The cryptocurrency market has gone mainstream. It is no longer retail investors’ assets as institutions globally are investing in Bitcoin and other major cryptocurrencies.&

As a risk-based asset, Bitcoin’s price is affected by central bank policies, especially those from the United States Federal Reserve.

Bitcoin’s rally in 2024 and connections with rate cut

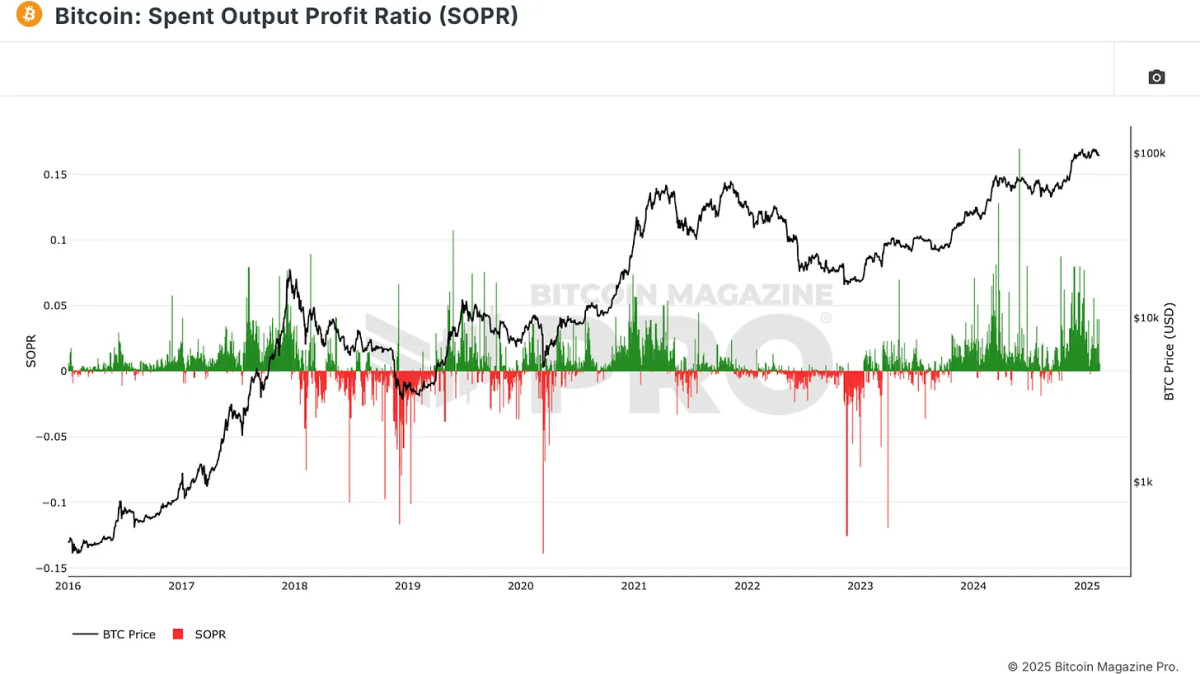

The cryptocurrency market was bullish in 2024, with the Bitcoin price surging by over 100%. The rally allowed Bitcoin to rally to an all-time high above $100k. A key catalyst to Bitcoin’s surge last year was the multiple rate cuts by the Federal Reserve.

In 2024, the Fed cut rates three times, bringing it down to the target range of 4.25%-4.50%. Before then, the rate had been on a lofty plateau of 5.25%-5.50% since July 2023.

The reduced interest rates affected Bitcoin’s price, allowing it to hit the $100k mark for the first time in its history. When interest rates are high, the cost of borrowing money is high. Higher interest rates decrease the liquidity in financial markets, providing more capital for less risky investments like bonds.

However, lower interest rates increase the liquidity in financial markets, with investors opting to push money into riskier assets like Bitcoin.&

Fed kept interest rates steady in January

Bitcoin reached an all-time high price of $109,410 on January 20 as the market reacted to Trump assuming office. However, it has since lost 11% of its value and now trades just above $97k.

A key factor in the poor market performance in the past few weeks was the Fed’s decision to hold interest rates steady. On January 29th, the Fed announced that the borrowing rate remained between 4.25% and 4.5%.

Leaving the rate unchanged affected Bitcoin’s price as it has failed to rally to a new all-time high. It has also struggled to stay above $100k since the start of February.&

Fed to cut interest rate twice in 2025

The first FOMC meeting of 2025 saw the Fed leave the interest rate unchanged. The United States Fed is expected to cut rates twice before the end of the year. However, this decision will be affected by inflation levels.

If the inflation levels rise sharply, the Fed will increase interest rates to curb the rising inflation. However, if inflation levels decline, the Fed will cut interest rates to stimulate the economy.&

The CPI report earlier today, February 12th, revealed that inflation in the United States rose to 3%, its highest level since June 2024. The rising inflation could hamper possible interest rate cuts, with the news sending Bitcoin to the $94k level earlier today.

Market analysts expect the Fed will lower rates twice this year, reaching 3.75%-4.00% by the end of 2025. However, the range of forecasts is wide, from a low of 3.00%-3.25% and a high of 4.50%-4.75%.

Thanks to the expected rate cuts and other macroeconomic factors, analysts are optimistic Bitcoin’s price could reach a new all-time high. While predictions differ, most analysts are optimistic BTC’s price could hit between $150k-$200k before the end of the year.

In addition to the expected lower interest rates, increased retail and institutional adoption could positively affect Bitcoin’s price in the coming months. Strategy (formerly MicroStrategy) continues to increase its exposure to Bitcoin while more companies are buying BlackRock’s spot Bitcoin ETF.&

The post The Fed is expected to cut interest rates twice in 2025, what might this mean for the Bitcoin price? appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments