On-chain data shows the Ethereum Exchange Reserve has remained at low levels recently. Here’s what it could mean for the ETH price.

Ethereum Exchange Reserve Has Been Moving Flat Recently

As explained by an analyst in a CryptoQuant Quicktake post, the Ethereum Exchange Reserve has recently been at its lowest level since 2016. The “Exchange Reserve” here refers to an on-chain indicator that keeps track of the total amount of ETH that’s sitting in the wallets affiliated with all centralized exchanges.

When the value of this metric goes up, it means the investors are depositing a net number of tokens to these platforms. As one of the main reasons why holders transfer to exchanges is for selling-related purposes, this kind of trend can have a bearish impact on the ETH price.

On the other hand, the indicator witnessing a decline suggests the exchange outflows are overwhelming the exchange inflows. Such a trend can be a sign that the investors are accumulating, which can naturally be bullish for the asset.

Now, here is a chart that shows the trend in the Ethereum Exchange Reserve over the past decade:

As is visible in the above graph, the Ethereum Exchange Reserve started riding a downtrend back in 2021, which accelerated during the 2022 bear market. In this new cycle, the decline in the metric has continued, although it’s notably slower than back then.

Nonetheless, the fact that coins have continued to leave exchanges could be a positive sign, as it means the investors are preferring to hold in their self-custodial wallets. Holders tend to move to self-custody when they plan to hold into the long term, as it’s the safer method of doing so.

More recently, the decline has completely crawled to a stop after the indicator hit the lowest levels since 2016, which implies the sector may have reached a state of equilibrium. ETH has been showing bearish price action lately, but the flat trajectory means the holders haven’t yet panicked into net selling.

It’s possible that the pause in the downtrend is only a temporary deviation for the Exchange Reserve, but for now, it seems inflows and outflows are balancing each other out.

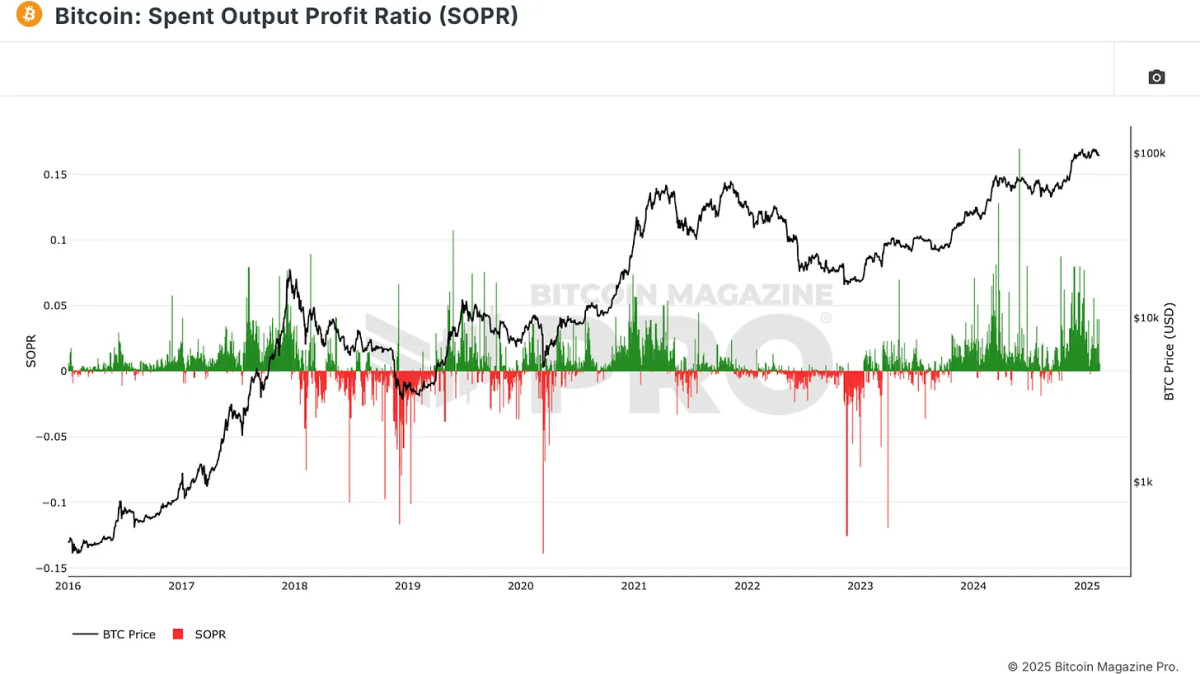

While the Ethereum Exchange Reserve has been in this state recently, the same hasn’t been true for Bitcoin, as another analyst has pointed out in a Quicktake post.

From the chart, it’s visible that the ratio between the Bitcoin exchange inflows and outflows has been under the 1 mark, which means these platforms have been witnessing the exodus of a net amount of BTC recently.

ETH Price

At the time of writing, Ethereum is floating around $2,700, up 1.5% over the last seven days.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments