Tast Nawarat/iStock via Getty Images

After publishing my article on Bitcoin (BTC-USD) two weeks ago, a few commenters mentioned how this latest Bitcoin crash was different. And this difference made all the difference and, therefore, there would be no next time. The difference at play was Bitcoin crashed during a high inflation environment. The idea swirling around the crypto fan club was Bitcoin was an inflationary hedge and should perform well during periods of high inflation. However, this was a poorly constructed argument perpetuated by banks wishing to sell a trading product. Bitcoin doesn't need to be a hedge against inflation to continue working and reach its next move higher.

Back To Basics

At its core, the inflation-protection idea comes from, at least in part, the idea Bitcoin is a deflationary asset.

What does this mean?

It means the supply of the asset is limited and, in its fundamental workings, diminishing. It accomplishes this by having a fixed supply - 21M coins. Theoretically, getting to this number becomes increasingly more challenging as time goes on, creating an asymptote situation, and forcing the rate of new supply to continually shrink. After mining 210,000 blocks, the reward for miners is cut in half. The next 210,000 triggers the same designed response, halving each time the milestone is reached. Estimates put the final coin mined sometime in the year 2140. This timeframe varies depending on the miners' abilities and network hash rate.

On the other end of the supply is the loss of Bitcoins; wallets (and passwords to wallets) go missing, holders forget their wallet's address, or the bits and bytes of addresses are destroyed with hard drives and other storage devices. In practice, the entire system means coins enter circulation through mining but are removed through the unfortunate methods I just mentioned. This creates a system where the supply is slightly increasing, flat, or outright decreasing, depending on the variables at any given moment, but always on this same coded path. This inherent scarcity, in theory, creates an inflating asset through a deflationary system.

This is where things get interesting and where the misleading conclusion comes about.

The US dollar is a fiat currency, as is well known, and, since its loss to the connection of gold (XAUUSD:CUR) in the summer of 1971, has created the ability to print it without an immediate cost (like raising gold inventories). This means its fundamental workings have turned into an on-demand, endless supply, backed only by the full faith and credit of the US.

Certainly, the United States will pay you back - if it can't, who will?

This is the opposite idea of Bitcoin; the dollar can continue to increase in supply, but its value diminishes if GDP doesn't keep up, leading to inflation.

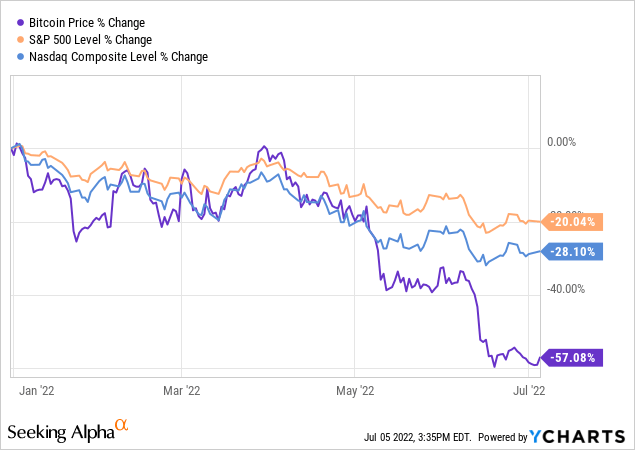

Now, the reason we're even having this conversation is because of the 40-plus-year inflation records we're setting lately. That, and the stock market crashing on expectations for more inflation (and mine, too) while Bitcoin and all other cryptos follow right along.

But since Bitcoin can be exchanged for dollars (and many other currencies), it should mean the deflationary asset rises while the inflationary asset decreases.

At least that's the conclusion to the perpetuated argument.

But because of several other factors, the correlation has been lost as Bitcoin crashed along with the S&P 500 (SP500) and Nasdaq (COMP.IND). In fact, the crypto has plunged far more than the indexes.

The markets appear to move together, so there must be nothing to see here.

So much for that theory of being an inflationary hedge!

The Problems With The Argument

But there are two problems with the argument and one problem with the measuring stick, providing either side of the debate with a fallacious conclusion.

A Cherry-Picking Issue

The problem with the measuring - saying Bitcoin isn't a hedge - is cherry-picking stock equities over short time periods versus Bitcoin's performance over the same period. If you want to measure the utility of being a hedge against inflation, you want to measure it against the value of the dollar, not equities, over many years.

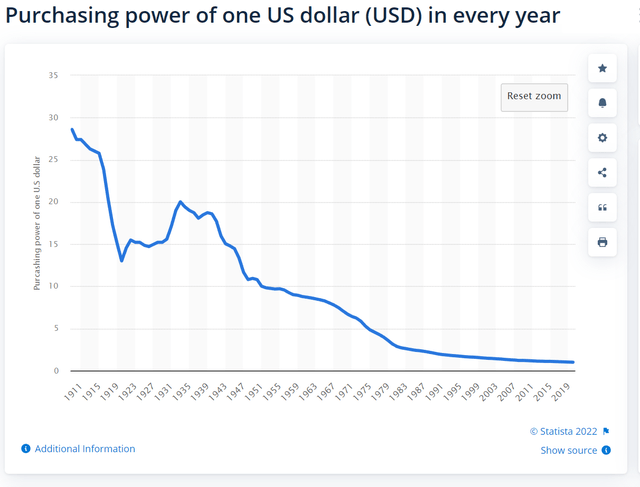

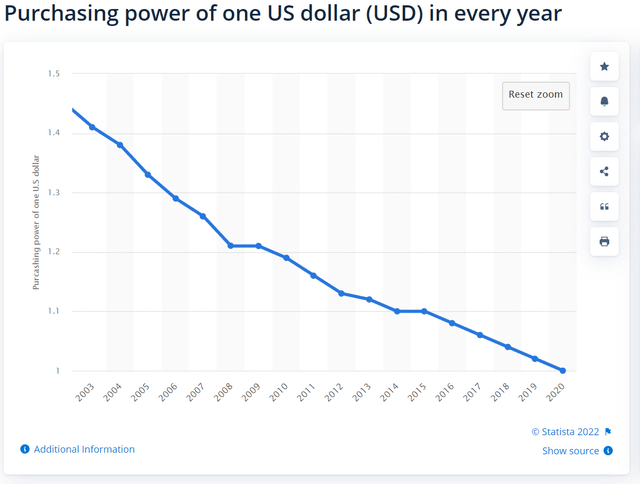

Statista

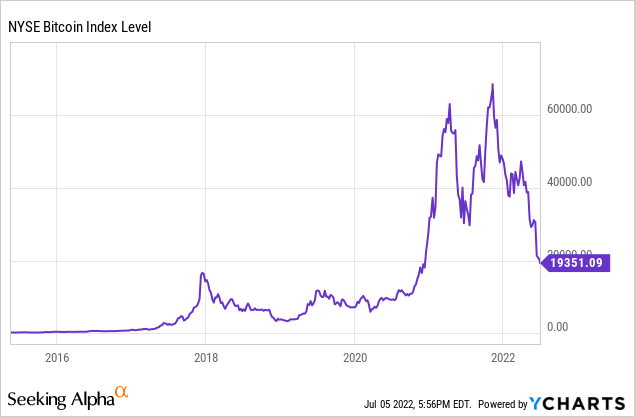

The truth is the dollar's purchasing power over many decades is a down-and-to-the-right slope, even when it was on the gold standard - we've just accelerated the problem since then. On the other hand, Bitcoin is an up-and-to-the-right chart, much like equities, mind you!

Statista

Measuring something like Bitcoin against a few months-to-one-year of inflation data isn't a logical argument; it's cherry-picking data in time. Of course, we can do this for any period and any graph we want and argue on either side of the issue. But unfortunately, it leaves us with a poorly constructed argument in the end.

The problem mainly stems from the relatively short periods of "high" inflation throughout the dollar's history. Finding a correlation becomes difficult as the volatility of Bitcoin and the brief periods of high inflation leave too much room and a lot of noise to pick through. Things proven to be hedged against inflation, like gold, are seen over decades.

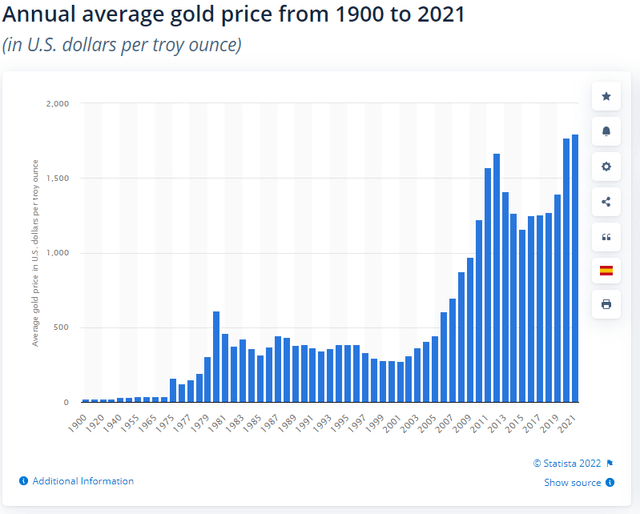

Statista

The real issue, however, is deciding how to measure something as a hedge against inflation. Gold, for example, shows an inverse correlation to the value of the dollar. As the dollar becomes worthless, gold continues to increase in value. That sounds like a hedge to me. In fact, at any point in history, one ounce of gold could get you a very nice suit and a fancy shave, whether in 1890 or 2022. Holding the same five dollars from 1890 today can't do that like the same ounce of gold.

The argument for Bitcoin as a hedge can be made here because, like equities and gold, it moves up-and-to-the-right and near lockstep with at least the equities market (regardless of whether Bitcoin moves more volatilely). So if equities or gold are a hedge (which can be argued), then by Bitcoin moving with equities over time, it, too, is a hedge. The problem, again, is the length of time. Bitcoin's lack of track record (relatively speaking) means we can't prove a correlation with enough data. It's why there's a lively debate about Bitcoin's staying power in the first place.

So, if anything, Bitcoin's argument for a hedge is proven through correlation with the equity and gold markets - up-and-to-the-right. However, just like the argument against it, the view for it doesn't have enough data to prove it relative to the data it's next to. And to further the point of the difficulty in finding something to hedge in the immediate face of roaring inflation, gold, which is the inflation hedge of hedges, hasn't moved up but 3% this year while inflation consistently carries on at 8%.

A Conflated Issue

Moving away from the data in time argument, the argument of Bitcoin being a hedge against inflation supposes it will go up or at least remain stable when inflation increases. But why would that be the case?

Simply because it's a deflationary currency system? Or because it's separated from the economy?

The first reason this hedging theory is hard to argue for is the money in one market comes from those with money in the other. This creates both a positive feedback loop and a negative one. For example, when things begin breaking down, and the equities market shows signs of steep losses, profits in crypto can quell margin calls on the equity side. The reverse is also true; if crypto creates a margin call situation, selling equities to cover the call can bring about balanced accounts. But this means both markets take a beating as money is exiting them both at near simultaneous rates.

Because of this, any inverse correlation to inflation is lost as the traded price of either of the assets is a net loss.

The fiat system and Bitcoin's infrastructure may be complete economic opposites, but it doesn't mean one can use it as a working hedge. There are many reasons to argue Bitcoin is built on a better system, able to give it an inflationary response due to a deflationary supply system. Still, market movements trump this in any short-to-medium term timeframe. While broadening the charts shows inverse correlation, it will take years to smooth out the gains seen from an inflationary hedge.

Perpetuated For Marketing

There's another level to this inflation hedge theory whereby the loose argument of a hedge was perpetuated as a marketing tactic. While Jamie Dimon was calling for the heads of his employees who traded crypto, his bank and other banks set up their own trading desks. And before you think I'm just saying this in hindsight, I called it out early in October:

It's clear firms are trying to jockey for position with the most recent explanation storied up as a hedge against inflation. Let it be clear, these firms are selling you something. The likes of JPMorgan (JPM) have gone from anyone who trades Bitcoin will be "fired in a second" to setting up its own cryptocurrency coin for internal transfers among clients to giving in and following the money by allowing trades. So it's no wonder we see headlines from the same company now saying, "Bitcoin is a hedge against inflation."

Naturally, once a new trading product is brought to the market, it needs promotion. That wasn't too hard with cryptocurrency, but reinforcing ideas about Bitcoin doesn't hurt. Using familiar assets like gold against familiar problems like inflation makes it easy to connect the dots to an asset touted as the answer. So when JPMorgan's analysts pour gasoline on the fire, it helps them.

Not easily moved from calls, analysts continued to push the narrative even as Bitcoin dropped this year. Why do that when many are now being turned off to the belief of hedging through price action? Simple. The trading desk and crypto product needed a shot in the arm as trading revenue more than likely dried up during this plunging market.

But now, Bank of America (BAC) is the first bank to switch gears and say it's not an inflation hedge. But, like most analysts, they're a bit behind the curve in telling their clients - or at least the public. As most would say, they're a day late and a dollar short - no different than their stock calls. Always be suspicious of someone selling you something for a weak reason.

Bitcoin And Inflation, The Arguments On Both Sides Are Weak

You're working uphill if you're a Bitcoin proponent and agree it's a hedge against inflation. Bitcoin doesn't have enough time on the books to make a good case for whether it does or doesn't hedge against inflation. Gold is easier to make a case for as there is a nearly equal amount of data across the same period to show correlation through price action. This doesn't mean Bitcoin isn't, but the short time window and the near-term noise of the markets through volatility make it hard to point to where it is. And just because one or several banks tout this as a reason for Bitcoin's rise doesn't mean it's true.

If you're either an opponent of Bitcoin or don't see the inflation connection, you're driving the "argument from ignorance" fallacy - just because it hasn't happened (or there's not enough data to prove it) doesn't mean it won't. For the same reasons of volatility and noise, one can't prove it isn't an inflation hedge.

In the future, Bitcoin may show signs it's an inflation hedge, but it'll take many years of continued trends to theorize it. Just because it's a deflationary system and it's working in tandem with an inflationary fiat system doesn't automatically make it a hedge against the US dollar's inflation problem. Having a bank further push the narrative doesn't change anything and can lead to cementing it's an unfounded idea.

No matter where the answer lies, the investment in Bitcoin should not be predicated on the idea of it being an inflation hedge. Only time will tell through continued use; even then, the debate will need to reshape and argue the merits. Nevertheless, Bitcoin's design has benefits over fiat currency. A valid argument is still found as it's observable in the code and the day-to-day workings of mining and halving events.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments