Key Takeaways:

- Solana (SOL) futures markets are showing a growing bearish sentiment.

- The Solana ecosystem is facing a crisis of confidence due to memecoin scandals.

- Despite challengesˏ Solana continues its strong revenue generation.

The cryptocurrency market is constantly evolving, and recentlyˏ Solana (SOL) has faced increasing volatility and trading volume fluctuations. It is suggested by data that a new common pattern of traders is when they bet on SOL price fall via a number of memecoin issues that have given rise to uncertainties about the system. While short selling contributes to Solana’s price declineˏ broader market sentiment also plays a crucial role.

Shifting Sentiment: From Bullish to Bearish

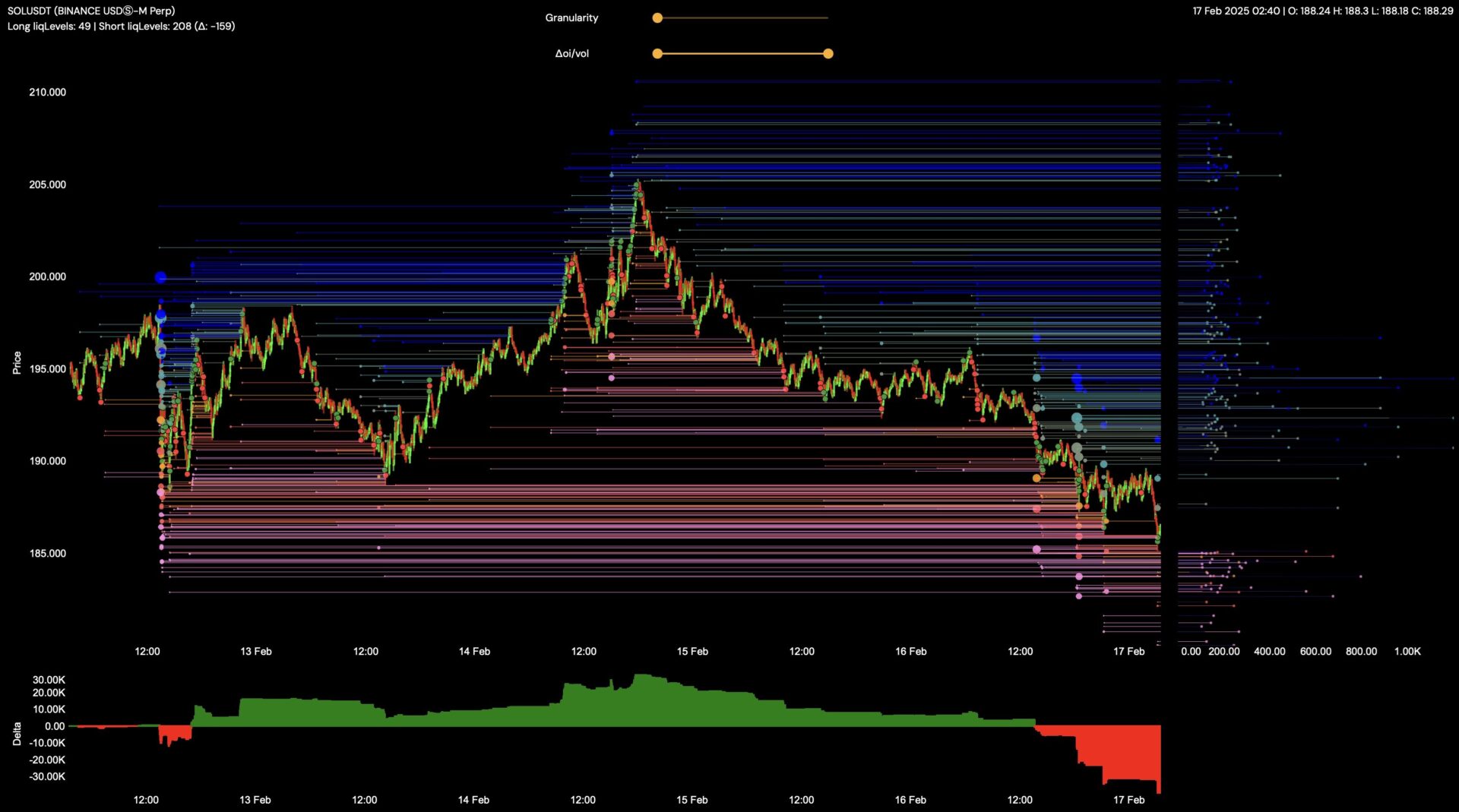

Coinalyze data reveals a significant change in the ratio of long to short SOL positions on cryptocurrency futures exchanges. On February 17thˏ the ratio experienced a drop from 4 to 2.5ˏ indicating a substantial decrease in optimistic recommendations. Under these conditionsˏ a major cause of concern for the future success of SOL emerged.

Crypto influencer Tyler Durden expressed similar concerns in a post on X. He said on Binance’s perpetual futures trading platformˏ the ratio of shorts to longs ascended to 4-to-1 levelsˏ underscoring a heavily one-sided bearish reasoning.

The market has decided it is angry at Solana.

Positions on the book..

Shorts 4:1 Longs pic.twitter.com/SGn7AAs7AL

— Tyler (@TylerDurden) February 17, 2025

The ratio of shorts to longs is high

Perpetual futures, or “perps,” are derivative contracts that allow traders to speculate on the future price of an asset without an expiration date. The number of traders shorting SOL in perpetual futures has risen sharply, indicating a bearish outlook.

According to CoinGecko, SOL’s price has dropped nearly 6%, further worsening market sentiment. This price movement is more a symptom of the larger issue the solana ecosystem is facing, which is decreasing trust.

The Rise and Fall of Solana Memecoins

Solana previously thrived as the go-to network for memecoins, leading to the rise of Bonk (BONK) and Dogwifhat (WIF). The dog-themed cryptocurrencies were dripping with money after receiving billions of dollars of investment that took them to over $4 billion each. Beyond BONK, even ETFs gained interest, potentially offering a new platform for these assets.

According to Messari, Solana’s application revenue surged 213% in Q4 2024, driven primarily by memecoin speculation. This large amount of funds seems to be a victory since the beginning of the year´s trading of coins and applications on Solana but deeper problems are developing.

Well, things are certainly shifting. Nowadays also, regarding the memecoin part of Solana, some stories of insider trading and the enormous losses incurred by retail investors are coming to the fore.

The Memecoin Scandals Eroding Trust

“The amount of shit thats coming up to the surface now is really badly damaging to SOL ecosystem,” familiar name Runner XBT said, highlighting the tension building among the community over the X.

At one point in the past, Libra was accused of being a hype project started by Argentine President Javier Milei. LIBRA, on February 14th, in a couple of hours, saw the market capitalization decrease by around 4.4 billion dollars of its debut price.

LIBRA’s market cap fell $4.4 billion in hours

Milei, who initially promoted the coin on X, has since deleted his post and is now facing legal scrutiny in Argentina for allegedly misleading investors. Still, this situation is a strong example of some very risky investment when it comes to unregulated meme-coins.

Let’s put it this way, the Official Trump (TRUMP), which is known for US President Donald Trump, is one of the meme coins. January crypto trader reports a loss of 800,000 wallets trading TRUMP with 2billion up to now. That being said, the price of TRUMP fully diluted has gone down from being over 70 million to becoming only 17, with the insiders owning more than 80% of the TRUMP tokens, according to CoinGecko.

Blockworks research analyst Westie states that TRUMP’s launch was “the clearest possible example of the insider game reaching its apex.” Thus, the issue of fairness and transparency in the memecoin market is raised to a greater level.

Solana’s Underlying Strength and Revenue Generation

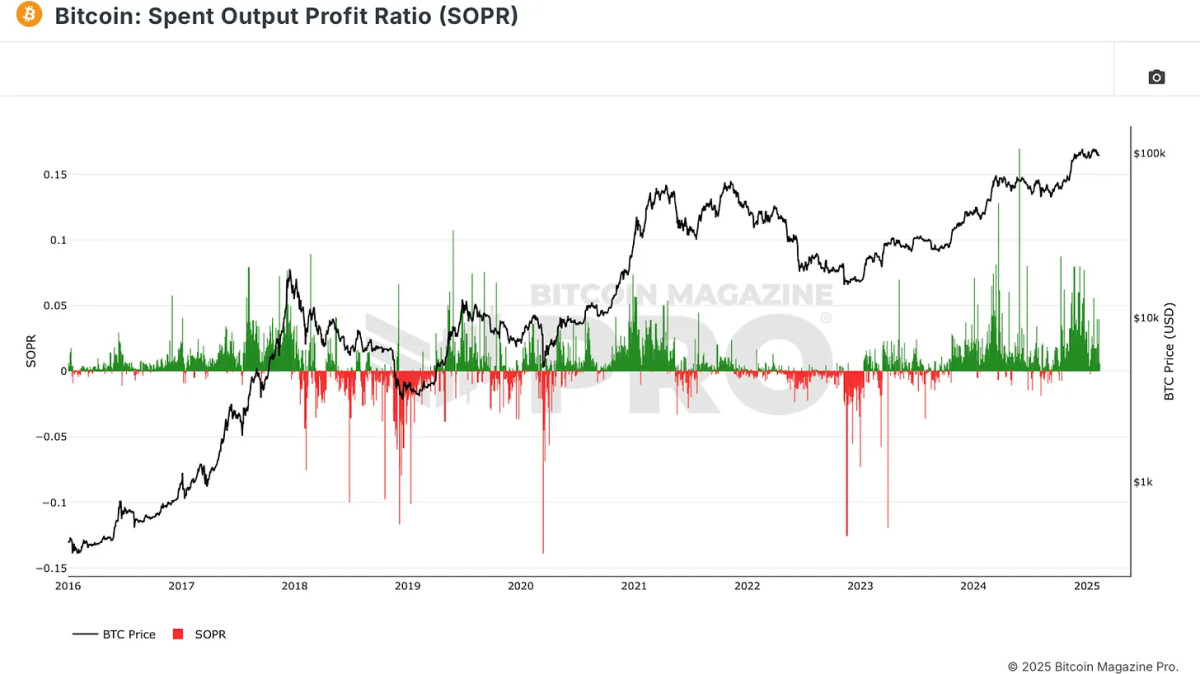

However, for Solana, it is necessary to grant challenges though at the same time, it still shows strength in the underlying areas. The data collected by DefiLlama shows that Solana keeps generating more revenue than Ethereum, which is the biggest layer-1 network, even besides the memecoin trading slowdown. The very idea that Solana’s infrastructure remains solid and its applications still see more user activity and income coming in verifies this opinion.

More News: Solana’s Revenue Surge: Is It Poised to Surpass Ethereum?

However, Solana has to accept the fact that the users and investors who are interested in it might not be the desired ones. The increase of capital and attention related to the memecoin mania might be both positive and negative for the new project. At the same time, it can not only impact the transaction volume which can be raised as a result of the enhanced network activity, but it can also attract quite speculative investors who are only interested in short-term profits.

The Future of Solana

The rising number of shorting activities in the SOL market would mean that a larger group has doubts about the memecoin network of the project. The case of Libra and the hurried and dubious ways of TRUMP tokens have been the cause of the shaking of investor faith. It is true that the basic technology of Solana is very good, but the exposure because such schemes knock its name.

Notwithstanding, Solana’s capability to produce income in the middle of the memecoin decrease CRV seems to be much more to offer than the assets of pure speculation.

The post Solana Shorts Surge: Are Memecoin Scandals Crashing the Party? appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments