footprint, which tracks how much nature we use and how much we have, as an accounting tool” for green finance initiatives and originated the concept of “ecological debt” based on that metric. Elsewhere, the GFN calls for “one-planet prosperity” and emphasizes climate finance, a field dominated by predatory Wall Street banks and billionaires, as an economic imperative. They work with governments at both the national and subnational level and establish the carbon emissions limits for localities, states and countries that programs like GREEN+ seek to enforce with satellite surveillance and binding contractual obligations.

The GFN is intimately connected to the Club of Rome. For instance, GFN’s founder and a member of its board, Mathis Wackernagel, who also co-created the Ecological Footprint concept, is a member of the Club of Rome. Wackernagel’s former mentor and the other developer of the Ecological Footprint, William Rees, was a member of the Club of Rome until 2018. Heiko Specking, a GFN board member, is also affiliated with the Club of Rome as is another GFN board member, Lewis Akenji.

The Club of Rome was founded in 1968 by the Italian industrialist Aurelio Peccei and Scottish chemist Alexander King. Its earliest success was the 1972 report and later book “The Limits to Growth," which was based on an MIT study and claimed that “if the world’s consumption patterns and population growth continued at the same high rates of the time, the earth would strike its limits within a century.” The book was heavily promoted by the earliest annual meetings of the World Economic Forum, particularly in 1973.

Peccei, who spent a large part of his life living in Argentina, had previously been a member of ADELA, the Atlantic Community Development Group for Latin America. ADELA was composed of powerful Western companies that pooled money to invest in Latin American companies of their choosing, essentially “king-making” the titans of the Latin American corporate world. ADELA’s backers included Bank of America, IBM, Fiat (where Peccei was an executive), and the Rockefeller family’s Standard Oil. The group was part of the Rockefeller-dominated network in Latin America, which also included the International Basic Economy Corporation (IBEC), which has been linked to the 1973 CIA-backed military coup in Chile through the Chilean Rockefeller associate Agustín Edwards, and Deltec, best known today as a main bank for the failed crypto exchange FTX and its close relationship with the stablecoin Tether. Modern iterations of this network include Endeavor and the Council of the Americas (CoA), which will be discussed in the second part of this series. Notably, it was Peccei’s speech at an ADELA conference that spurred his partnership with Alexander King and led to the Club of Rome’s formation.

At the time he got involved with Peccei and made the Club of Rome, King was head of the Organization for Economic Co-operation and Development (OECD). The OECD was originally established as the OEEC to help administer the post-WWII, US-developed Marshall Plan and was later expanded to become a global organization in 1961. The US remains the OECD’s main funder by a significant margin. The group has long claimed to promote “sustainable economic growth” and “consistently improving standard of living in its member countries,” but – in practice – it routinely favors neoliberal policies that enrich Western-based multi-national corporations. It is closely partnered with entities like the IMF, the World Bank and the broader multi-lateral development banking system that has used debt slavery sold as “economic development” to privatize state-owned assets and sell them off to privileged corporate interests. That system has also been considered by the US military to be part of its arsenal of “financial weapons” used to protect US interests abroad.

The Club of Rome was criticized for many decades for embracing neo-Malthusian thought (i.e. eugenics and specifically population control measures in the developing world) as well as for promoting greater global governance. Some of its members have championed the imposition of a “benevolent” global dictatorship. Criticisms of the Club of Rome have been voiced by academia as well as independent and mainstream media. The group’s attempt to rebrand as an environmental group in order to gain popular support for those same policies was discussed in their 1991 book “The First Global Revolution,” which states:

“In searching for a common enemy against whom we can unite, we came up with the idea that pollution, the threat of global warming, water shortages, famine and the like, would fit the bill. In their totality and their interactions these phenomena do constitute a common threat which must be confronted by everyone together. But in designating these dangers as the enemy, we fall into the trap, which we have already warned readers about, namely mistaking symptoms for causes. All these dangers are caused by human intervention in natural processes, and it is only through changed attitudes and behaviour that they can be overcome. The real enemy then is humanity itself.”

The Global Footprint Network’s methods, products and ideology are very much aligned with the neo-Malthusian “Limits to Growth” view of the Club of Rome as well as the efforts to incorporate nature into financial markets via so-called “nature-based solutions.” Indeed, the GFN’s ecological footprint metric is promoted by groups like the World Economic Forum and the World Wildlife Fund (where Peccei served on the board and which has long been tied to European oligarch and corporate interests). GFN also provides the statistical means of imposing Limits to Growth-style models that control both population levels and industrialization levels on governments by developing “ecological budgets” that, as evidenced by GREEN+, are now interfacing directly with carbon markets.

Building a “GREEN” Power Monopoly

The other member of the GREEN+ governing committee that will control the program as well as Satellogic’s surveillance data is The Energy Coalition (TEC). Notably, it was TEC’s executive director Craig Perkins who said that GREEN+ would also enable the surveillance of carbon emissions of populated areas, presumably via satellite. TEC was founded by John Phillips, who ran Phillips Energy – an oil and gas company, in 1975. Since 1979, it has been closely partnered with local California governments via its Community Energy Partnership program. Currently, TEC is partnered with, and some of its key initiatives are financed by, major California gas companies, referred to by TEC as California’s “investor-owned utilities.” These include Pacific Gas and Electric Company, Southern California Edison, SDGE and SoCalGas.

With the backing of these major oil and gas companies, TEC assures us it is “creating the building blocks for a new energy economy.” One of its main partners in doing so is Community Electricity, which claims to be “building the NASDAQ of the clean energy field.” TEC and Community Electricity, which is backed by Google, have co-designed “a master plan” financed by the California Energy Commission “to implement the largest and first-of-its-kind decarbonization by electrification protocols using DERs [distributed energy resources], carbon emissions management, blockchain, AI and IoT [internet of things] all connected under one plug-and-play platform.” Community Electric designs, funds and develops this technology for GluHomes (formerly GluEnergy), its parent company which shares the same founder as Community Electricity – Felipe Cano. The program is being piloted in the poorest neighborhoods of Los Angeles as well as in disadvantaged communities in Colombia. The goal, per Cano, is to “bring the Americas together” through an inter-continental, “clean” smart grid.

The blockchain involved in these efforts is RSK, the smart contract-oriented sidechain that runs on top of the Bitcoin network. As previously mentioned, RSK is a founding member of GREEN+. The initiative involving TEC, Community Electricity, California’s government, and RSK also seeks “to digitize carbon credit reporting” and to “create opportunities for businesses to redeem credits.” The Community Electricity/TEC program also uses the RSK blockchain to record a person’s energy usage “with the help of RIF, an identity product [i.e. digital identity] developed by RSK Labs.” The Community Electricity system requires a digital ID tied to a digital wallet that “is embedded to store daily profits derived from surplus energy sales” that allow electricity consumers to trade energy credits and become what the company calls “prosumers,” with the goal of creating “an energy social network.” The Community Electricity hardware produced with GluHomes also “utilize[s] AI and machine learning to transform any home intro a smart micro electricity generation utility.”

The group is partnering with real estate developers to develop smart homes connected to their energy-related technology, with a focus on social housing and affordable housing, i.e. housing for lower income families. The goal is to connect together retro-fitted existing homes, new smart homes, a neighborhood co-op of electric vehicles and a reward-payment system called GluPay, which is partnered with Mastercard and Contigo, which designs products “for the unbanked, immigrants, homeless and disadvantaged population,” with a focus on remittance payments. Contigo is currently in talks with El Salvador’s government to have the company’s “Payments Wallet tied into the Salvadoran financial inclusion products.” Contigo is run by Raul Hinojosa, an academic at UCLA who wrote a book entitled “Convergence and Divergence between NAFTA, Chile, and MERCOSUR: Overcoming Dilemmas of North and South American Economic Integration,” which focuses on “the impact of a potential Free Trade of the Americas Agreement.”

The creator of Community Electricity and GluHomes, Felipe Cano has also spent most of his career attempting to economically integrate large swathes of the world. For instance, in 1998, his vision was “to unify both European and US stock exchanges under one platform and protocol, the create the smart grid of the equity market and stock trading in a bilateral, single network.” This vision led him to create ECN Access, which “was the first tech hub in Europe to route the first block of institutional order flows from a European Bank directly to the NASDAQ electronic exchange without intermediaries,” creating what Cano calls “the first smart grid every built.” He then sought to “create a digital market for the energy sector,” which has since culminated in his creation of Community Electricity and GluHomes. Cano is an adviser to TEC and is also a senior partner at Silverbear Capital, where he focuses on investments related to smart cities. According to his bio at Silverbear, Cano is also CEO of “Olidata Smart Cities LLC, a market-maker platform which uses nano-grids and microgrids as the underlying strategy to deploy the Internet of Things Protocol of the future.”

Cano was also, until recently, the president of Global Carbon Parks, which is a consortium of companies, the only known members of which all happen to be companies that founded GREEN+, with the one exception being Cano’s Community Electricity. Global Carbon Parks, unsurprisingly, is now one of the main implementers of the GREEN+ program. Global Carbon Parks is also partnered with Aclima, a start-up backed by Microsoft and the foundation of former Google CEO Eric Schmidt. Global Carbon Park’s stated mission is to “transform protected areas into natural equity” via public-private partnerships, essentially admitting that the GREEN+ program it now helps manage is about financializing protected natural assets and resources.

Global Carbon Parks “transforms” these forests into “natural equity” by measuring, certifying and trading carbon credits in conjunction with the carbon credit certification Cercarbono (discussed later in this article). Their partnership with Satellogic, which goes beyond but also includes the GREEN+ program, uses satellite surveillance “to ensure the integrity of the preserved area” which contains the carbon represented by the carbon credits. The company also promotes their integration with The Energy Coalition and Community Electricity to develop “advanced electricity communities” that develop “renewable energy credits," which the company claims will “contribute to local wealth creation.” The company is partnered with a financial firm, which does the actual trading of carbon credits for both Global Carbon Parks and presumably GREEN+. However, Global Carbon Parks declines to reveal their identity, merely stating that “They are a financial firm that integrates technical, economic, and environmental solutions.”

In summary, the governance of the GREEN+ program and the group with control over its satellite surveillance data; are tied to or funded by groups that have long used debt as a form of control over the Global South in particular; seek to control the population size and the degree of industrialization in countries; are tied to globalist efforts to economically and politically integrate the Americas; are building a Bitcoin blockchain-based smart grid that surveils and limits energy usage and links energy usage to currency; and are integrating and tokenizing the natural world, including endangered or protected areas, into the financial system under the guise of conservation. Through CC35’s Alcades por el Clima (Mayors for the Climate) initiative, over 15,000 local governments in Latin America have signed agreements with CC35 related to carbon emission trading schemes and limits, led by Brazil (5,564 local governments), Argentina (2,457 local governments), and Mexico (2,481 local governments). Presumably, those carbon neutrality/trading agreements will allow CC35 to push those municipalities into the GREEN+ program, if they aren’t already planning to participate directly (many are).

In other words, the vast majority of Latin America, unbeknownst to the vast majority of its populace, is already contractually yoked to one of the main organizations behind the GREEN+ program – run by interests tied to foreign banks, corporations and even intelligence services. The program is set to launch continent-wide in a matter of weeks. As this article and subsequent article will show, what has transpired is a brazen attempt to conduct a silent coup of the continent’s natural resources, energy production, local governments and economy.

The GREEN+ Trust and the Bitcoin Carbon Market

The GREEN+ Trust, which is to hold and handle the profits from the carbon credits produced and then disburse them to governments if certain conditions are met, is to be managed by individuals “selected from the members institutions of the [GREEN+] Executive Board” as well as from Isolas, Lockton and Rootstock (RSK). According to GREEN+, the Trust is not only responsible for fund custody, but also “the regulation of smart contracts, in coordination with the certification standard [Cercarbono] and the monitoring of mitigation initiatives [conducted by Satellogic].” The only known member of the Trust, as previously mentioned, is Alejandro Guerrero, the head of Lockton’s branch in Argentina and Uruguay.

Lockton, a founding member of GREEN+ and also of Global Carbon Parks, is the world’s largest, privately held insurance brokerage firm that also provides risk management services, employee benefits and retirement services. They are owned by the Lockton family and the company – and the family behind it – are rather secretive. However, the company has been overt about the opportunities they see in the type of carbon market that initiatives like GREEN+ will create.

In a 2023 article, Lockton’s head of Digital Integration and Special Projects, David Briscoe, wrote that making carbon credits “a stable and trusted currency” would “require the support of the insurance market.” This is because, as Briscoe notes, “voluntary” carbon markets come with risks, particularly because “of the financial values involved.” Per Briscoe, these risks include “non- or under-delivery of forward purchased carbon removal credits," “start-ups involved in the voluntary carbon market may face insolvency risks,” and “fraud and negligence.” Indeed, mismanagement and fraud has been a major driver of why carbon markets have failed to catch on despite relentless promotion and the adoption of ESG and climate change plans by many of the most powerful names in finance and industry. Instead of addressing the rampant fraud in carbon credits directly, it appears that the high probability of fraud and insolvency has been seen as an opportunity to create a new market for the insurance industry, with carbon credit insurance being framed as the only “feasible” means of de-risking the fraud-prone world of carbon markets, which have been criticized by environmental groups and have been shown to have a negligible impact on climate.

Lockton offers a variety of products related to carbon credits and so do its competitors, with the first such insurance having been issued by the UK-based insurance company Howden in 2022. That product was designed to “increase confidence in the Voluntary Carbon Market” and was “incubated” in collaboration with “the Insurance Task Force of the Sustainable Markets Initiative; an initiative led by His Royal Highness The Prince of Wales [now King Charles].” Industry publications have openly posited that carbon credits are likely to be “the next $1 billion insurance market.” Some companies, like Kita and Oka, were created specifically to insure carbon credits. Presumably, Lockton’s involvement with GREEN+ means that Lockton will be insuring the mass of carbon credits to be produced by the program, which plans to harvest carbon credits from all of the world’s “subnational protected areas.” In addition, Lockton’s role as the carbon credits insurer means it will be involved in ensuring that those cities/regions that are to become part of GREEN+ comply with the program’s stipulations in order to receive funds from the trust.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments